Can I Withdraw From 401k While Still Working

Hey there, awesome readers! Ever found yourself staring at your 401(k) balance like it's a secret treasure chest, wondering if you can ever dip into it while you're still busy conquering the weekdays? You know, that feeling when an unexpected expense pops up, or maybe you've just got a really, really good idea for a small business (like a gourmet dog biscuit bakery, because who doesn't love wagging tails and delicious treats?). It's a totally common question, and the short answer is: sometimes, yes! But, as with most things in life, there's a little more to the story than a simple nod or shake of the head.

Think of your 401(k) like a super-powered savings account, but with a special rulebook. It's designed to help you build a comfy nest egg for when you're done with the daily grind, enjoying all those leisurely mornings and guilt-free naps. The government gives you tax breaks for putting money in, and employers often toss in some extra cash as a "thank you" for being a great employee. It’s like getting paid to save for your future self – pretty neat, right?

But what happens when life throws you a curveball, or when that dream of owning a llama farm starts to feel a little more real than just a silly thought? Can you tap into that future-you money now? The answer is a big, fat, and often complicated, "it depends."

The Big "Why" Behind the Rules

Before we dive into the "how," let's chat about the "why." The government, bless their bureaucratic hearts, wants to make sure you're actually using this money for its intended purpose: retirement. They want to encourage you to save, not to use it as a personal ATM for every impulse purchase or minor inconvenience. So, they've put some hoops to jump through, and breaking those rules can come with some less-than-cheerful consequences.

Imagine you're saving up for a fancy new bike. You've been putting away a little bit each week, dreaming of those sunny rides. If you suddenly needed the money for a flat tire on your current bike, you'd probably use some of it. But if you just decided you wanted to buy a jet ski instead, well, that might not be the best use of your bike fund, and you might get some side-eye from your future-self who's still waiting for that dream bike.

When You Can Reach for Your 401(k) (The "Hardship" Edition)

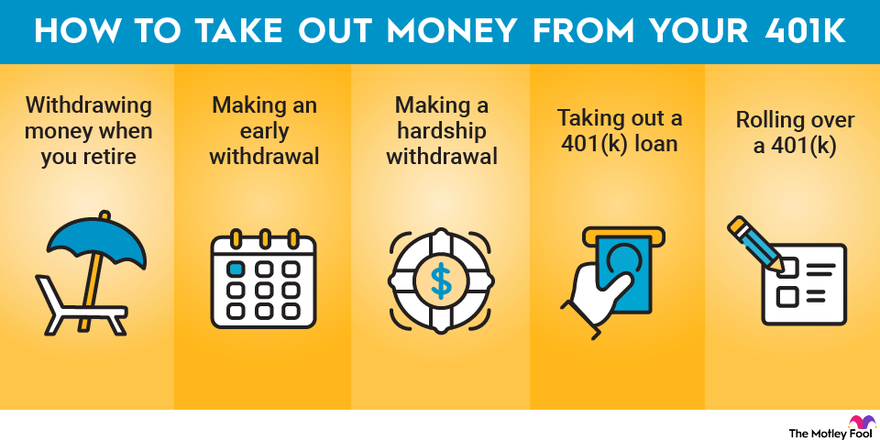

Okay, so the most common way to access your 401(k) while still employed is through something called a hardship withdrawal. This isn't for buying that designer handbag you've been eyeing (though we all have those moments, right?). This is for situations where you have an immediate and heavy financial need that you can't meet from other available resources. Think of it as a genuine emergency, like needing to pay for:

- Medical expenses: For yourself, your spouse, or dependents. This could be a surprise surgery, a chronic illness, or even just a really, really bad case of the flu that requires an expensive hospital stay.

- Home purchase: For a primary residence. So, if you've been dreaming of your own little bungalow with a porch swing, this might be an option.

- Tuition and education expenses: For yourself, your spouse, or your dependents. Sometimes, furthering your education is a necessary step for your career and future financial stability.

- Preventing eviction or foreclosure: This is serious stuff, folks. If you're at risk of losing your home, a hardship withdrawal can be a lifeline.

- Burial expenses: For a deceased parent, spouse, or child. A truly heartbreaking situation where financial worries shouldn't add to the pain.

It’s important to remember that your employer's 401(k) plan has to allow for hardship withdrawals in the first place. Not all plans do. So, the first step is always to check your plan documents or talk to your HR department.

The Catch: It's Not Free Money!

Now, here's where that little voice of caution chimes in. While a hardship withdrawal might seem like a superhero swooping in to save the day, it comes with some significant downsides. It’s not like borrowing from your personal savings where you just pay yourself back. It's more like a rescue mission that comes with a price tag.

First off, you'll likely have to pay ordinary income taxes on the amount you withdraw. So, if you pull out $5,000, that $5,000 gets added to your taxable income for the year. Depending on your tax bracket, this could be a hefty chunk of change. Imagine you’re going to a party, and you’re asked to bring a dish. You can bring your amazing potato salad, but you have to give up some of your favorite cookies to make room for it. Not quite the same, but you get the idea – you’re giving up something to gain something else.

Then, there's the potential for a 10% early withdrawal penalty if you're under age 59½. This is an extra kick in the pants from Uncle Sam for taking the money out before retirement. So, that $5,000 withdrawal could actually end up costing you more like $5,500 (or more, depending on your tax bracket!). That's like going to buy that gourmet dog biscuit ingredients and finding out the price has doubled unexpectedly. Ouch.

And the biggest bummer of all? You're taking money out of your future. Every dollar you withdraw is a dollar that won't be earning compound interest over the years. That $5,000 you take out now could have grown into $10,000 or even $20,000 by the time you retire, thanks to the magic of compounding. It’s like planting a tiny sapling and then digging it up a few years later because you want a quick snack from its fruit. You miss out on the full-grown, bountiful tree it could have become.

:max_bytes(150000):strip_icc()/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c-6724ec42ef6141c8bc59e3404bcda89b.jpg)

Loans: A Different Kind of Withdrawal

Some 401(k) plans also allow you to take out a loan against your vested balance. This is a bit different from a withdrawal because you’re essentially borrowing money from yourself. You then pay it back, with interest, over a set period (usually up to five years). The interest you pay typically goes back into your own account, which is a nice perk.

Think of it like this: you have a really cool piggy bank, and you need some cash for a surprise birthday gift. Instead of breaking the piggy bank, you take out some coins, promising to put them back, plus a little extra for your trouble. You still have all your coins in the end, and you get to keep the birthday gift.

Loans generally don't have the same immediate tax implications or penalties as hardship withdrawals, provided you adhere to the repayment terms. However, there are still risks. If you leave your job (voluntarily or involuntarily) while the loan is outstanding, you might have to repay the entire balance within a very short timeframe. If you can't, the outstanding loan balance will be treated as a taxable distribution, and you'll likely face the 10% early withdrawal penalty. So, it’s like borrowing that money from your piggy bank and then accidentally dropping the whole thing down a well right before you were supposed to pay it back. Big trouble!

:max_bytes(150000):strip_icc()/howtotakemoneyoutofa401kplan-79531c969f74433db11c032e3cfd3636.png)

So, Should You Do It?

Accessing your 401(k) while still working is a big decision. It's not something to be taken lightly. It should really be your last resort, after you've explored all other options, like:

- Selling other assets you might have.

- Seeking a personal loan from a bank or credit union (which might have better terms than early withdrawal penalties).

- Talking to your family or friends to see if they can help.

- Creating a strict budget to cut down on expenses.

If you're considering a hardship withdrawal or a loan, the absolute best thing you can do is talk to your HR department or your 401(k) administrator. They can explain the specific rules of your plan, the exact steps you need to take, and help you understand all the potential consequences. Don't be afraid to ask questions! It's your money, and it's your future.

Ultimately, your 401(k) is a fantastic tool for building financial security for your golden years. While it might offer a temporary fix in a tough spot, remember that it's a marathon, not a sprint. Protecting that future nest egg is usually the wisest path. But hey, life happens! Just make sure you go into any decision with your eyes wide open, understanding all the ins and outs. Your future self will thank you for it!