Can I Still File Taxes After April 15th

So, you blinked. And poof! April 15th just zoomed by like a startled squirrel. Don't sweat it. This happens. More often than you'd think, actually.

The tax deadline is basically a suggestion for some people. A really important suggestion, sure, but life happens. Did your cat suddenly decide to become a financial advisor and eat all your receipts? Totally understandable.

Or maybe you were busy training for that competitive thumb-wrestling tournament. We get it. Some things are just more pressing than Form 1040.

The good news? You can absolutely still file your taxes after April 15th. 🎉

Panic Over! Let's Talk Options

First things first: deep breaths. You're not a criminal. The IRS isn't going to send out bounty hunters on unfiled tax returns. Well, not usually. Unless you owe a LOT. But let's not go there yet.

Think of April 15th as the "official" party date. But the tax-filing fun can continue for a while longer.

The Glorious Extension

This is your best friend. Your tax-filing superhero. The magical phrase you need to know is: "Extension to File."

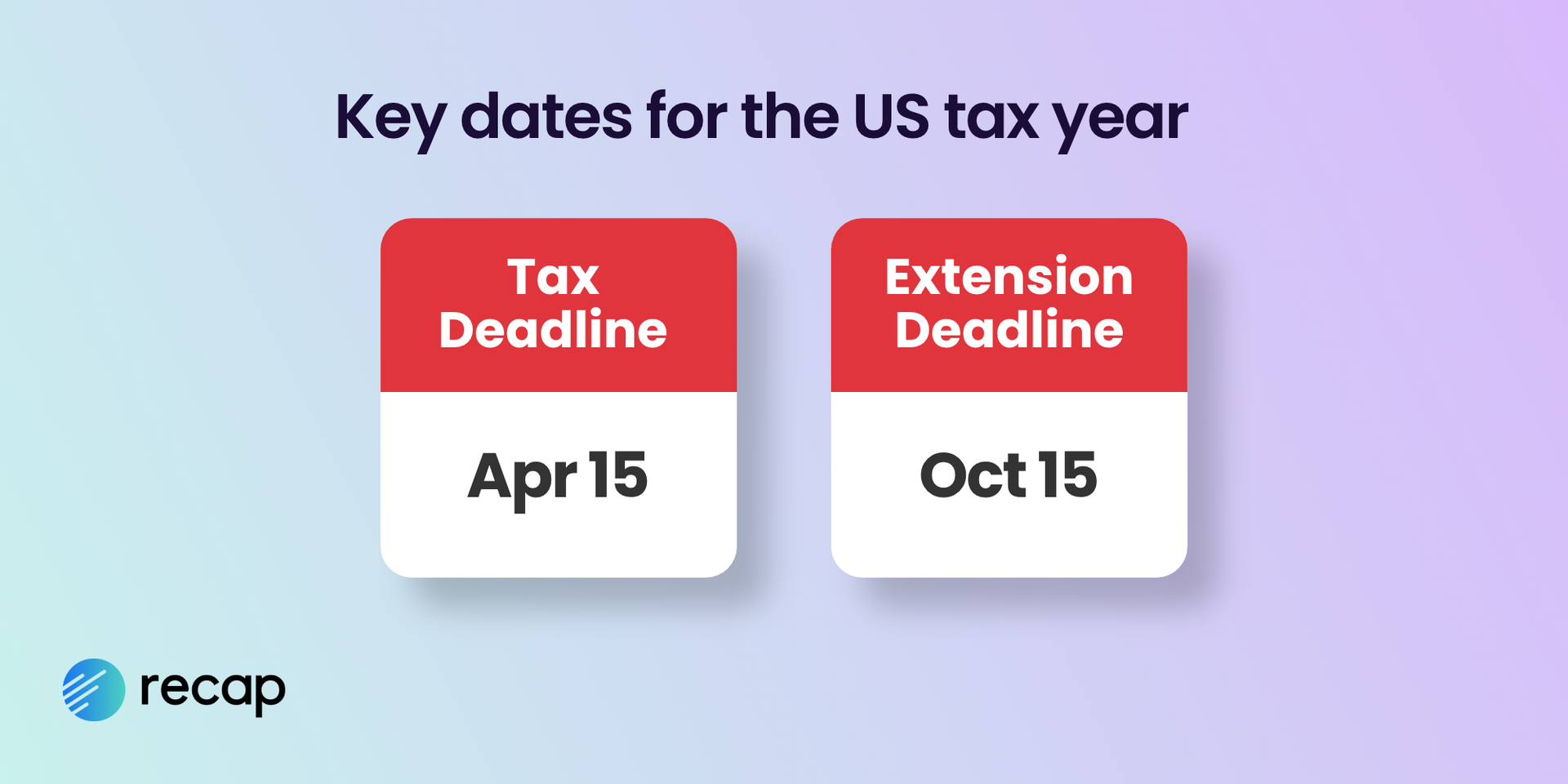

You can get an automatic six-month extension. That means you get until October 15th to actually file your paperwork. Six months! That’s like a whole new tax season to get your ducks in a row.

How do you get this mythical extension? It's surprisingly simple. You usually do it by filing Form 4868. You can do this online, by mail, or even through most tax software. It’s like ordering a pizza, but for paperwork.

And the best part? You don't even need a good excuse. "I was busy contemplating the existential nature of tax forms" is perfectly acceptable.

But Wait, There's a Catch (There's Always a Catch, Right?)

Okay, so the extension is for filing. It is NOT an extension for paying. 😬

This is where things get a tiny bit more serious. If you owe taxes, you still need to pay them by April 15th. Or as close to it as you can.

Why? Because if you don't pay on time, you'll start accruing penalties and interest. Think of it as a late fee, but for your government. And the government's late fees can be a bit… persistent.

So, what do you do if you owe and you missed the deadline? You can still file! Just estimate what you owe and send that in with your extension form. It’s better than nothing. The IRS appreciates an honest effort. Mostly.

This is why the extension is so crucial. It gives you time to figure out exactly what you owe without facing immediate penalties for being late with your payment.

What if I Don't Owe Anything?

Ah, the dream scenario! If you're getting a refund, you have a little more wiggle room. You can usually file late without incurring penalties. Though, you do have a statute of limitations to claim your refund. It's typically three years from the original due date. So, don't wait too long. That money is yours!

Imagine that refund money sitting there, earning its own little interest. It's like a tiny financial reward for finally getting your taxes done.

Quirky Tax Facts to Brighten Your Day

Did you know that the U.S. has been collecting income tax since 1861? Yep. This whole tax thing isn't exactly new. It’s been around longer than selfies and cat videos.

And the IRS? It was created in 1862. So, they’ve had plenty of practice. They’re the seasoned veterans of tax season.

Ever wonder why April 15th? It's not totally random. It has to do with when certain tax laws were enacted. It’s a bit of historical trivia that most people conveniently forget when they’re stressing about their W-2s.

Think of it as a historical marker. A day that looms in the collective consciousness of every tax-paying citizen.

So, You Missed the Deadline. Now What?

1. Don't Panic. Seriously. It's not the end of the world. Your friends at the IRS have a process for this.

2. File for an Extension. This is your priority. Get Form 4868 in ASAP. You can usually do this electronically, which is fast and easy.

3. Estimate Your Payment. If you think you owe money, try to estimate the amount and pay it by the original deadline. Even a good guess is better than a complete no-show.

4. Gather Your Documents. Use this extra time wisely. Round up all those receipts, W-2s, 1099s, and any other financial confetti you’ve accumulated.

5. File Your Return. Once you have everything, file your return. The sooner, the better. Don’t procrastinate again! You’ve had your practice round.

Why Is This Even Fun to Talk About?

Because it’s relatable! We’ve all been there. Staring at a pile of papers, feeling a vague sense of dread, and wondering if we can just… pretend it didn’t happen.

Taxes can be intimidating. They’re complex. They involve numbers. But understanding that you have options, that you’re not alone, and that there are actual solutions makes it less scary. It makes it almost… manageable.

Plus, the feeling of accomplishment when you finally file? Priceless. It’s like conquering a mini-mountain. A mountain made of paper and digital forms.

So, go ahead. Breathe. You can still file. Just don't forget to actually do it. Your future self (and your wallet) will thank you. And who knows, maybe next year you’ll be the one who files early. But for now, let’s focus on getting this done. Happy (late) filing!