Can I Have Both Traditional Ira And Roth Ira

Ever feel like you're trying to have your cake and eat it too when it comes to saving for the future? Well, when it comes to retirement accounts, you actually can have your cake and enjoy a different, equally delicious slice! The question, "Can I have both a Traditional IRA and a Roth IRA?" is a hot topic, and for good reason. It's not just about maximizing your savings; it's about smart savings, and that's always a win.

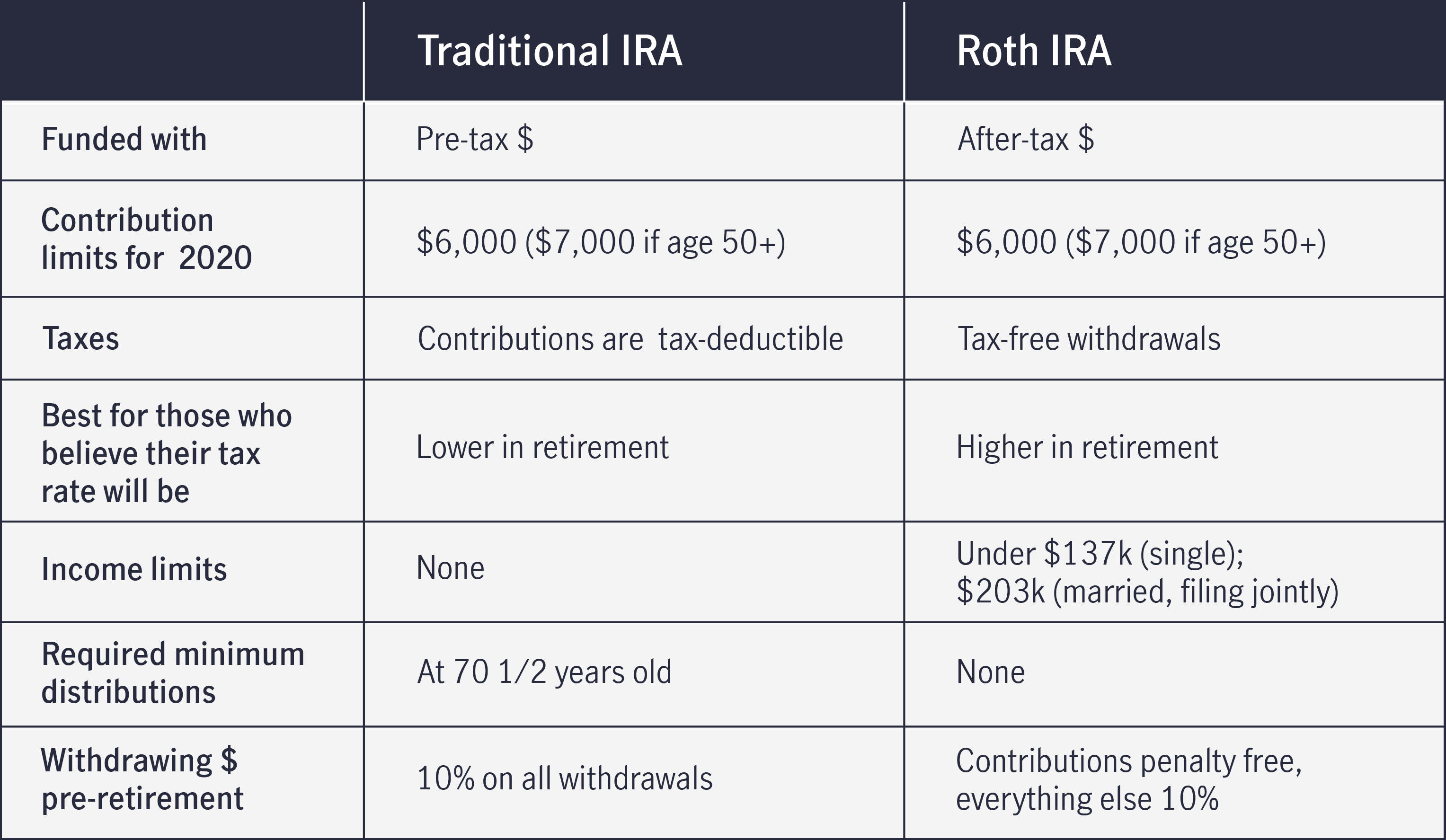

Let's break it down. Think of a Traditional IRA as your "save money now" option. You contribute pre-tax dollars, which means your taxable income is lower this year. This can be a fantastic benefit if you're in a higher tax bracket now and expect to be in a lower one in retirement. For beginners, it’s a straightforward way to reduce your current tax bill. Families, especially those with dual incomes, might find this appealing as it can lower their overall household taxable income. Hobbyists who are passionate about their craft but might have fluctuating income could also benefit from the immediate tax deduction.

Then there's the Roth IRA, your "pay taxes now, enjoy tax-free later" option. You contribute after-tax dollars, and the real magic happens in retirement. All your qualified withdrawals are completely tax-free. This is incredibly attractive if you believe you'll be in a higher tax bracket in retirement, or if you simply want the certainty of knowing your retirement income won't be taxed. For younger individuals just starting their careers, a Roth IRA is often a great choice because they're likely in a lower tax bracket now and have many years for their investments to grow tax-free. Families might use a Roth to diversify their retirement tax strategy. Hobbyists who foresee their income increasing significantly in the future might opt for a Roth to lock in lower taxes now.

So, can you have both? Absolutely! The IRS allows you to contribute to both a Traditional and a Roth IRA, as long as your total contributions across all your IRAs (Traditional, Roth, or any inherited IRAs) don't exceed the annual contribution limit. This is where things get interesting. You could, for example, contribute half the annual limit to a Traditional IRA and half to a Roth IRA. Or, you could max out one and put a smaller amount into the other, depending on your current financial situation and future tax outlook.

Getting started is simpler than you might think. First, determine your eligibility based on your income. There are income limits for contributing directly to a Roth IRA and for deducting Traditional IRA contributions. If you're over the income limits for a Roth, don't despair! You might be able to do a "backdoor Roth IRA" conversion. Next, open accounts with a brokerage or financial institution. You can often open both types of accounts with the same provider. Finally, start contributing! Even small, regular contributions add up significantly over time. Don't be intimidated; the most important step is taking that first step.

Having both a Traditional and a Roth IRA offers a powerful way to hedge your bets against future tax uncertainties and maximize your retirement nest egg. It’s like having a diversified investment portfolio for your taxes! Enjoy the peace of mind and the potential for a brighter, tax-free retirement.