Can I Give My House To My Son? What To Know

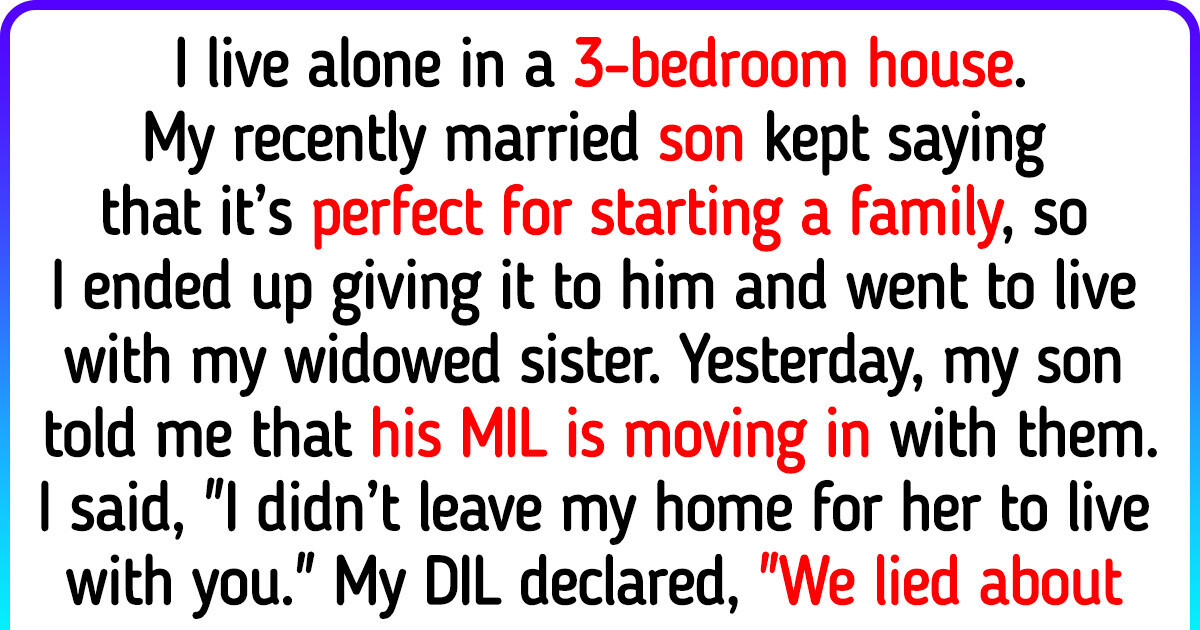

Hey there, wonderful homeowners! Ever find yourself gazing at your beloved house, maybe with a cup of tea in hand, and thinking, "You know, this place would be perfect for little Timmy (or Susie!) when they're older?" Or perhaps they're already grown and you're just itching to help them out. Well, the age-old question pops into your head: "Can I actually give my house to my son?"

Short answer? Absolutely! It’s a generous and often very practical idea. But like most things in life, it’s not quite as simple as just handing over the keys and a big hug. There are a few things to chew on before you make this move. Think of it as planning a surprise party – you want all the details to be just right for maximum joy, right?

So, let's ditch the stuffy legal jargon and have a friendly chat about what you need to know. Grab another cuppa, get comfy, and let’s dive in!

The "Why" Behind the "Can I?"

First off, why are you even considering this? Is it to help your son get a foot on the property ladder? Are you looking to reduce your own taxable estate down the line? Or is it simply a heartfelt desire to leave a lasting legacy for your child? Knowing your motivations will really help steer you towards the best approach.

It's a beautiful thing, wanting to pass on something as significant as your home. It’s more than just bricks and mortar; it’s where memories are made, where you’ve poured your heart and soul. And wanting to share that with your son is incredibly thoughtful.

Different Ways to "Give" the House

When we say "give" a house, it can take a few forms. It’s not like handing over a homemade cookie (though that's nice too!). Here are the main avenues:

1. Gifting the House During Your Lifetime

This is probably what most people picture. You transfer ownership of the house to your son while you're still around. Easy peasy, right? Well, almost. This usually involves a formal process, often called a "deed transfer" or a "gift deed."

Basically, you're signing over your ownership rights to him. This is a big deal! It means he officially becomes the owner. You’ll likely need a lawyer to help with the paperwork – they’re like the super-smart guides who navigate the legal maze for you. Think of them as your property-transfer sherpas!

2. Selling the House to Your Son at a Discount (or for $1!)

Sometimes, a full "gift" might have tax implications (more on that later, don't panic!). So, a common strategy is to sell the house to your son for a price significantly lower than its market value. Some people even do a “$1 sale” for a token amount. This is still considered a gift for tax purposes, but it’s a way to formally transfer ownership through a sale transaction.

This can be a clever way to manage things. It’s like giving him a massive discount on the best deal ever! He gets the house, and you get a bit of cash (or a symbolic dollar) and help manage potential tax issues.

3. Leaving the House in Your Will

This is the classic "inheritance" route. You specify in your will that your son will inherit the house upon your passing. This means you retain ownership and control during your lifetime. When the time comes, your will guides the process of transferring ownership to him.

This is a straightforward approach if you’re not in a rush or if you want to continue living in the house without any immediate changes. It’s like saying, "This is yours, but I get to enjoy it for a while longer."

The Nitty-Gritty: What You Really Need to Know

Okay, now for the not-so-glamorous but super-important bits. These are the things that can trip you up if you’re not prepared. Let’s break them down.

1. Tax Implications (The Big Kahuna!)

Ah, taxes. The word that makes grown adults shudder. When you give away a significant asset like a house, there can be tax consequences for both you and your son. Don’t let this scare you – it’s manageable!

Gift Tax: In many countries, there’s an annual exclusion amount for gifts. This means you can give a certain amount of money or assets to someone each year without it counting towards your lifetime gift tax exclusion. For 2023 (and likely 2024, these figures tend to be adjusted annually), this amount is quite generous – around $17,000 per person, per year. If the value of the house (or the portion you're gifting) exceeds this, you might need to file a gift tax return. Don’t worry, you might not actually owe tax if you’re under your lifetime exclusion, but filing is still important.

Capital Gains Tax: If you sell the house to your son for less than you bought it for, or even for a nominal amount, he might inherit your "cost basis" in the property. This means when he eventually sells it, he might have to pay capital gains tax on the difference between the sale price he gets and your original purchase price (plus improvements). This can be a hefty surprise for him down the line!

Inheritance Tax/Estate Tax: If the house is left in your will, it becomes part of your taxable estate. Depending on the total value of your estate and the laws in your jurisdiction, there might be estate taxes to consider. However, there are usually significant thresholds before estate taxes kick in, so for many people, this isn't an issue.

The Golden Rule: Always consult with a tax advisor or an estate planning attorney. They can look at your specific situation and give you the best advice to minimize tax liabilities for everyone involved. Seriously, this is not a place to wing it!

2. Capital Gains Tax for Your Son (The "Future You" Problem)

This is a big one that often gets overlooked when gifting a home. When you gift a house, your son generally inherits your "cost basis." This is the price you originally paid for the house, plus the cost of any major improvements you made over the years. Let’s say you bought your house for $100,000 decades ago, and it’s now worth $500,000. If you gift it to your son, his cost basis is $100,000. If he sells it later for $600,000, he’ll owe capital gains tax on $500,000 ($600,000 - $100,000).

Compare this to if he inherited the house through your will. In that case, he usually gets a "stepped-up basis." This means his cost basis becomes the fair market value of the house at the time of your death. So, if the house is worth $500,000 when you pass, his basis becomes $500,000. If he sells it for $600,000, he only owes capital gains tax on $100,000 ($600,000 - $500,000). See the difference? It can save him a lot of money!

This is why, for tax purposes, leaving a house in your will often makes more sense for the recipient than gifting it during your lifetime, especially if the property has appreciated significantly. Again, your tax advisor is your best friend here!

3. Property Taxes and Insurance

Once your son is the legal owner, guess who’s responsible for the property taxes and homeowner’s insurance? Yep, him! Make sure he’s aware of these ongoing costs and is financially prepared to take them on. You don’t want him to be blindsided by a hefty property tax bill!

This also means he'll be responsible for any maintenance, repairs, or upgrades. So, have a frank conversation about the condition of the house and any potential future costs.

4. Your Living Situation (The "Where Will I Go?" Question)

This is a huge consideration, especially if you plan to gift the house while you’re still living in it. Are you planning to move out? If so, where will you go? Will you rent? Buy a smaller place? Live with your son?

If you want to continue living in the house after gifting it, you’ll need to discuss this very clearly with your son. You might consider a "life estate" agreement. This allows you to live in the home for the rest of your life, while your son owns it. It’s a legal arrangement that protects your right to reside there. Your estate planning attorney can explain how this works.

It’s important to have a clear understanding with your son about the terms of your living arrangements. Communication is key – like a well-oiled machine!

5. Your Son’s Circumstances

Think about your son’s current life. Is he married? Does he have children? What’s his financial situation like? What are his plans for the future?

If he’s married, the house might become marital property. If he has debts, the house could potentially be at risk. If he has other siblings, gifting the house to just one son might create feelings of unfairness or lead to disputes down the line. These are sensitive topics, but it’s better to address them upfront.

Sometimes, people gift their home and then realize their son isn't quite ready for that responsibility, or it creates more stress than joy. It’s good to have an honest chat with him about his readiness and his aspirations.

6. Legal and Paperwork Maze

As mentioned, transferring property ownership is a legal process. You’ll need to prepare and file a new deed. This deed needs to be accurate, and it’s crucial that it’s correctly recorded with your local government office (often called the county recorder or land registry).

This usually involves:

- A new deed (like a Quitclaim Deed or Warranty Deed, depending on the situation)

- A legal description of the property

- The names of the grantor (you) and the grantee (your son)

- Signatures, often notarized

- Recording fees

This is where your lawyer or a qualified title company comes in. They ensure everything is done by the book. Trying to DIY this is like trying to perform surgery with a butter knife – not recommended!

Putting it All Together: The Happy Ending

So, can you give your house to your son? Yes! It's a wonderful gesture of love and support. But it’s a significant decision that requires careful planning and professional advice.

Think of it like baking a really special cake. You need the right ingredients (understanding the different transfer methods), you need the right recipe (legal and tax advice), and you need to follow the instructions carefully (paperwork and process). If you do it right, the result is a delicious, heartwarming success!

By taking the time to understand the tax implications, the legal steps, and having open conversations with your son, you can ensure this generous act brings joy and security for years to come. You’re not just giving him a house; you're giving him a foundation, a piece of your legacy, and a tangible expression of your love. And that, my friends, is truly something to smile about.

So go ahead, dream big, plan wisely, and make those generous dreams a reality. Your son (and your future self!) will thank you for it!