Can I Get A Life Insurance Policy On Anyone

Ever caught yourself watching a movie and thinking, "Could I actually get a life insurance policy on that character?" It's a fun thought experiment, right? The idea of insuring someone's life, especially someone famous or someone you know, sparks all sorts of interesting questions. It's like a real-life game of "what if," but with actual financial implications!

So, can you just waltz into an insurance office and ask to insure your favorite celebrity? Or your quirky neighbor? The short answer is a resounding "no," unless you have a very specific and legitimate reason. It's not quite as simple as picking someone you admire and signing on the dotted line. There are rules, and they're there for a good reason!

Think of it this way: life insurance is all about protecting someone from financial loss. You can only get a policy on someone if their passing would cause you a real financial hardship. This is known as having an "insurable interest." It’s the cornerstone of life insurance, and it’s what keeps things fair and prevents all sorts of shenanigans.

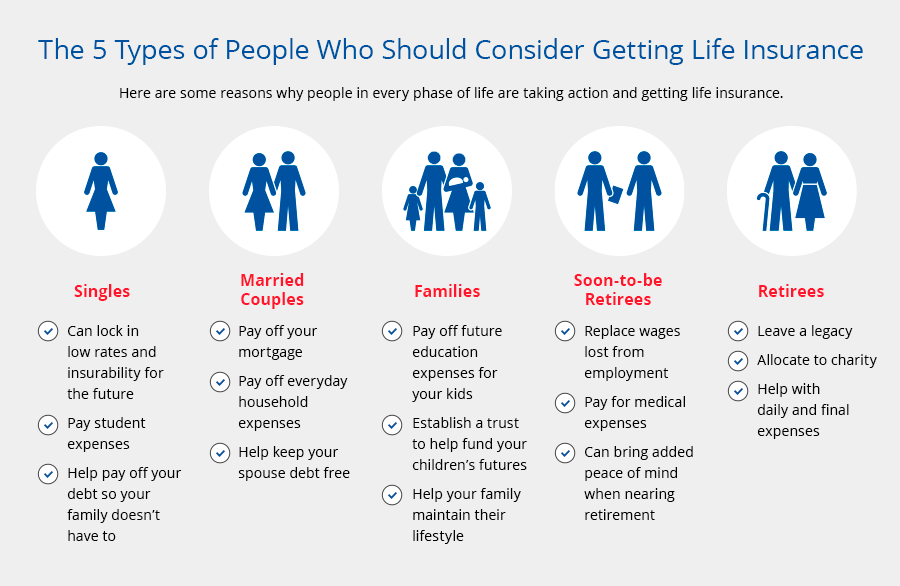

The most common example of insurable interest is your spouse or children. If your partner passes away, you might have a mortgage to pay, bills to cover, and a family to support. Your life insurance policy helps fill that financial gap. It’s a safety net, pure and simple.

What about your best friend? Could you get a policy on them? Probably not, unless they owe you a significant amount of money or you rely on them for your income in some way. It’s not about how much you love them or how much you’d miss them. It’s strictly about the money, which can feel a bit cold, but it's crucial.

This concept of insurable interest is what makes the idea of insuring random people so entertaining to consider. Imagine the possibilities! Could you get a policy on Taylor Swift? Think of all the fans who would be devastated! But no, unless you're her manager and her income directly supports your business, you're out of luck.

And what about that eccentric inventor down the street who's always tinkering with something that might just explode? If their groundbreaking invention was meant to make you a millionaire, and their untimely demise would mean you lose that fortune, then maybe, just maybe, you'd have an insurable interest. But these are rare cases!

The whole thing is a bit like a detective story. You have to prove that you'd suffer a financial loss if the person died. It’s not about emotional distress, as much as we might feel it. It's about tangible, measurable financial pain.

So, while you can't just pick anyone you fancy and insure them, the thought process behind it is what makes it so intriguing. It forces you to think about value, risk, and financial relationships in a new light. It’s a conversation starter, for sure!

Let’s dive a bit deeper into the "why" behind this rule. It’s to prevent people from taking out life insurance policies on strangers and then hoping for the worst. Imagine if anyone could insure anyone! It would be a recipe for disaster and would likely lead to some very dark outcomes. The insurance industry wouldn't survive!

The primary purpose of life insurance is to provide financial security for dependents or to cover debts. It's a contract of protection, not a lottery ticket. The person whose life is insured must agree to it, and they usually do, especially when it's for their spouse or family.

When you apply for a life insurance policy, you have to disclose a lot of information. This includes the medical history of the person being insured, their lifestyle, and the relationship you have with them. Insurers want to make sure everything is legitimate.

What if you're a business owner? You might have an insurable interest in your key employees. If their death would cripple your business, you might be able to get a policy on them. This is called a "key person" insurance policy. It’s a practical business tool, not a whimsical choice.

The idea of insuring someone you've only just met is purely in the realm of fiction. In real life, the paperwork and the legalities are quite stringent. They have to be. It’s about maintaining trust and integrity in the financial system.

Think about it from the insurance company's perspective. They are in the business of assessing risk. If they allowed policies to be taken out on anyone, their risk assessment would be impossible. They wouldn't be able to calculate premiums or manage their liabilities.

The fun part is exploring the boundaries of "insurable interest." Could a business partner have an insurable interest in another partner? Yes, if their business relied on that person's contributions and their death would cause financial ruin to the business. It’s about the financial dependency.

What about a creditor? Can a bank get life insurance on a borrower? Yes, especially for large loans. If the borrower dies, the bank can be repaid. This protects the bank's assets.

So, while you can’t get a life insurance policy on, say, the entire cast of your favorite TV show just because you’d be sad if they were gone, the underlying principles are fascinating. It highlights the practical and financial aspects of life insurance.

It's the "what ifs" that capture our imagination. What if you could insure the life of someone who held the cure for a deadly disease? The financial implications would be astronomical. But again, this is where imagination meets reality, and reality has strict rules.

The entertainment value comes from understanding these rules and how they differ from our wildest desires. We want to believe we can have a say in protecting the lives of those we admire or those who impact us, even if it's just a fleeting thought.

Consider the scenario of a long-lost relative who suddenly appears with a massive debt owed to you. If their passing would mean you never get that money back, you might have an insurable interest. It’s a bit dramatic, but within the bounds of possibility!

The concept of insurable interest also prevents fraud. Without it, people could take out policies on individuals they have no connection with, with the intent to cause harm. That’s a dark thought, and why the rules are so firm.

The core idea is that life insurance is a tool for mitigating financial risk, not for speculative gain or as a form of entertainment. It's serious business, designed to provide a safety net when it's most needed.

But the conversation around it? That can be fun. It can lead to discussions about who we value, who impacts us financially, and the complex web of relationships that bind us.

So, while you can't insure your celebrity crush or the charming barista at your local coffee shop, the reason why is a fascinating insight into the world of finance and protection. It’s a practical system with an engaging underlying logic.

It’s the difference between a romantic comedy and a hard-hitting drama. Life insurance is firmly in the latter category, but the questions it raises can be as thought-provoking and entertaining as any good story.

The next time you see a dramatic scene in a movie where someone's life is at stake and there's a financial element, you can appreciate the real-world constraints that insurance policies operate under. It’s a world away from plot devices, and much more grounded in everyday reality.

And that grounded reality, with its specific rules and requirements, is what makes the initial, fantastical question so engaging. It’s a peek behind the curtain of a system that impacts so many lives, even if we can’t insure everyone we wish we could.

So, no, you generally can't get a life insurance policy on anyone. But understanding why you can’t is a surprisingly interesting journey into the world of financial responsibility and protection. It's more than just a policy; it's a testament to careful planning and genuine need.