Can I Contribute To Sep Ira And Traditional

Hey there, coffee buddy! Grab a refill, because we need to chat about IRAs. You know, those magical accounts that help us stash away cash for our golden years. Today's burning question, the one that keeps us up at night (or at least during our commute), is: Can I contribute to a SEP IRA and a Traditional IRA? It's a doozy, right? Like asking if you can have your cake and eat it too. Let's dive in!

So, you're thinking about retirement. Good for you! Seriously, pat yourself on the back. Planning for the future is practically a superpower. And IRAs are like your secret weapon in that quest. We’ve got the Traditional IRA, the OG, the classic. And then there's the SEP IRA, which sounds a bit more… exclusive. Like a VIP club for your savings. But can you be in both clubs? That’s the million-dollar question, isn't it? (Hopefully, it will be a million dollars someday, right?)

Let’s break it down, friend. The short answer, the one that might make you do a little happy dance, is yes, generally, you can contribute to both a SEP IRA and a Traditional IRA. Cue the confetti! But, as with most things in life, there's a little asterisk. Or maybe a whole paragraph of asterisks. You know how it is.

First, let’s get our ducks in a row and define our players. What exactly is a SEP IRA? SEP stands for Simplified Employee Pension. Sounds fancy, right? It's basically a retirement plan that's super easy for self-employed individuals and small business owners to set up and manage. Think of it as the boss setting up a retirement fund for themselves and their employees (if they have any, that is). The contributions are made by the employer, and guess who is often the employer and the employee in this scenario? Yup, it's probably you!

Now, the Traditional IRA. This is the one most folks are familiar with. You contribute money, and if you meet certain income limits and aren't covered by a retirement plan at work, your contributions might be tax-deductible. It’s like a little tax break now, and then the money grows tax-deferred until you start withdrawing it in retirement. Then, of course, it gets taxed. Boo. But hey, delaying taxes is pretty sweet, wouldn't you agree?

So, the big question: can you play in both sandboxes? For the most part, the IRS is pretty chill about this, as long as you're eligible for both. The key word here is eligible. You can't just magic yourself into a SEP IRA if you're not self-employed or a business owner, right? That would be too easy. And let's be honest, life's rarely that easy. But if you fit the bill for both, then go for it!

Here's the juicy part, the "how it works" bit. If you have a side hustle, or you're a freelancer, or you run your own little empire (even if it's just you and your cat), you can contribute to a SEP IRA as the "employer." Then, if you also have a regular W-2 job with a 401(k) or other employer-sponsored plan, you can also contribute to a Traditional IRA. Mind. Blown. Right? It’s like having a double shot of espresso for your retirement savings!

But wait, there's a catch, as there always is. The limits. Oh, the glorious limits. Your ability to contribute to a Traditional IRA might be affected if you (or your spouse, if you're married) are covered by a retirement plan at work. This is where those income phase-outs come into play. If your income creeps up, your deduction might shrink or disappear. It’s like a magic trick, but less fun.

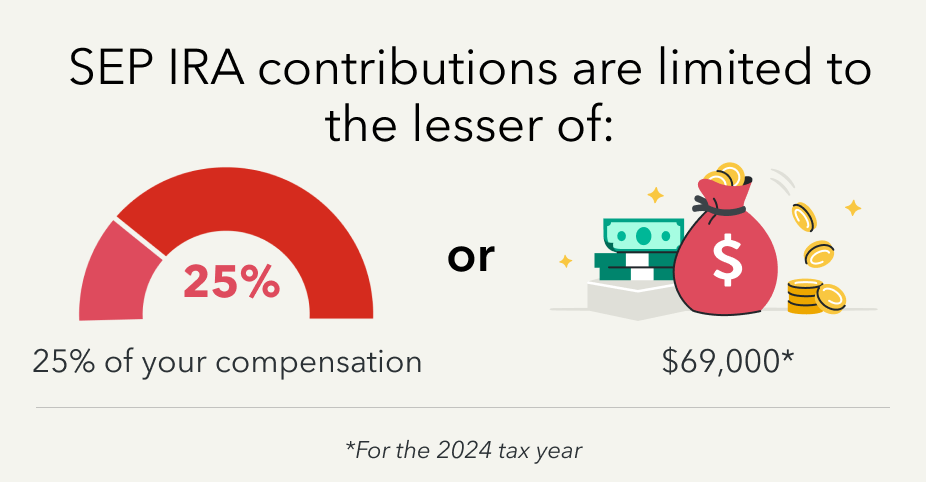

And the SEP IRA? The contribution limits there are way more generous. They’re a percentage of your net earnings from self-employment. So, the more you earn from your side gig, the more you can squirrel away in your SEP. It's a beautiful, beautiful thing for the entrepreneurial spirit. Just remember, the employer contribution to a SEP IRA is your contribution as the employer.

Now, let's talk about the actual contribution part. When you contribute to a SEP IRA, those are employer contributions. They're not subject to the same annual limits as employee contributions to a 401(k) or a Traditional IRA. That's a huge advantage. You can put a significant chunk of your self-employment income into a SEP. And for 2023, for instance, the maximum you could contribute to a SEP IRA was 25% of your net adjusted self-employment income, up to $66,000. Whoa nelly!

So, if you're contributing to your SEP IRA as the employer, that doesn't magically stop you from making your own employee contributions to a Traditional IRA, provided you meet those Traditional IRA rules. It's like having two separate piggy banks, and you can put money in both, as long as you follow the rules for each specific piggy bank.

Let's get super clear on this. Imagine this: You have a full-time job. Your employer offers a 401(k). You're contributing to that. Great! Now, on the weekends, you're a freelance graphic designer. You're your own boss. You can open a SEP IRA for your design business. And, because you're also an individual, you can also contribute to a Traditional IRA. See? Two different hats, two different retirement accounts. It’s all about your different roles in the financial world.

But here’s where things get a little fuzzy, a little "are you sure?" The IRS doesn't want you double-dipping on tax deductions for the same money. That would be too good to be true, right? So, while you can contribute to both, the contributions to your Traditional IRA might not be deductible if your income is too high and you're covered by a retirement plan at your main job. And the SEP IRA contributions are made with pre-tax dollars from your self-employment income, so they're generally deductible for the business. It's a subtle but important distinction.

Think of it this way: Your SEP IRA contributions are coming from your self-employment income, effectively reducing your taxable income from that business. Your Traditional IRA contributions are made from your personal funds. If those personal funds are from your W-2 job and your income is above certain thresholds, and you're covered by a work retirement plan, those Traditional IRA contributions might be non-deductible. That means you contribute after-tax dollars, and then the growth is still tax-deferred, and withdrawals in retirement are tax-free. Not ideal, but still better than nothing!

So, the takeaway? You can indeed contribute to both a SEP IRA and a Traditional IRA. It's a fantastic strategy if you're self-employed and have other income. It allows you to maximize your retirement savings across different avenues. But always, always, always check the current year's IRS contribution limits and income phase-out rules. These things change, and nobody wants to get a surprise bill from Uncle Sam, do they? It's like that surprise bill for your electricity usage – never fun.

What about Roth IRAs, you ask? Ooh, good question! While this article is about Traditional IRAs, it's worth a brief mention. The rules are a little different for Roth IRAs. You can contribute to a SEP IRA and a Roth IRA, but here's the kicker: your SEP IRA contributions are considered employer contributions, and they don't count towards your Roth IRA contribution limit. Your Roth IRA contributions are made with after-tax dollars, and the distributions in retirement are tax-free. So, you're not going to get a deduction for the SEP contributions, but you can have both.

Let's get back to our main characters: SEP and Traditional. The bottom line is that if you're wearing two hats – let’s say, employee of a company and self-employed individual – you can potentially contribute to both. It’s all about managing your different income streams and taking advantage of the tax benefits each account offers. It's like having a well-rounded investment portfolio, but for your retirement savings! Who knew adulting could be so… strategic?

One of the biggest advantages of a SEP IRA is its flexibility and the high contribution limits. This is especially beneficial if your self-employment income fluctuates. You can adjust your contributions year by year, which is a nice little perk. And then, on top of that, you can still contribute to a Traditional IRA to potentially get that upfront tax deduction if your income allows. It's a win-win, or at least, a "win-more" situation.

So, next time you’re pondering the mysteries of retirement accounts over your morning latte, remember this little chat. Yes, you can contribute to both a SEP IRA and a Traditional IRA. It’s a powerful way to boost your savings. Just remember to dot your i's and cross your t's, consult those IRS guidelines, and maybe even chat with a financial advisor if you're feeling overwhelmed. They're the real wizards of the financial world, you know?

Ultimately, the goal is to build a nest egg big enough to enjoy your retirement without a second thought. And if you can leverage multiple retirement savings vehicles to get there faster, well, who are we to argue with that? It's all about being smart, being prepared, and maybe, just maybe, having a little fun with your money. Cheers to your future financial freedom, my friend!