Can I Amend My Tax Return If I Already Filed

So, you've done it. You've bravely navigated the labyrinth of tax forms, wrestled with receipts, and finally hit that glorious "submit" button. Congratulations! You're officially done... or are you? Life, as we know it, is full of little surprises, and sometimes, so is your tax return.

Think of your tax return like a carefully crafted recipe. You gather all your ingredients, follow the instructions to the letter, and present your delicious creation. But what if, after you've served it, you realize you accidentally forgot the pinch of secret ingredient that would have made it truly divine? Or maybe, just maybe, you put in a tad too much salt?

Well, guess what? The tax world, in its own wonderfully quirky way, understands that perfection is sometimes a journey, not a destination. That’s right, folks, even after you’ve thought your tax adventure was over, you might have a chance to go back and tweak your masterpiece. It's like realizing you left the oven on, but for your finances!

The Great Tax Return Revelation!

This magical ability to go back and make changes is called amending your tax return. It’s not a do-over for every tiny misstep, mind you. Think of it more as a friendly nudge to fix those "oops" moments that could actually make a difference. Did you forget to claim that sweet deduction for your artisanal pickle-making supplies? Or perhaps you accidentally told the tax gods you made more money than you actually did from your prize-winning poodle grooming business?

The most common reason people amend their returns is usually because they discover they’ve missed something that would save them money. Who doesn't love saving money? It’s like finding a forgotten twenty-dollar bill in your winter coat pocket, but potentially much, much more!

Sometimes, it’s the tax agencies themselves that might send you a friendly little note. It's not a scolding, more like a gentle reminder, "Hey there, friend! We noticed a small discrepancy. Want to clear the air?" These nudges often happen when there's a mismatch between what you reported and what other sources, like your employer, reported.

When Your Spreadsheet Sheds a Tear

Imagine this: You’re happily humming along, enjoying your newfound free time after filing. Suddenly, a thought strikes you. Did you remember to add in the charitable donation you made to the Society for the Preservation of Obscure Folk Music? Or was that a deduction you could have taken for your extensive collection of vintage board games?

The heart-warming part? It’s often about correcting an honest mistake that could lead to you getting a bigger refund. It’s like getting an unexpected birthday present, but from the government! And who wouldn't be thrilled about that?

Or, on the flip side, maybe you’ve realized you owe a little more than you initially thought. While not as exciting as a bigger refund, it’s still a good feeling to be on the right side of things. It's about tidiness, financial tidiness, and that’s a surprisingly satisfying feeling for many.

“I totally forgot about my student loan interest! I was so focused on getting it done, I just glossed over it. A few weeks later, I saw the form again and my jaw just dropped. I actually qualified for a deduction. It was like a mini-financial miracle!” - Brenda, a very happy tax-return-amender.

Brenda’s story is a common one. We get so caught up in the whirlwind of filing, our brains are practically begging for a break. It’s human nature to overlook things when you’re under a deadline, even if that deadline is self-imposed after the initial filing.

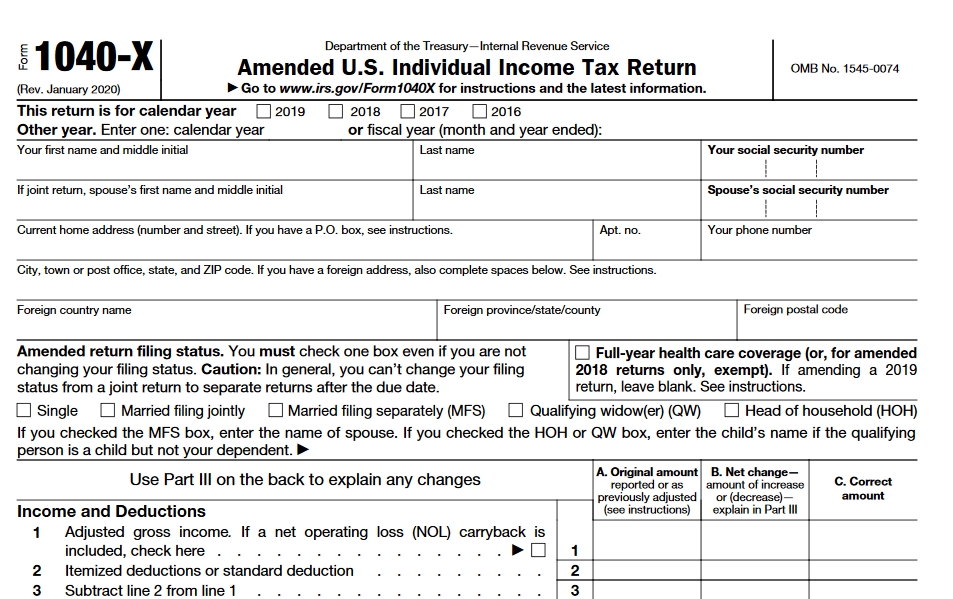

The Not-So-Scary Process: Form 1040-X!

Now, before you start picturing a complex legal battle, let me introduce you to the star of our show: Form 1040-X, the Amended U.S. Individual Income Tax Return. It sounds a bit formal, a bit intimidating, but think of it as your friendly repair kit for your tax return.

This form is designed to be straightforward. You basically fill it out, explaining what you're changing and why. The IRS wants to help you get it right. They’re not looking to catch you out; they’re looking for accuracy.

The beauty of Form 1040-X is that it allows you to clearly show the original amounts you filed, the corrected amounts, and the difference. It's like showing your work in math class, but for Uncle Sam. And the more clearly you show your work, the smoother the process usually is.

The biggest hurdle for most people is simply knowing that this option exists. Once you discover it, it's like finding a hidden shortcut on a long road trip. Suddenly, the journey feels a lot less daunting.

A Tale of Two Tax Returns

Let’s imagine two scenarios. Scenario A: You file, you forget about it, and then you get a letter from the IRS about a small issue. Mild panic ensues. Scenario B: You file, you remember a missed deduction for your impressive collection of rubber chickens, and you decide to amend. You file Form 1040-X, explain your rubber chicken situation, and lo and behold, you get a bigger refund.

Which scenario sounds more appealing? I’m guessing it’s Scenario B, where you proactively fix things and potentially get more money back. It's the difference between being reactive and proactive, and in the world of taxes, being proactive can be quite rewarding.

The heartwarming aspect here is the sense of control. You're not waiting for a potential problem; you're taking charge of your financial information. It's a small act of self-empowerment that can have a tangible, positive outcome.

“My uncle, bless his heart, is a wonderful man, but his grasp of numbers is… shall we say, whimsical. He filed his taxes last year and was so proud. A few months later, he realized he’d completely forgotten to include income from a small side hustle. He was worried sick! But his accountant, a saint in my book, helped him file an amendment. He was so relieved, and actually got a refund he wasn’t expecting!” - Maria, grateful niece.

How To File An Amended Tax Return

Maria’s uncle’s story perfectly captures the relief and peace of mind that amending can bring. It’s not just about the money; it’s about closing that little nagging worry in the back of your mind. It's about knowing your financial house is in order.

The Golden Rules of Amending

Now, like any good adventure, there are a few things to keep in mind. First, there's a time limit. You generally have three years from the date you filed your original return, or two years from the date you paid the tax, whichever is later. So, don’t dawdle too long!

Second, be honest and accurate. The IRS is a stickler for details. If you’re amending because you owe more, make sure you include that payment with your amended return. Nobody likes a surprise bill, but paying what you owe promptly avoids further complications.

Finally, keep good records. Those receipts, those statements – they are your best friends when it comes to amending. They are the proof of your financial story, the evidence that supports your corrections.

So, the next time you finish filing your taxes, take a deep breath. You've conquered the beast! But if, in the days or weeks that follow, a little voice whispers, "Did you forget something?" don't despair. The possibility of amending your tax return is a surprisingly accessible and often beneficial option. It’s a testament to the fact that sometimes, in the grand, often confusing, world of taxes, there’s a second chance to get it right, and maybe even snag a little extra cash while you’re at it!