Can Hospital Bills Affect Your Credit Score

Okay, so let's talk about something that's probably not your go-to dinner party topic: hospital bills. Yeah, I know, thrilling stuff. But hold up! Did you know these surprise visitors from the ER or that unexpected surgery could actually be playing a tiny role in your credit score? Mind. Blown.

It’s true! That little number that dictates if you can get a new credit card, a snazzy apartment, or even a decent car loan? It might be getting a nudge (or a shove!) from medical debt. Who knew your sprained ankle had such sophisticated financial repercussions?

The Unexpected Side Hustle of Your Health

Think about it. You’re probably focused on recovery, maybe binge-watching your favorite shows, and definitely not thinking about credit reporting agencies. But somewhere, in the digital ether, your medical bill is having a whole other adventure.

It's like your health decided to embark on a secret mission, and its mission report is being sent directly to Equifax, Experian, and TransUnion. And guess what? They're taking notes. Big notes.

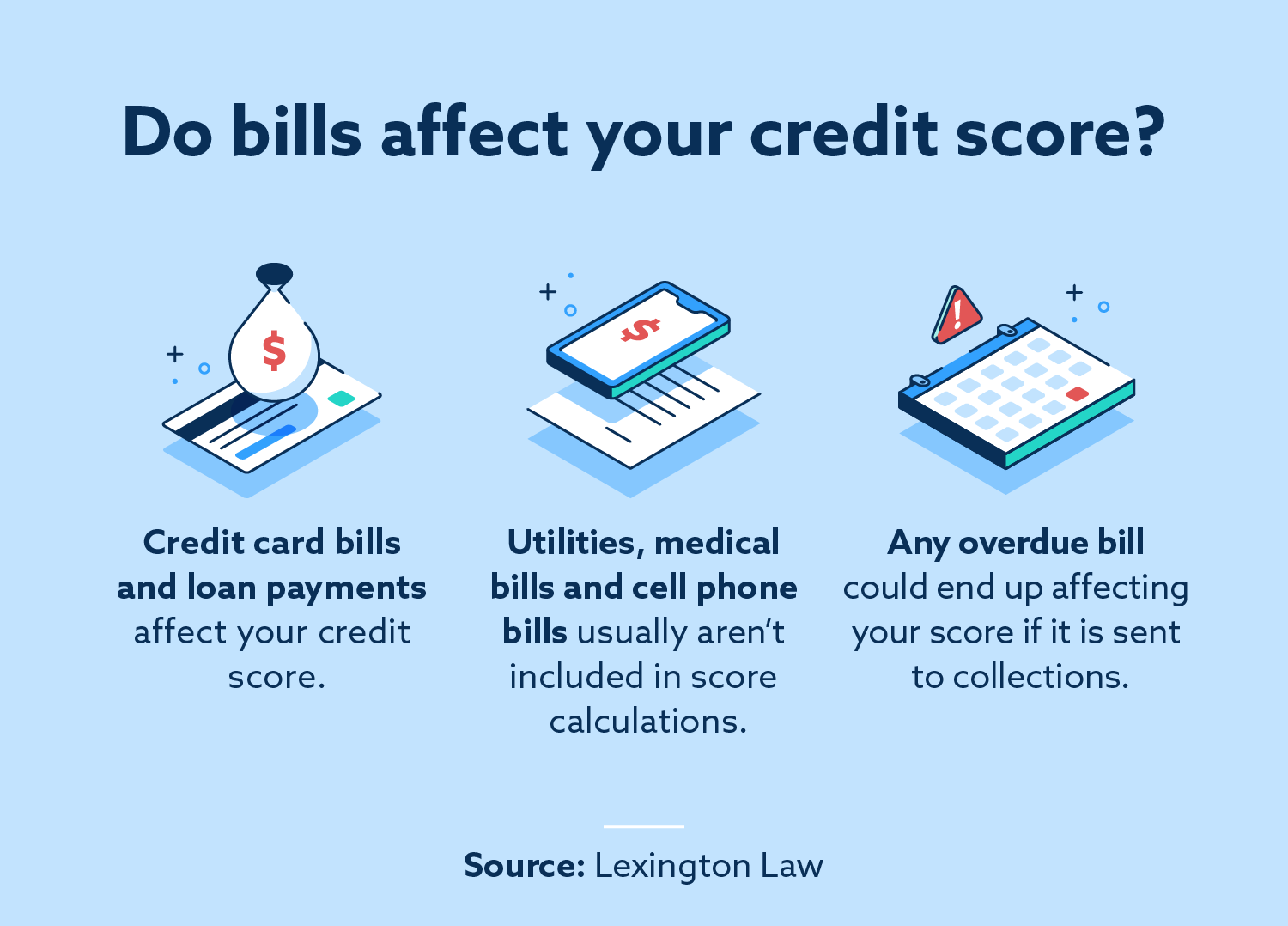

So, how does this whole credit score thing even work with medical bills? It’s not as straightforward as a late credit card payment. It’s a bit more… nuanced. And dare I say, a little bit quirky?

When Does a Bill Become a Credit Score Culprit?

Here's the juicy bit. A hospital bill won't automatically tank your credit score the second it arrives in your mailbox. Nope. There's a whole process, like a very serious, very boring game of Go Fish, but with debt.

First, the bill needs to go into collections. This means the hospital has tried to get their money, you haven't paid, and they've decided to hand it over to a collection agency. Think of them as the repo men of the medical world, but way less intimidating… or maybe just as intimidating, depending on how you feel about debt collectors.

This collection agency is the one that can report the overdue amount to the credit bureaus. And that's when your credit score might start to feel the sting. It’s like your medical debt gets a tiny, unwelcome passport and travels to the land of credit reports.

The Funny Side of Medical Debt (Spoiler: There Isn't Much)

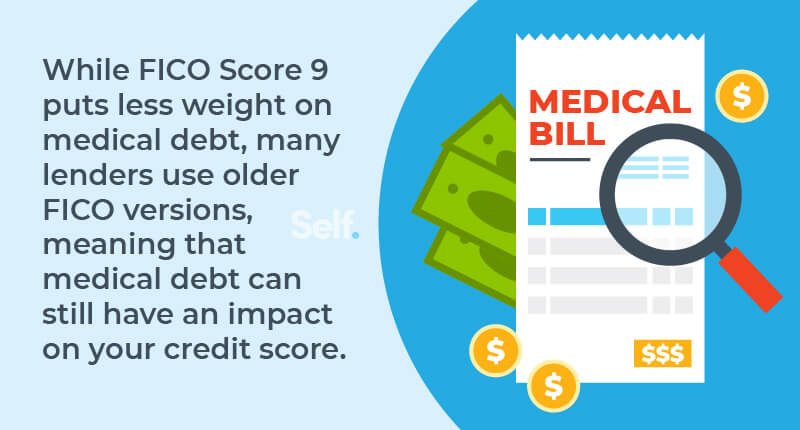

Okay, so maybe "funny" is a strong word. But there are some pretty wild quirky facts about this whole situation that are almost amusing in their absurdity. For example, did you know that medical debt used to be a huge problem for credit scores?

For ages, even paid-off medical collections could linger on your report for years, making it harder to get approved for things. It was like having a bad haircut from high school that just wouldn’t fade away. But then, some rules changed! Hooray for progress!

Now, paid medical collections are supposed to be removed from your credit report. This is a big deal! It means if you can somehow wrangle that debt and pay it off, the negative impact can disappear like a magic trick. Poof!

When Bills Go Ghost (and Then Come Back to Haunt You)

Another weird thing? Sometimes, bills get lost. Or they go to the wrong address. Or they get stuck in a bureaucratic black hole. You might think you're in the clear, living your best life, only for a collection agency to suddenly pop up like a surprise party you didn't want.

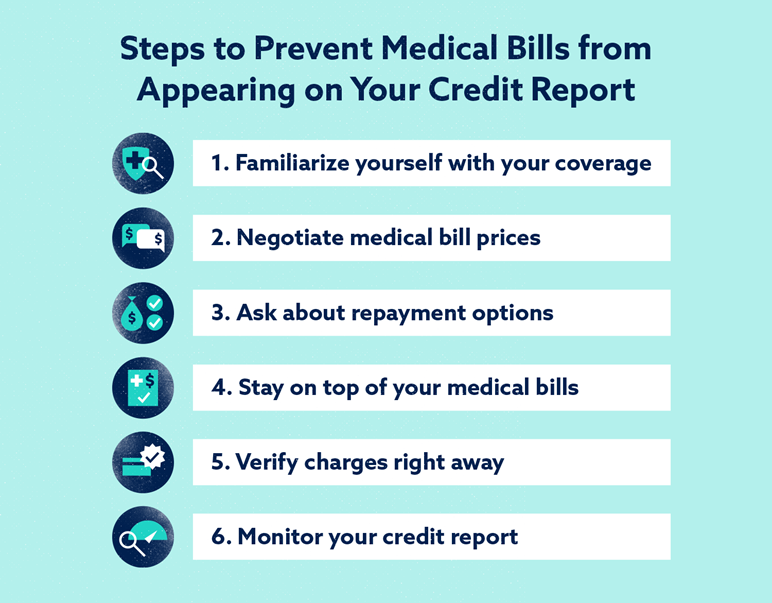

This is where being a detective for your own finances becomes important. Keep an eye on your mail. Check your credit reports regularly. You don't want a forgotten $50 co-pay to turn into a credit score nightmare, do you?

It’s like a financial scavenger hunt, but instead of treasure, you’re looking for… unexpected debt. Fun!

The Credit Score's Secret Life

Your credit score is this mysterious entity, right? It’s like a picky bouncer at the club of financial opportunities. And apparently, it’s a bit sensitive to unpaid medical bills that have been handed over to a debt collector.

It doesn't care if you were delirious from fever or if the bill was for something totally unnecessary. If it's in collections and reported, it can affect your score. It’s a purely transactional relationship. No empathy allowed.

This is why it’s kind of a fascinating topic to ponder. It connects our very human experiences of getting sick to the cold, hard logic of credit reporting. It’s a bizarre intersection of biology and finance.

Why Should You Even Care?

Because your credit score is a big deal! A lower score means higher interest rates on loans, more expensive insurance, and potentially a harder time renting an apartment. It’s the gift that keeps on giving… or not giving, depending on how good your credit is.

So, understanding how medical bills can impact it is like having a secret weapon. It empowers you to be proactive. You can catch things early. You can negotiate. You can fight back against those sneaky collection agencies.

It’s not about being paranoid, it’s about being informed. Think of it as adulting homework that’s actually kind of interesting.

So, What's the Takeaway?

Don't let a medical bill become a credit score monster. Stay vigilant. If you get a bill you don't understand, or if you can't afford it, reach out to the hospital. They often have financial assistance programs or can set up payment plans.

And if a bill does go to collections, deal with it. Don't ignore it. The sooner you address it, the less likely it is to cause long-term damage to your credit. You might even be able to negotiate a settlement or get it removed from your report once paid.

It's a bit of a wild ride, this medical debt and credit score thing. But a little bit of knowledge goes a long way. Now go forth and be credit-score-savvy! You’ve got this!