Buy Now Pay Later Routing And Account Number

Ever found yourself eyeing something you really want, but your bank account is giving you a stern look? We've all been there! Lately, you might have heard whispers about "Buy Now, Pay Later" (BNPL) options, and perhaps even a mention of routing and account numbers in relation to them. It might sound a tad technical, but understanding this little slice of the financial world can be surprisingly empowering, and dare we say, even a little fun!

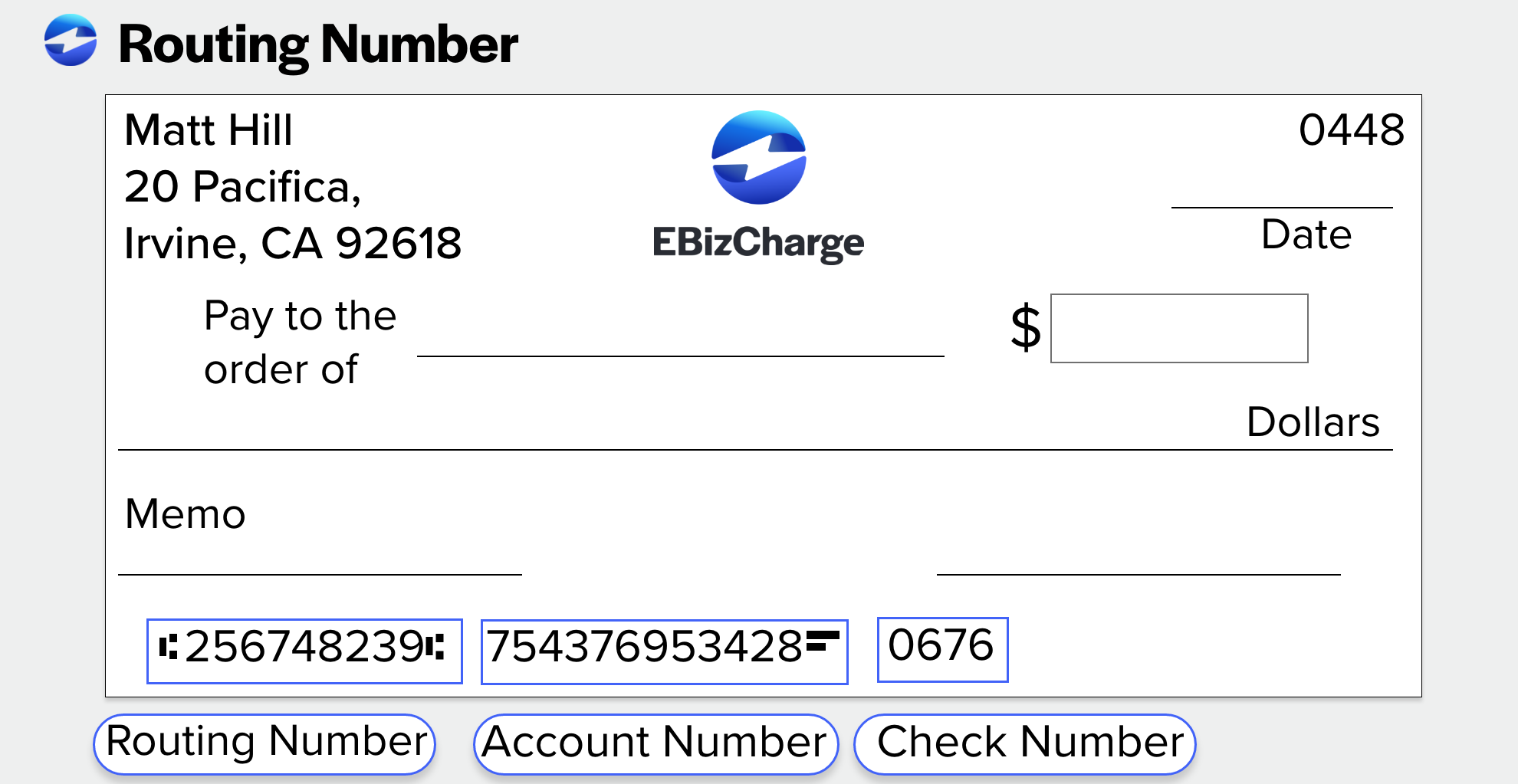

Think of BNPL as a modern-day layaway, but with a lot more flexibility. Instead of holding your item until you've paid it all off, BNPL services allow you to take your purchase home now and spread the cost over a few manageable payments, often interest-free if you stick to the schedule. So, what about those routing and account numbers? Well, when you sign up for a BNPL service and choose to link your bank account for repayments, these are the digits that let the service securely pull funds from your account on your agreed-upon dates. It’s essentially the same information you'd use to set up a direct deposit or transfer money between your own accounts.

The benefits are pretty clear, right? For starters, it makes larger purchases feel a lot more achievable. Imagine needing a new laptop for online courses or a specific piece of equipment for a hobby. BNPL can take the sting out of the upfront cost, allowing you to manage your budget more smoothly. In our daily lives, it can be incredibly useful for things like furniture upgrades, holiday gifts, or even covering unexpected but necessary expenses without draining your savings. It’s all about financial flexibility and giving you a bit more breathing room.

Let's peek at some examples. In an educational context, a student might use BNPL to purchase textbooks for the semester, spreading the cost over several months instead of facing a large bill right at the start. For daily life, consider needing a new washing machine. Instead of a hefty lump sum, you could use BNPL to pay for it in four installments, ensuring your laundry gets done without financial panic. It’s a tool that can help you smooth out your cash flow.

Curious to learn more or even dip your toes in? It's simpler than you think! Many online retailers now prominently feature BNPL options at checkout. When you select one, you’ll usually be guided through a quick application process. If you decide to link your bank account, that’s where you'll be prompted to enter your routing and account number. Don't worry, reputable BNPL providers use secure encryption to protect your sensitive information. You can also explore BNPL apps directly, which often offer a range of retailers and payment plans. Just remember to always read the terms and conditions carefully, especially regarding payment due dates and any potential fees. Understanding how your money moves is key to using these tools wisely and keeping your finances happy!