Borrowing From Life Insurance Pros And Cons

Ever thought about your life insurance policy being more than just a rainy-day fund for your loved ones? You know, something that could actually sprinkle a little sunshine into your current life? Well, buckle up, buttercup, because we're about to dive into the surprisingly cheerful world of borrowing from your life insurance! Sounds a bit like pulling a rabbit out of a hat, doesn't it?

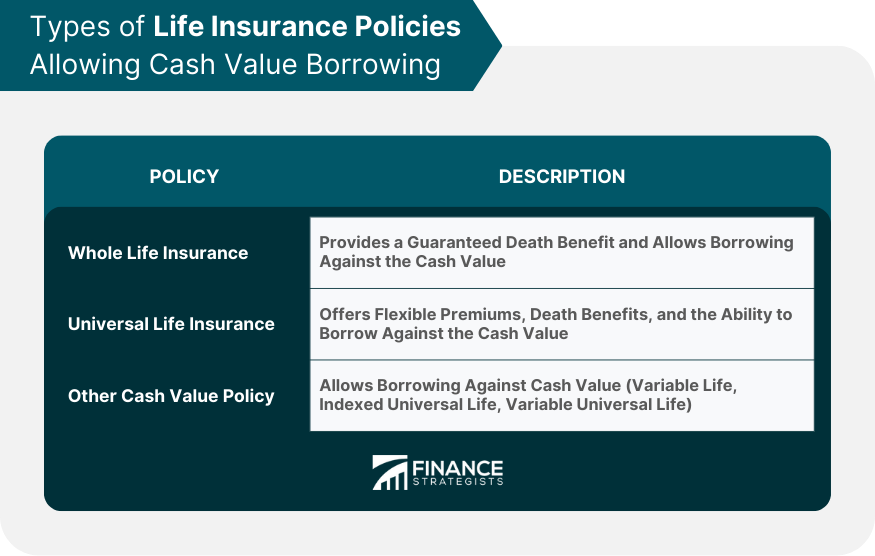

Now, before you start picturing yourself sporting a top hat and tails, let's get real. This isn't about waving a magic wand. We're talking about cash value life insurance, specifically policies like whole life or universal life. These aren't your basic term policies that just… well, terminate after a set period. These guys are the G.O.A.T.s when it comes to building up a little nest egg within the policy itself.

The "Borrowing from Your Life Insurance" Adventure: Let's Peek Behind the Curtain!

So, how does this whole "borrowing" thing even work? Think of it like this: your life insurance company is holding onto a little pot of money that's grown over the years – that's your cash value. When you need a little boost, a helping hand, or even a spontaneous trip to Bali (we can dream, right?), you can actually borrow against that cash value. It’s like unlocking a secret piggy bank, but a really, really sophisticated one.

And here's the kicker, the part that makes life a whole lot more fun: you generally don't need to prove your creditworthiness. Yep, you read that right! No mountains of paperwork, no credit score anxiety. The insurance company is lending you money against your own money. It's like saying, "Hey, I'm good for it because, well, it's my money!" This is a huge perk, especially if your credit isn't exactly singing opera right now.

The process is usually pretty straightforward. You'll fill out a form, and boom! The money is on its way. It's like a financial superhero swooping in to save the day. How cool is that? This flexibility can be a lifesaver for unexpected expenses, a down payment on something exciting, or even just to give yourself a little breathing room when life throws you a curveball.

The Sunny Side: Why Borrowing Can Be Your New Best Friend

Let's talk about the good stuff, the reasons why this could be the most brilliant financial move you make this year. Firstly, as we mentioned, the convenience and speed are unparalleled. Need cash for that emergency car repair? Poof! You can likely get it much faster than a traditional loan. This immediacy can be a real game-changer when you're feeling the pressure.

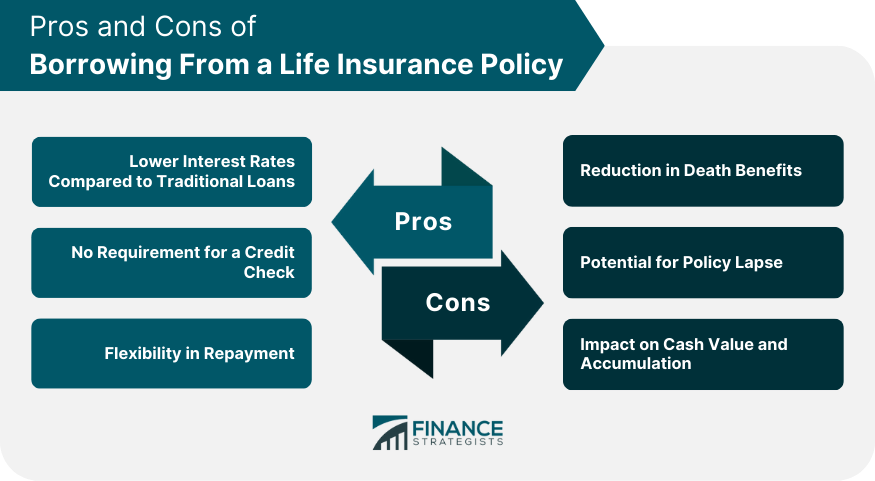

Secondly, the interest rates can be surprisingly competitive. While you do pay interest on the borrowed amount, it's often lower than what you'd find on a personal loan or credit card. Plus, in some cases, the interest you earn on your remaining cash value can offset some of the interest you're paying on the loan. It's like a financial magic trick where money is both going out and coming in! Talk about a win-win scenario.

And then there's the absolute beauty of not impacting your credit score. Think about it: you're not taking out a new loan that gets reported to the credit bureaus. This means you can access funds without the stress of potentially lowering your credit score. For those who are trying to maintain a pristine credit history, this is a massive advantage.

Imagine this: you've always wanted to take that photography workshop, or maybe finally invest in that fancy new grill for backyard barbecues. With a policy loan, you might just be able to fund those dreams without derailing your long-term financial goals. It's about using your assets to enhance your life, not just preserve it for some distant future.

Moreover, and this is a big one, the borrowed money is generally tax-free. Since you're borrowing against money you've already paid taxes on (through your premiums), the loan itself isn't considered taxable income. That means more of your money stays in your pocket, ready to be used for whatever makes you happy!

The Cloudier Skies: What to Keep an Eye On

Okay, okay, so it's not all sunshine and rainbows. We'd be doing you a disservice if we didn't mention the potential downsides. The biggest one, the elephant in the room, is that any outstanding loan amount, plus accrued interest, will reduce the death benefit paid out to your beneficiaries when you pass away. So, if you borrow $10,000 and pass away before repaying it, your beneficiaries will receive the original death benefit minus that $10,000 (and any interest).

It's crucial to remember that this is a loan, not a gift. You do have to pay it back, although there's often no strict repayment schedule. However, if you don't pay it back, or at least make some payments, the interest will continue to accrue. This can eat into your cash value and, if left unchecked, could even cause your policy to lapse, which is definitely not a fun outcome. Nobody wants their life insurance policy to disappear!

:max_bytes(150000):strip_icc()/understanding-life-insurance-loans.asp-Final-c9eda1aebe3141a0b58658374dd5c7c5.jpg)

Another thing to be aware of is that if your policy lapses due to unpaid loans and accrued interest, you could be responsible for taxes on any cash value exceeding the premiums you've paid. That's a scenario we definitely want to avoid, so staying on top of your policy is key.

And finally, while the interest rates can be competitive, they are still interest. You're essentially paying for the privilege of using that money. So, it's important to weigh the costs against the benefits. Is the immediate need or desire worth the interest you'll be paying?

Making Life Insurance a Tool for Awesome, Not Just an Obligation

So, what’s the takeaway? Borrowing from your life insurance policy can be an incredibly useful tool for navigating life's ups and downs, and even for seizing those exciting opportunities. It's about understanding your policy, knowing its capabilities, and using it wisely to enhance your life now, not just for the future.

Think of it as giving your life insurance policy a dual purpose. It’s a safety net for your loved ones, yes, but it can also be a springboard for your own adventures. It’s about financial empowerment and having the flexibility to live your life more fully. Who knew your insurance policy could be a ticket to making life more fun?

The world of financial planning can sometimes feel a bit dry, can’t it? But topics like this show us that there are often clever and even exciting ways to manage our money. It’s about being informed and making your money work for you. So, if you have a cash value policy, take a moment to explore its potential. You might be surprised at the opportunities waiting to be unlocked!

Don't let your life insurance policy just sit there collecting dust. Dive in, learn more, and discover how it can become an active, vibrant part of your financial life. It's your money, after all, and there are amazing ways to put it to good use. Go on, get curious!