Best Way To Start Saving For Retirement

Imagine your future self, lounging on a hammock strung between two palm trees, sipping on something tropical. That’s the dream, right? But how do we get that hammock-and-cocktail-fueled reality? It all starts with a tiny seed of money, planted today, and nurtured with a little bit of love (and smarts!).

Think of it like tending to a beloved houseplant. You don't just plop it in a pot and forget about it. You give it sunlight, water, and sometimes a little pep talk. Saving for retirement is remarkably similar, just with fancier terms and a much, much bigger pot.

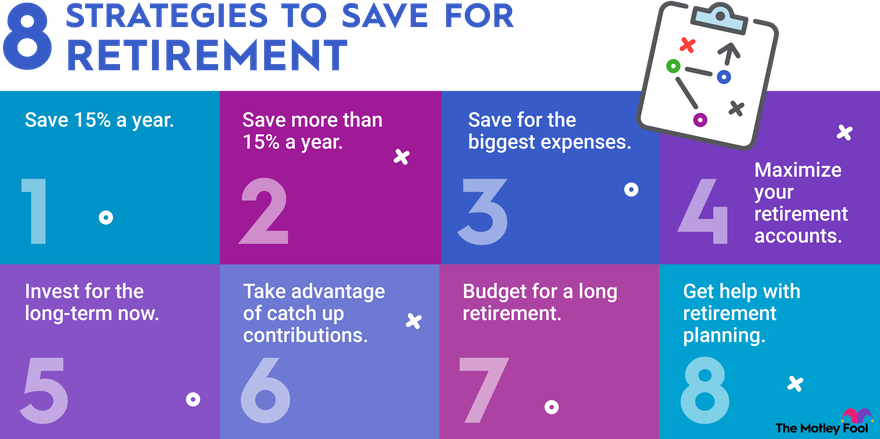

The absolute best way to start is to make it a no-brainer. We're talking about making saving happen before you even have a chance to spend it. This is where the magic of “pay yourself first” comes in. It sounds a bit bossy, doesn't it? But it’s actually the kindest thing you can do for your future self.

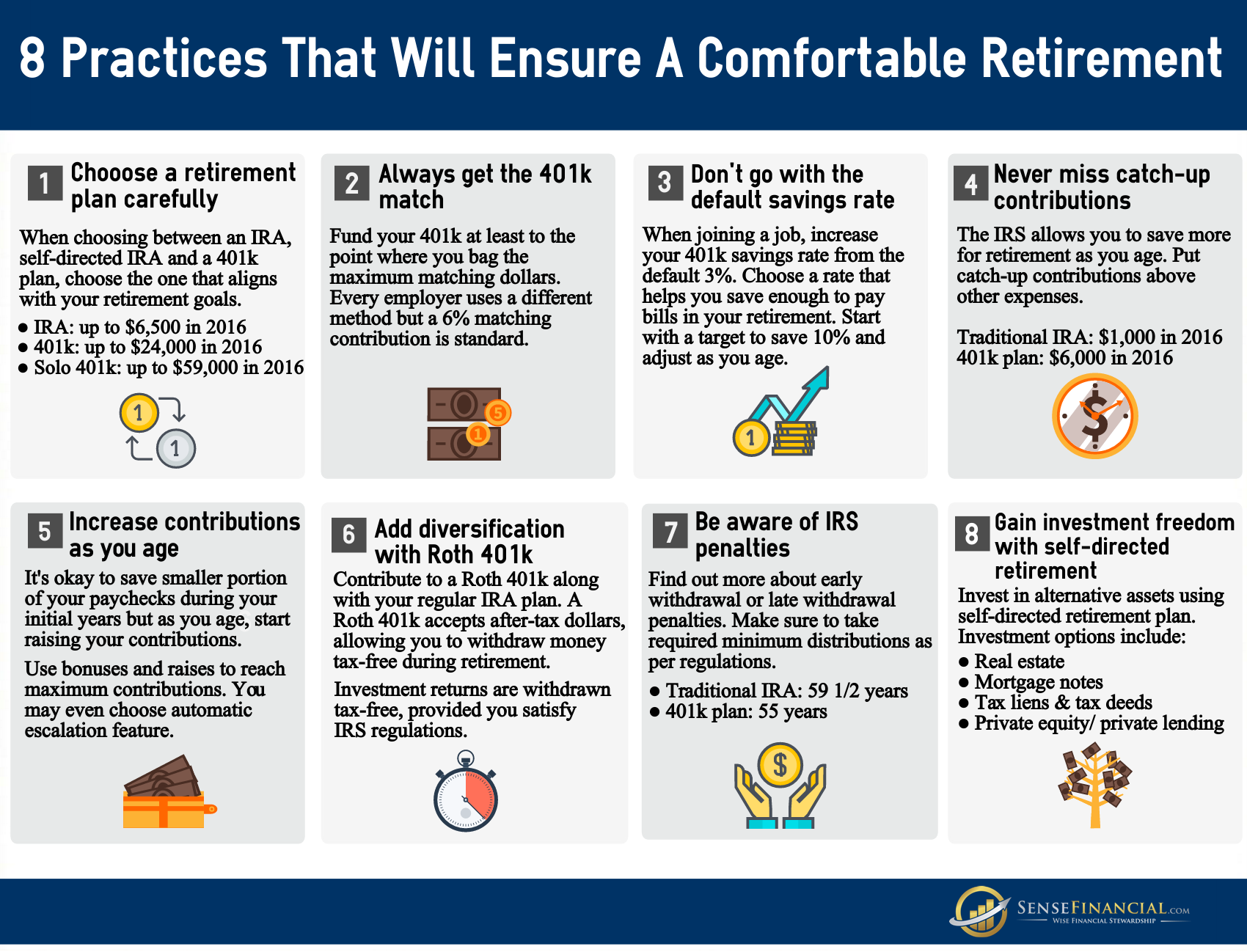

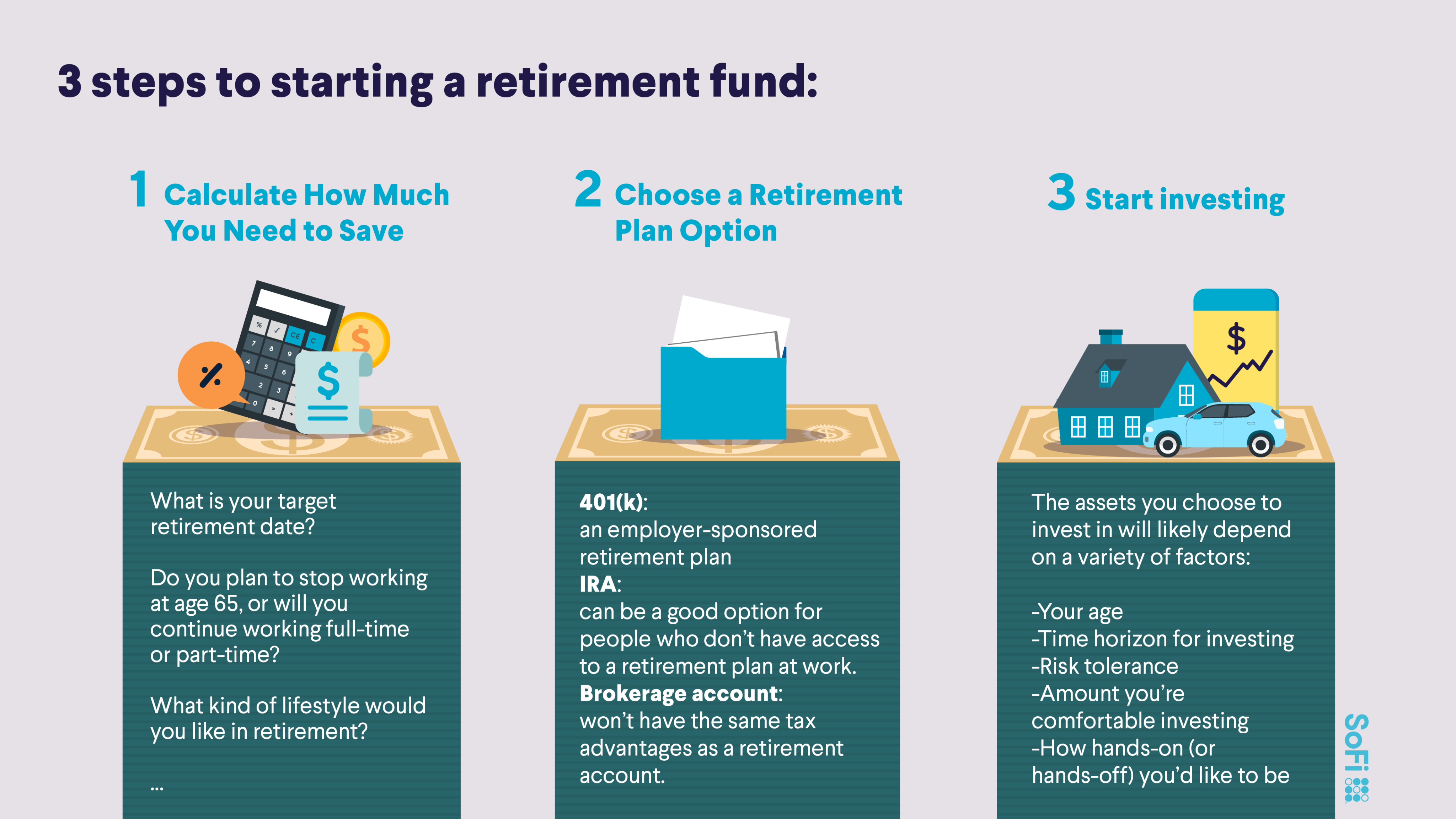

Most workplaces offer a fantastic perk called a 401(k). It’s like a secret piggy bank your company helps you fill. You tell them how much you want to tuck away from each paycheck, and poof! It disappears from your main account and magically appears in your retirement fund.

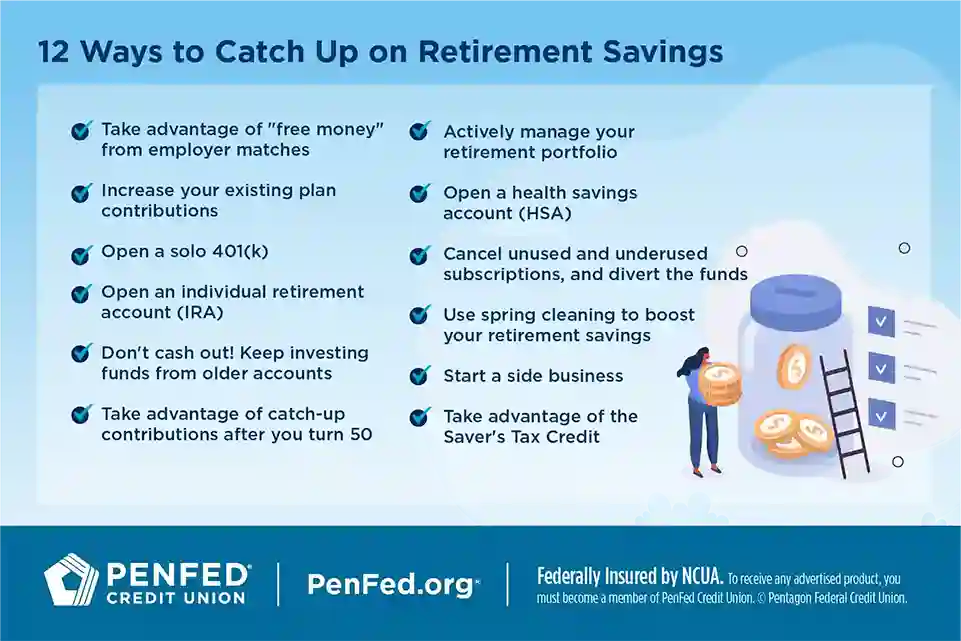

Here’s the real kicker, the part that makes your wallet do a happy dance: many companies offer a “match”. This means for every dollar you put in, they put in a dollar too, or maybe 50 cents. It’s literally FREE MONEY! Imagine finding a twenty-dollar bill on the sidewalk every time you put a twenty in your savings jar. That's the 401(k) match in a nutshell. Don’t leave that free money on the table; your future self will definitely judge you for it.

Even if your workplace doesn't have a 401(k), or if you’re self-employed, don’t fret! There are other superhero vehicles for your savings. The IRA (Individual Retirement Arrangement) is your personal retirement sidekick. Think of it as a super-powered savings account that grows your money tax-free.

There are a couple of flavors of IRA, but the most common ones to start with are the Traditional IRA and the Roth IRA. The Traditional IRA lets you deduct your contributions from your current income, which can lower your tax bill now. The Roth IRA, on the other hand, lets your money grow tax-free and you can withdraw it tax-free in retirement. It's like choosing between getting a discount now or having a completely tax-free treat later. Both are pretty sweet deals!

The key is to pick one and start. Don’t get caught up in the nitty-gritty of which is “perfect” for you right this second. The most perfect strategy is simply the one you actually do. The universe rewards action, especially when it comes to future hammock-related happiness.

Let’s talk about starting small. Maybe you think you can’t afford to save. But what if you started with just enough to get that company match? Even if it’s just 3% of your paycheck, that’s a good chunk of free money! It’s like buying a coffee and getting a whole pastry for free.

Think about that daily latte. If you skipped it a couple of times a week, where could that money go? It’s not about deprivation; it’s about a tiny shift in priorities. You’re trading a fleeting caffeine buzz for the potential for a lifetime of worry-free beach days. That seems like a pretty good trade-off, wouldn’t you agree?

Another sneaky way to boost your savings is to save windfalls. Got a tax refund? A bonus at work? A birthday check from your favorite aunt? Instead of immediately earmarking it for that new gadget or a spontaneous shopping spree, send a portion of it straight to your retirement fund. It’s like planting seeds you didn’t even know you had!

The most heartwarming part of this whole saving journey is the feeling of taking control. You’re not at the mercy of fate; you’re actively building your own comfortable future. It’s like being the architect of your own happiness, brick by tiny, dollar-shaped brick.

And here’s a surprising truth: it doesn’t have to be complicated. You don’t need a finance degree or a crystal ball. The “best way” is simply the one that starts. Pick a plan, set up an automatic transfer, and then try your best to forget about it until retirement.

Imagine your future self thanking you profusely. They’ll be doing a little jig of joy, perhaps while polishing their award for “Best Decision Maker of the Millennium.” All because you decided to be a little bit proactive today.

The power of compounding is another little bit of magic to keep in mind. This is where your money starts making its own money. It’s like having tiny little money-making elves working for you 24/7. The longer you let them work, the more they make. So, starting early is like giving your elves a head start on their lucrative careers.

It's like planting a tree. You don't get a shady spot to read a book overnight. It takes time for the roots to deepen and the branches to spread. Retirement saving is the same; it’s a long-term investment in your future comfort and peace of mind.

Don't be intimidated by the numbers. Start with what you can. Even a small, consistent amount will grow into something significant over time. It’s the tortoise, not the hare, that wins this race. Patience and persistence are your greatest allies.

Think about the joy of a hobby you love. Retirement saving can feel a bit like that. It’s an investment in something that will bring you immense pleasure and freedom down the line. You're essentially funding your future hobbies, travel, and downtime.

So, take a deep breath. You’ve got this! The first step is often the hardest, but it’s also the most rewarding. Your future self is already cheering you on, probably from that very hammock.

Start with your workplace 401(k) if you can, and snag that match. If not, open an IRA. Automate your savings, and then let time and the magic of compounding do their work. It’s the simplest, most effective, and dare we say, most heartwarming way to build your nest egg.

Remember, it's not about depriving yourself today, but about giving yourself the gift of freedom and choice tomorrow. And who wouldn’t want to give their future self that kind of present?