Best Way To Pay Credit Card To Build Credit

Let's be honest. Talking about credit cards can feel like wading through a swamp. All those terms and conditions, the interest rates that seem to multiply faster than rabbits... it's enough to make anyone want to hide under their duvet. But here's the secret: building good credit isn't some arcane wizardry. It's actually way simpler than you think. And the best way to do it? Well, it might just be the most obvious way. The way that makes your wallet sigh with relief instead of panic.

We're talking about paying your credit card bill. Groundbreaking, I know. Hold your applause. But seriously, how many times have you seen those articles promising the "secret sauce" to credit building? They're usually packed with jargon that makes your head spin. We're going to skip all that noise. Because the real secret? It’s not a secret at all. It’s just… being responsible. Revolutionary, right?

Think of your credit card like a little helper. It’s there to make purchases easier. It’s not a magic money tree. And the best way to treat this helper so it keeps being friendly and not, you know, sending angry debt collectors your way, is to show it you mean business. And by "business," I mean promptly paying it back.

Now, there are different schools of thought on this. Some people will tell you to pay off your balance in full every single month. And yes, that's the gold standard. It's like winning the Super Bowl of credit card management. You get zero interest. Your credit score does a little happy dance. Everyone wins. But let's be real. Sometimes life happens. That car repair. That unexpected doctor's visit. Suddenly, your wallet is looking a bit thinner, and paying off the entire balance seems about as likely as winning the lottery.

So, what’s the next best thing? The silver medal, the runner-up champion of credit card payments? It's all about consistency. It’s about showing up. It’s about treating your credit card like a reliable friend, not a one-night stand.

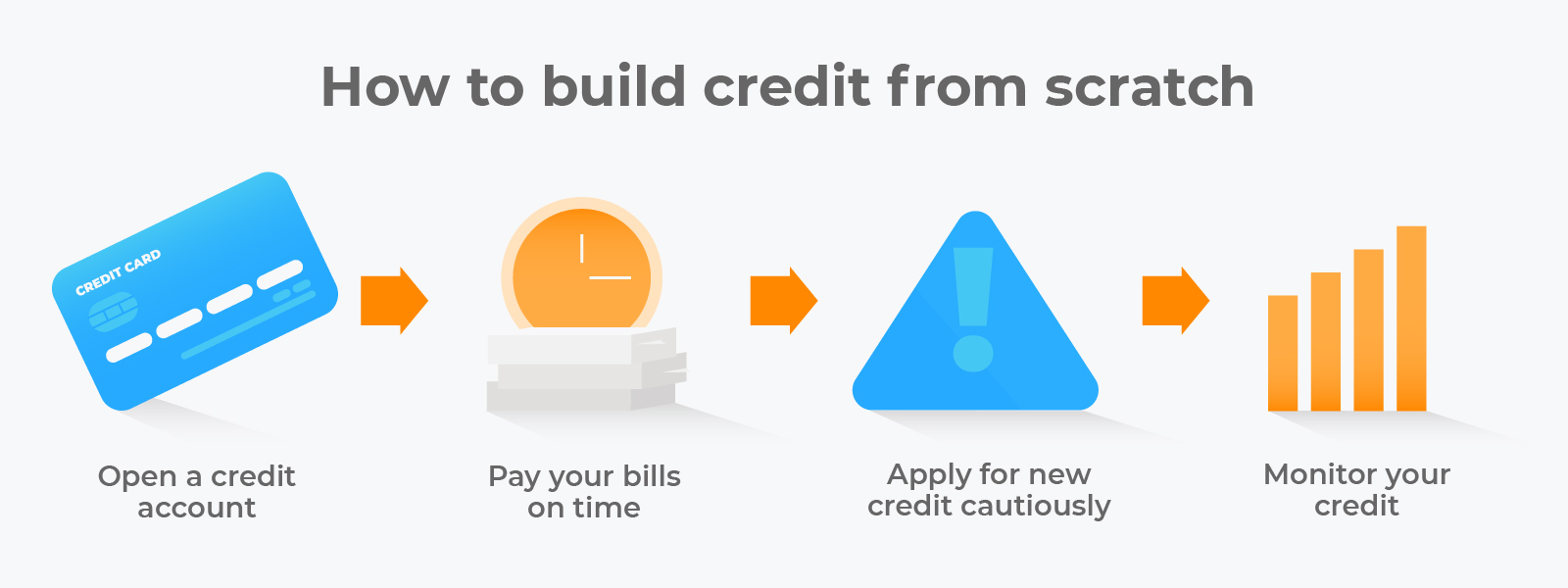

How to Build Credit in 7+ Ways - Self. Credit Builder.

The easiest and most entertaining way to build credit? Pay your bill. Every. Single. Month. Even if you can't pay the full amount, pay something. And pay it on time. Seriously, that's it. Don't overthink it. Don't let the internet convince you there's a secret handshake or a magic incantation required.

Imagine your credit card company as a very patient grandparent. They're giving you this nice little plastic card, a tool to use. They're not asking for a pound of flesh immediately. They just want to know you're going to be a good kid and pay them back. And the best way to be a good kid? Make your payments. Don't miss them. Even if it's just the minimum payment, that's better than a missed payment. A missed payment is like forgetting your grandparent's birthday. It’s a big deal.

What about paying a little bit, then a little bit more? Like a financial juggling act? Some people swear by it. They’ll pay the minimum, then add a bit more before the due date. Others will pay it off twice a month. And hey, if that system works for you and keeps you organized, go for it! It's like having a personal trainer for your finances. But for the rest of us, the ones who might get tangled in our own financial shoelaces, the simplest approach is usually the best.

Here's my (slightly controversial, perhaps?) "unpopular opinion": The absolute best way to pay your credit card to build credit is to simply pay it when it's due. That's it. No fancy tricks. No complicated strategies. Just… pay it. It sounds so simple it’s almost insulting, right? Like someone telling you the best way to become a great chef is to… cook food.

But think about it. The biggest ding on your credit score isn't how much you owe, it’s whether you pay it back. Late payments are the boogeymen of credit building. They’re the reason credit scores go on vacation to the Mariana Trench. So, if you can consistently avoid those late payments, you’re already miles ahead of the game. You’re in the winner’s circle. You’re practically a credit card guru.

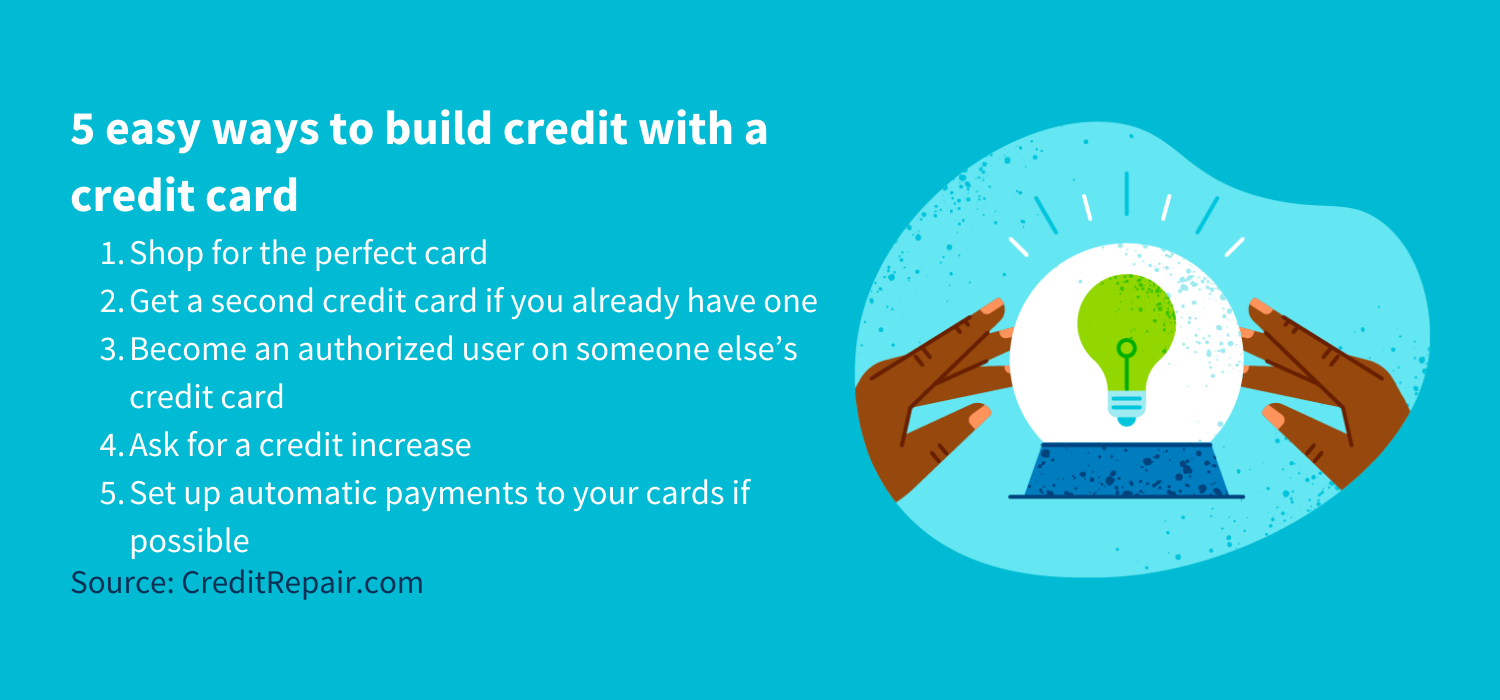

So, let's ditch the complex charts and the scary financial jargon. The simplest, most effective, and dare I say, most entertaining way to build your credit is to develop a healthy habit of paying your credit card bill on time. Set reminders. Automate payments if you can. Whatever works to make sure that payment gets there. Treat your credit card like a responsible adult, and it will, in turn, treat you like one. And that, my friends, is the real magic trick.

Don't get me wrong, paying in full is fantastic. It saves you money on interest, which is always a win. But if you're just starting out, or if your budget is feeling a bit stretched, focusing on making your minimum payments on time is a perfectly valid and effective strategy. It's the solid foundation upon which all good credit is built. It’s the unsung hero of financial responsibility. So, go forth and pay your bills! Your future self, with a stellar credit score, will thank you.

Remember, it's not about being perfect. It's about being consistent. It’s about showing up for your financial responsibilities. And when it comes to credit cards, showing up means making those payments. So, next time you get that credit card statement, don't dread it. See it as an opportunity. An opportunity to build a stronger financial future, one on-time payment at a time. It’s surprisingly easy. And dare I say, a little bit empowering.