Best Home Equity Line Of Credit Rates In Va

Alright, let's talk about something that can feel a little bit like finding buried treasure right in your own backyard: your home equity! Specifically, we're diving into the wonderful world of Home Equity Lines of Credit (HELOCs), and more importantly, snagging the best rates for our amazing neighbors in Virginia! Think of it as unlocking the vault of your home's value, and we're here to help you find the key with the most dazzling shine!

Now, I know what you might be thinking. "Rates? HELOCs? My head is already spinning faster than a toddler on a sugar rush!" But hold your horses, or your trusty Virginia ham, because this is going to be way more fun and, dare I say, profitable than you imagine. We're talking about giving your hard-earned equity a chance to work FOR you, not just sit there looking pretty!

Imagine this: You've got a home in the Old Dominion, a place you've poured your heart, soul, and probably a questionable amount of paint into. That home has been growing in value, silently building up equity like a squirrel hoarding nuts for winter. And now, Virginia lenders are offering up some seriously sweet deals on HELOCs – basically, a credit line backed by that equity. It’s like your house saying, "Hey, I've got your back! Let's go build that dream deck or finally get that fancy new kitchen you've been eyeing!"

Finding the best rates isn't just about luck; it’s about being a savvy home-owner and doing a little happy dance of research. We’re talking about rates that could make your wallet sing opera, or at least hum a happy tune. You want those low, low numbers, the kind that make you do a double-take and question if you accidentally stumbled into a secret lender convention.

So, what makes a Virginia HELOC rate truly "best"? It's a combination of things, a magical potion of lender competitiveness, your own creditworthiness, and perhaps a sprinkle of Virginian charm. Lenders in our beloved state are often vying for your business, and that's fantastic news for your bottom line!

Let's break down some of the players in this exciting game. You've got your big, national banks, of course. They offer stability and a familiar face, but sometimes their rates can be like that one cousin who always brings a fruitcake to Thanksgiving – a bit predictable. Then you have your regional banks, those solid, dependable institutions that know Virginia like the back of their hand. They often have a sweet spot for competitive rates.

And then, my friends, are the credit unions! Oh, the credit unions! These are like the hidden gems of the financial world. Often member-owned, they tend to prioritize their members’ well-being, which often translates into fantastic HELOC rates. Think of them as your friendly neighborhood financial wizards, ready to cast a spell of low interest rates upon your home equity!

When we talk about rates, we're usually referring to the Annual Percentage Rate (APR). This is your main number, the one you'll be staring at with the intensity of a hawk eyeing a delicious field mouse. A lower APR means you're paying less in interest over time, which is like getting a discount on a really, really big purchase!

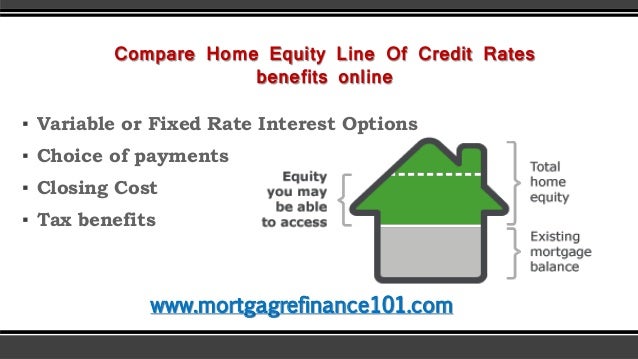

For HELOCs, rates are often variable. This means they can go up or down with the market. It’s like riding a roller coaster – sometimes thrilling, sometimes a little nerve-wracking. However, many Virginia lenders offer introductory fixed rates, which is like having a calm stretch of track before the big dips and dives! These can be incredibly valuable for budgeting and peace of mind.

So, how do you actually find these mythical best rates in Virginia? It's time to put on your detective hat and channel your inner Sherlock Holmes! Your first mission, should you choose to accept it, is to get your credit score in tip-top shape. A higher credit score is like a golden ticket to lower interest rates. Lenders see it as a sign that you're a responsible borrower, and they're eager to offer you their best deals.

Next, you’ll want to shop around. Don’t just waltz into the first bank you see! Compare offers from at least three to five different lenders. This is where the magic happens. You might find one lender offering a rock-bottom introductory rate, while another has a slightly higher rate but way lower fees. It’s like comparing different brands of your favorite Virginia ham – you want the best flavor and the best price!

Online lenders are also a huge player in the game these days. They often have lower overhead costs, which can translate into surprisingly competitive HELOC rates. Think of them as the fast-food chains of the lending world, but in this case, "fast" and "cheap" actually means good for your wallet!

What are we looking for in a “best” rate? Well, in Virginia, for a HELOC, you might be seeing rates that hover in the mid-to-high single digits for variable rates, and potentially even lower for introductory fixed periods. Of course, this is a moving target, and your specific rate will depend on your credit score, the loan-to-value ratio of your home, and the current economic climate. But aiming for the lower end of that spectrum is your ultimate goal!

Let’s talk about fees for a second. Sometimes a lender might lure you in with a seemingly amazing rate, but then hit you with a laundry list of fees that could make your eyes water. Watch out for origination fees, appraisal fees, and annual fees. These can significantly increase the overall cost of your HELOC. A truly "best" rate often comes with minimal, or even waived, fees. It’s the whole package deal, the cherry on top of your already delicious financial sundae!

Consider your loan-to-value ratio (LTV). This is the amount you owe on your mortgage compared to the current market value of your home. Lenders generally want this to be below 80% to offer you the best rates. So, the more equity you have, the better your chances of snagging a fantastic deal. It's like having more marbles in your bag – you can get the best toys!

And don't forget to ask about introductory rates. Many lenders offer a temporary period of a lower, fixed interest rate. This can be a lifesaver for managing your budget during a renovation or a large purchase. It's like getting a sneak peek at the concert before the main act – a little preview of how good it can be!

One of the most powerful tools in your arsenal is the Virginia credit union. Seriously, these guys are often the unsung heroes of low-interest loans. They’re not driven by shareholder profits in the same way as big banks, so they can pass those savings onto their members. It’s like finding a secret discount code that everyone else doesn't know about!

So, when you’re looking for the best HELOC rates in Virginia, here’s your action plan: 1. Boost that credit score like it’s your job! 2. Shop around like you’re buying the last bottle of that amazing Virginia wine. 3. Compare APRs AND fees. Don’t get tricked by a shiny rate with hidden costs. 4. Explore local credit unions – they’re often your secret weapon! 5. Understand your LTV and how it impacts your rate. 6. Ask about introductory fixed rates for budget stability.

Finding the best home equity line of credit rates in Virginia is entirely achievable, and it can be a genuinely exciting process. It’s about taking control of your finances and making your home’s equity work for you in the most economical way possible. So, go forth, do your research, and snag yourself a HELOC rate that makes you want to do a happy little jig! Your future self, enjoying that renovated kitchen or debt-free home project, will thank you!