Best Home Equity Line Of Credit Rates In Pa

Hey there, Pennsylvania homeowners! Ever found yourself staring at your house, wondering if it’s secretly a giant piggy bank just waiting to be tapped? Well, it kinda is! And one of the coolest ways to access that built-up equity is through something called a Home Equity Line of Credit, or HELOC for short. Think of it like a credit card secured by your home, but with way better interest rates. We’re talking about the best Home Equity Line of Credit rates in PA, and let’s dive into why that’s pretty darn exciting.

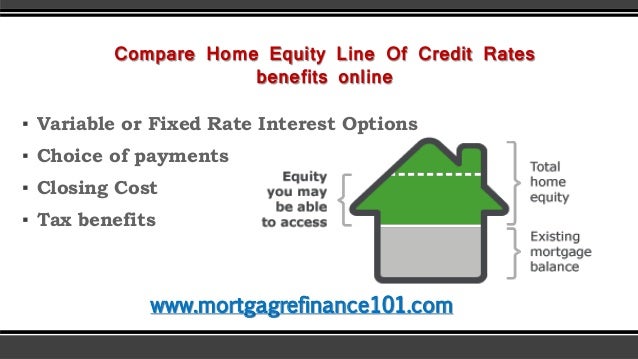

So, what exactly is a HELOC, anyway? Imagine you've been diligently paying down your mortgage for years, and your house's value has, hopefully, gone up. That difference between what you owe and what your house is worth? That's your home equity. A HELOC lets you borrow against that equity. It’s not a lump sum loan; instead, it’s a revolving credit line. You can draw from it as you need it, pay it back, and then draw from it again. Pretty neat, right?

Why Should You Even Care About HELOC Rates in PA?

Okay, so why the big fuss about HELOC rates in Pennsylvania specifically? Well, interest rates are kind of like the price of admission to borrowing money. The lower the rate, the less you pay in interest over time. And when we're talking about potentially borrowing thousands or even tens of thousands of dollars, even a small difference in the interest rate can add up to some serious savings. It’s like getting a great deal on that vacation you’ve been dreaming of, or finally tackling that home renovation you’ve put off for ages.

Think of it like this: if you're buying a slice of pizza, and one place is selling it for $3 and another for $5, you're probably going to go with the $3 slice, right? It’s the same idea with HELOCs. You want the "cheaper" slice of borrowing, which means the lower interest rate. And Pennsylvania borrowers are often in a pretty good spot when it comes to snagging competitive rates.

What Makes a HELOC Rate "Good"?

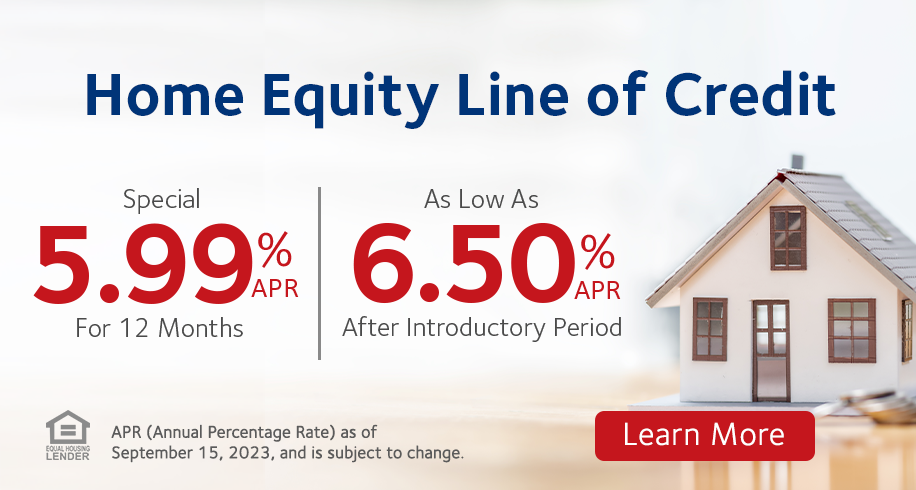

This is where things get interesting. A "good" HELOC rate isn't just about the number; it's about what it means for you. Generally, lower is better. But you'll also see a lot of talk about variable rates when it comes to HELOCs. This means the interest rate can go up or down over time, influenced by market conditions (like the prime rate). It’s kind of like the weather – sometimes it’s sunny, sometimes it’s rainy. So, while you might get a fantastic low rate today, it could change.

That said, even with a variable rate, finding the best HELOC rates in PA can offer significant advantages. Lenders are always competing for your business, and that competition can drive rates down. Plus, if you have a solid credit history and your home is worth a good chunk more than you owe, you’re in a prime position to get a fantastic deal.

Decoding the Jargon: APR and More

You'll often hear about the Annual Percentage Rate (APR). This is a super important number because it gives you a more complete picture of the cost of borrowing, including fees. So, when you're comparing offers, always look at the APR. It's like comparing the total price of that pizza, not just the base price, to make sure you're getting the real deal.

Other things that can influence your rate? Your credit score is a big one. A higher credit score usually means you’re seen as a lower risk, and lenders are more likely to offer you their best rates. It’s like being a VIP customer – you get the perks!

And, of course, your loan-to-value ratio (LTV). This is simply the amount you want to borrow compared to the value of your home. The lower your LTV (meaning you have more equity), the more attractive you are to lenders, and the better your rate might be.

Where to Find Those Sweet PA HELOC Deals

So, where do you actually go to find these coveted low HELOC rates in Pennsylvania? You’ve got a few avenues:

Your Current Bank or Credit Union

It often makes sense to start with the institution where you already have your mortgage or checking account. They know you, and they might be willing to offer you preferential rates as a loyal customer. It's like getting a discount at your favorite coffee shop because you're a regular.

Online Lenders

The digital world has opened up a whole new playground for finding loans. Many online lenders specialize in HELOCs and can offer highly competitive rates because they have lower overhead costs. They’re often super efficient too, meaning you can get approved and funded faster. Think of them as the lightning-fast delivery service of the HELOC world.

Local Pennsylvania Banks and Credit Unions

Don’t forget about the smaller, local players! Community banks and credit unions can be fantastic sources of competitive rates and personalized service. They often understand the local market really well and might be eager to work with homeowners in their community. It's like finding a hidden gem of a restaurant that serves amazing food.

What Can You Actually Use a HELOC For?

This is the fun part! A HELOC isn't just for emergencies (though it's great for that too!). Think of it as your financial toolbox for making your life better or your home even more amazing. Some popular uses include:

- Home Renovations: That kitchen remodel you've been dreaming about? A new bathroom? A finished basement? A HELOC can be a fantastic way to finance these projects, potentially increasing your home's value even further.

- Debt Consolidation: Got high-interest credit card debt? You might be able to use a HELOC to pay it off and replace it with a lower-interest loan. This can save you a ton of money on interest payments.

- Education Expenses: Funding college or other educational pursuits for yourself or your children can be a significant cost. A HELOC can provide a flexible way to manage these expenses.

- Major Purchases: Need a new car? Planning a big trip? While it's wise to be cautious, a HELOC can offer a way to finance these larger purchases with a potentially lower interest rate than a personal loan.

- Emergency Fund Supplement: While not a replacement for a dedicated emergency fund, a HELOC can provide access to funds in truly unexpected situations.

Getting Started: It’s Easier Than You Think!

So, how do you actually go about getting one of these awesome HELOCs with the best rates in PA? It usually involves a few straightforward steps:

- Do Your Homework: Research different lenders, compare rates and fees, and read reviews.

- Check Your Credit: Make sure your credit score is in good shape. The better it is, the better your chances of getting a great rate.

- Gather Your Documents: You'll typically need proof of income, bank statements, and information about your home.

- Apply: Submit your application online, at a branch, or over the phone.

- Appraisal: A lender will likely appraise your home to determine its current value.

- Closing: If approved, you'll go through a closing process, similar to when you got your mortgage.

Finding the best Home Equity Line of Credit rates in PA is all about being informed and proactive. It’s a powerful tool that can help you achieve your financial goals, improve your home, and give you some peace of mind. So, go ahead, explore your options, and see if your house can help you build a brighter future. Happy house-piggy-banking!