Best Credit Cards For Credit Score 640

Hey there, credit score superheroes in training! Ever feel like your credit score is doing a little dance in the 640 neighborhood? Don't worry, it's a totally common place to be! Think of it as the "trying your best" zone. And guess what? Even from here, you can unlock some pretty awesome credit cards.

It’s like being in a video game and you’re leveling up. This score isn’t the end of the world; it’s actually a great starting point. We’re here to sprinkle some magic dust and show you how to find cards that are perfect for your current credit score. Get ready to be surprised by how many doors can open!

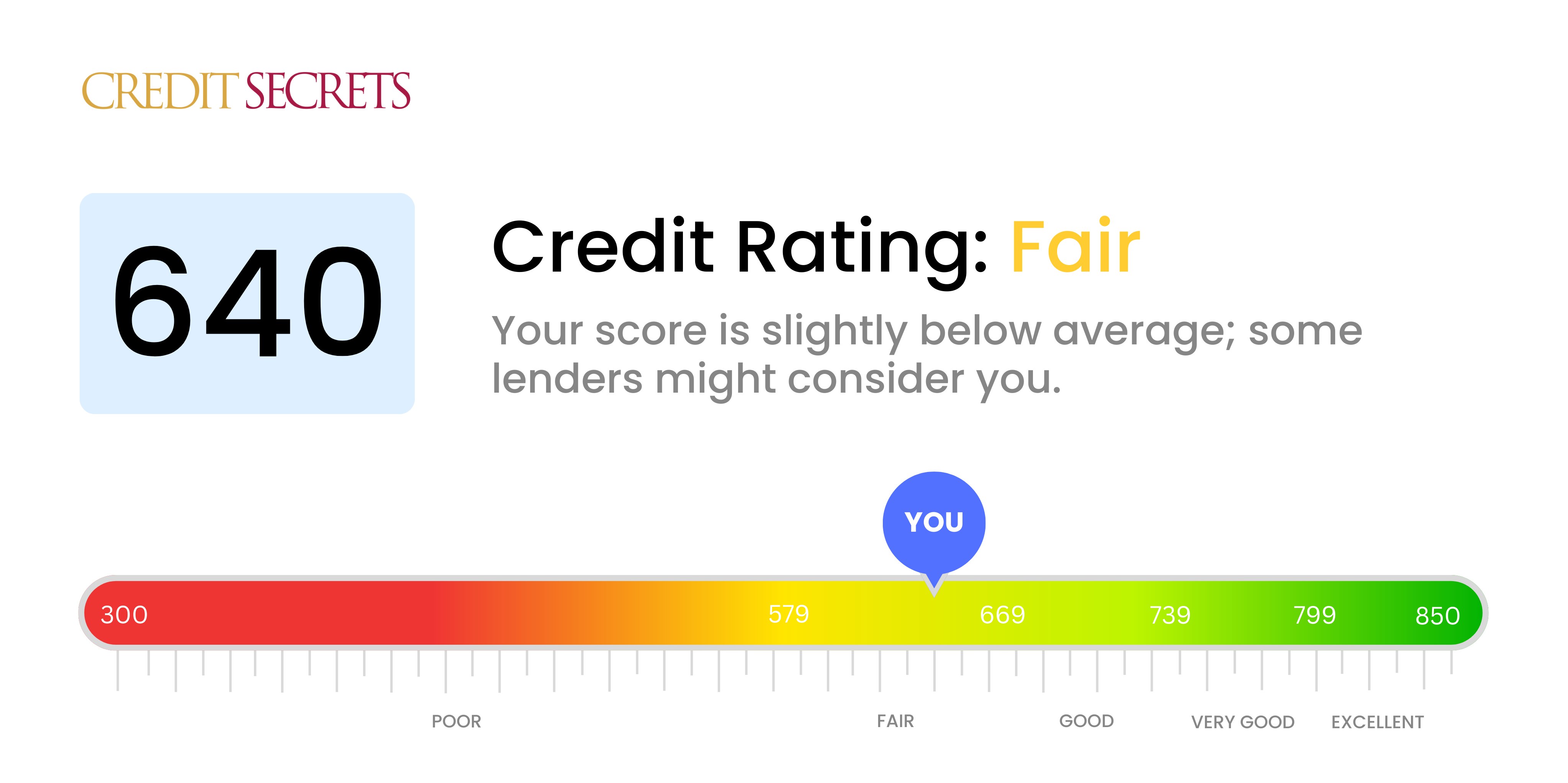

So, what’s the big deal about a 640 credit score? Well, it means you’ve got some experience with credit, but maybe there have been a few bumps along the road. Lenders see this score and think, "Okay, they're getting there!" It's not a "no," it's more of a "let's see what you've got."

And that’s where the right credit card comes in. It’s like getting a new tool in your toolbox. A good card can help you build a stronger credit history, earn cool rewards, and maybe even save you some cash. It's a win-win-win situation, and we’re going to help you find that winning ticket.

Now, let's talk about what makes certain cards special for this score range. It’s not about being picky; it’s about being smart. We’re looking for cards that are a little more forgiving but still offer fantastic benefits. Think of them as your friendly neighborhood credit card guides.

These aren’t the super-exclusive, black-card-only deals. Instead, they’re the accessible cards that say, "Welcome! Let's build something great together." They understand you’re on a journey and they want to be part of your success story. Pretty cool, right?

The Usual Suspects: Cards to Keep an Eye On

Okay, let's dive into some of the card types that often shine for a 640 credit score. These are the ones that tend to be more welcoming to folks who are working on their credit. They might not have the flashiest perks right away, but they are solid building blocks.

One of the most popular choices in this category is a secured credit card. Now, don't let the word "secured" scare you off! It's actually a super smart way to start. You put down a security deposit, and that deposit usually becomes your credit limit.

Think of it like a safety net. It shows the credit card company you're serious and responsible. And the best part? Most secured cards report your activity to the credit bureaus, which is exactly what you need to boost your score!

Some of the stars in the secured card universe include the Discover it Secured Credit Card. This one is often praised for its no annual fee and the fact that it can graduate you to an unsecured card if you use it responsibly. Plus, Discover sometimes offers cashback rewards even on secured cards, which is a sweet bonus!

Another contender you might hear about is the Capital One Secured Mastercard. This card is known for its straightforward approach. They often allow you to get a credit line increase after a few on-time payments, which is fantastic for building your credit limit. They also have a super easy online application process.

Why are these so special? They focus on helping you grow. They don’t just hand out credit; they partner with you. It’s like having a coach who believes in your potential and gives you the right drills to succeed.

Unsecured Options: When You're Ready for a Little More

Now, if you've been diligently managing any existing credit or have a slightly higher score within the 640 range, you might qualify for some unsecured credit cards. These don't require a security deposit, which is exciting!

These cards often come with a bit more in the way of rewards or perks. It's like moving up a level in the game and unlocking new power-ups. You’re still building, but you’re getting more goodies along the way.

A card to consider here is the Credit One Bank Unsecured Visa. They are known for offering cards to people with fair credit. While their rewards program might not be the absolute top-tier, they often come with cashback rewards and a chance to build your credit history.

Another option that sometimes pops up is the Total Visa® Unsecured Credit Card. These types of cards are designed to be accessible. They often report to all three major credit bureaus, which is crucial for your credit-building journey. Just be sure to look closely at any potential fees.

What makes these unsecured cards special for you? They offer a step up in accessibility and potential rewards. They acknowledge your efforts and give you a chance to earn while you improve. It’s a tangible reward for your progress!

The "Why It's So Entertaining" Factor

Let's be honest, talking about credit scores and credit cards can sometimes sound a bit dry. But when you're at the 640 mark, it's actually a really exciting place to be. It’s the start of a growth spurt!

Think of it like watching a plant sprout. You’ve given it the right conditions, and now it’s about to take off. Each on-time payment is like watering that plant, and the right credit card is like giving it a little sunshine.

The entertainment comes from seeing your score climb. It's like unlocking achievements in a video game. Every little improvement feels like a victory, and these cards are your tools to get those victories.

Plus, the idea of earning rewards while you're simply doing your everyday spending? That's pretty cool! It’s like getting a little thank you note from the credit card company for being a good customer.

The special sauce here is that these cards are about progress. They are designed to be stepping stones. They’re not promising you the moon on day one, but they are showing you the path to get there, with some fun perks along the way.

What Makes a Card "Special" for You?

Beyond the general categories, what makes a card truly special for your personal journey? It's about matching the card's features to your goals.

Are you looking to build credit as fast as possible? Then a secured card that reports diligently is your MVP. Do you want to start earning some cashback while you build? Then an unsecured card with a simple rewards program might be your jam.

It's also about the fees. Some cards have annual fees, others don't. For a 640 score, starting with a card that has no annual fee can be a smart move. It keeps more money in your pocket.

And let's not forget customer service. If you're new to managing credit cards, having a helpful support team can make all the difference. It's like having a friendly face to ask questions when you need them.

The specialness comes down to finding a card that feels like a partner, not just a transaction. It’s a card that understands you’re on a journey and wants to help you succeed. It’s about feeling empowered, not intimidated.

The Thrill of the Upgrade

One of the most exciting things about starting with a card for a 640 score is the potential for upgrades. Many secured cards have a path to becoming unsecured cards. That's a huge milestone!

It’s like graduating from a beginner's class to an advanced one. You’ve proven yourself, and now you get to reap the rewards of your hard work. This upgrade often comes with a higher credit limit and better rewards programs.

Imagine getting a notification that your secured card is now unsecured! It's a moment of triumph. It signifies that your credit habits have paid off. That’s a pretty powerful feeling.

The specialness of these starter cards is that they enable this upgrade. They are built with your future creditworthiness in mind. They are designed to be a temporary stepping stone to something even better.

So, while the initial offerings might seem modest, the true magic lies in the journey they facilitate. It’s a journey of growth, responsibility, and ultimately, greater financial freedom.

Ready to Take the Leap?

Finding the best credit card for a 640 credit score is less about hitting a home run on the first swing and more about building a solid foundation. It’s about making smart choices that set you up for future success.

These cards, whether secured or carefully chosen unsecured options, are your allies. They are designed to help you rebuild, improve, and ultimately thrive. They turn what might seem like a limitation into an opportunity.

So, don’t let that 640 score hold you back. Explore your options! Look into cards like the Discover it Secured Credit Card or the Capital One Secured Mastercard. See if an unsecured option like the Credit One Bank Unsecured Visa is within reach.

The world of credit cards is more accessible than you might think. It’s an exciting time to take charge of your credit journey. Your future, more financially empowered self will thank you!

Go on, get curious! You might be surprised at how easy it is to find a card that’s perfect for you right now. Happy credit card hunting!