Best Credit Card For Balance Transfers 2019

Hey there, my fellow finance-fanatics (or maybe just folks drowning in credit card debt, no judgment here!). So, you've been staring at those credit card statements lately, feeling a bit like a character in a horror movie where the monster is… interest? Yeah, I’ve been there. It’s that creeping feeling that no matter how much you pay, the debt just won't quit. But fear not, my friends! We’re about to embark on a quest, a noble pursuit of the best credit card for balance transfers in 2019.

Think of a balance transfer as a financial magic trick. You take all that nasty debt from one (or more!) cards and poof – move it to a shiny new card with a much sweeter deal. Usually, this means a 0% introductory APR for a set period. It’s like hitting the reset button on your debt, giving you a breathing room to actually pay down the principal without your money being eaten alive by interest. Pretty neat, right?

Now, before we dive headfirst into the land of 0% APR, let’s have a little chat. This isn't a "get rich quick" scheme, and it's definitely not an excuse to rack up more debt. This is about being smart, strategic, and getting yourself out of a sticky situation. So, grab a cup of your favorite beverage, get comfy, and let’s break down how to find that perfect balance transfer card.

Why Bother With a Balance Transfer? The Sweet, Sweet Symphony of 0% APR

Let’s be real for a second. Credit card interest rates can be brutal. We’re talking APRs that can make your eyes water, sometimes soaring into the 20s or even higher. That means every dollar you pay might just be covering interest, leaving your original debt practically untouched. It’s like trying to bail out a sinking ship with a teaspoon!

A balance transfer card with a 0% introductory APR is your superhero cape in this scenario. For that introductory period (which can range from a few months to over a year – woohoo!), you won't be charged a dime in interest on the balance you transfer. This is HUGE. It means every single penny you pay goes directly towards chipping away at that mountain of debt. Suddenly, that mountain starts to look a little less intimidating, more like a molehill you can conquer.

Imagine this: you owe $5,000 on a card with a 20% APR. If you only make minimum payments, it could take you years to pay off, and you’ll end up paying thousands in interest. Now, imagine transferring that $5,000 to a card with a 0% intro APR for 18 months. If you pay $277.78 each month, you'll pay off the entire balance without paying a single cent in interest. That’s a serious chunk of change saved, my friends!

The Not-So-Glamorous Bits: What to Watch Out For

Okay, okay, so it’s not all sunshine and rainbows. Like that friend who’s amazing but always late, balance transfer cards have their quirks. We need to be aware of them so we don’t end up in a worse spot than we started. Think of this as the disclaimer before the magic show.

Balance Transfer Fees: The Gatekeepers of Your Savings

Most balance transfer cards charge a fee to move your debt. This is usually a percentage of the amount you’re transferring, often somewhere between 3% and 5%. So, if you transfer $5,000 and the fee is 3%, that’s an extra $150 upfront. Ouch. But, if you do the math and the interest you save over the intro period is significantly more than that fee, it’s still a win!

Pro tip: Some cards occasionally offer 0% intro APR on both purchases and balance transfers, and sometimes they even waive the balance transfer fee for a limited time. These are the golden geese, so keep an eye out for those!

The Dreaded Regular APR: What Happens After the Party Ends?

The 0% APR is an introductory offer. It’s like a trial period. Once that period is over, your interest rate will jump up to the card’s regular APR. This is usually pretty high, so your goal should be to pay off as much of your balance as possible (ideally, all of it!) before that introductory period expires. If you don't pay it off, you’ll be back in interest-rate quicksand, and it might be even deeper this time!

Also important: If you miss a payment during the intro period, some cards might even revoke your 0% APR offer, and bam! You’re back to paying interest. So, set up auto-pay, send yourself reminders, tie a string around your finger – whatever it takes to avoid missing a payment. This is not the time to be forgetful!

New Purchases: Handle With Care!

Some cards offer 0% intro APR on balance transfers but have a different (and often higher) intro APR on new purchases. So, if you’re planning on using the card for new spending too, make sure you understand the terms for both. Ideally, you want a card that offers 0% intro APR on both balance transfers and new purchases if you plan on using it for both.

A word of caution: It's generally a good idea to try and avoid making new purchases on a balance transfer card while you're trying to pay down your transferred balance. The reason? If you have both a transferred balance and new purchases, and you make a payment, the payment might be applied to the 0% APR balance first. This means your high-interest purchases will continue to accrue interest, negating some of the benefits of the intro offer.

Key Features to Hunt For in a Balance Transfer Card

Alright, so we know what to watch out for. Now, let's talk about what makes a balance transfer card truly shine. Think of these as the superpowers of your potential new plastic friend.

The Length of the 0% Intro APR Period: More Time, More Savings!

This is probably the most crucial factor. The longer the 0% intro APR period, the more time you have to pay down your debt without interest. In 2019, you can find offers ranging from 6 months all the way up to 21 months! For larger balances, a longer intro period is definitely your best bet. If you have a big chunk of debt, a 12-18 month offer is usually a sweet spot.

The Balance Transfer Fee: The Smaller, The Better!

As we discussed, this is a cost. While 3-5% is common, some cards might offer lower fees or even a promotional 0% balance transfer fee for a limited time. If you can snag a card with a low fee, or no fee at all, that's a definite win. It means more of your money goes directly to debt reduction.

The Regular APR (After the Intro Period): A Necessary Evil

While your focus is on the intro period, it's wise to know what you'll be dealing with once it ends. If you anticipate not being able to pay off the entire balance within the intro period, a lower regular APR will save you money in the long run. However, don't let a slightly lower regular APR blind you if the intro period is significantly shorter than another card.

Credit Score Requirements: Be Realistic!

Let's be honest, these sweet 0% APR offers are usually reserved for folks with good to excellent credit. If your credit score isn't quite there yet, you might have to settle for shorter intro periods or slightly less attractive deals. But don't despair! Focusing on improving your credit score is always a good idea, and you can always re-evaluate balance transfer options down the line.

Quick tip: You can check your credit score for free through various online services or sometimes directly from your current credit card issuer. Knowing where you stand is the first step!

Top Contenders for the 2019 Balance Transfer Crown (Considerations, Not Direct Recommendations!)

Now, I can't give you specific card names because the market changes faster than my New Year's resolutions. Plus, what’s best for Brenda might not be best for Bartholomew. But I can tell you the types of cards and the issuers that often offer competitive balance transfer deals. Think of this as a treasure map!

The Big Banks with the Long Hauls

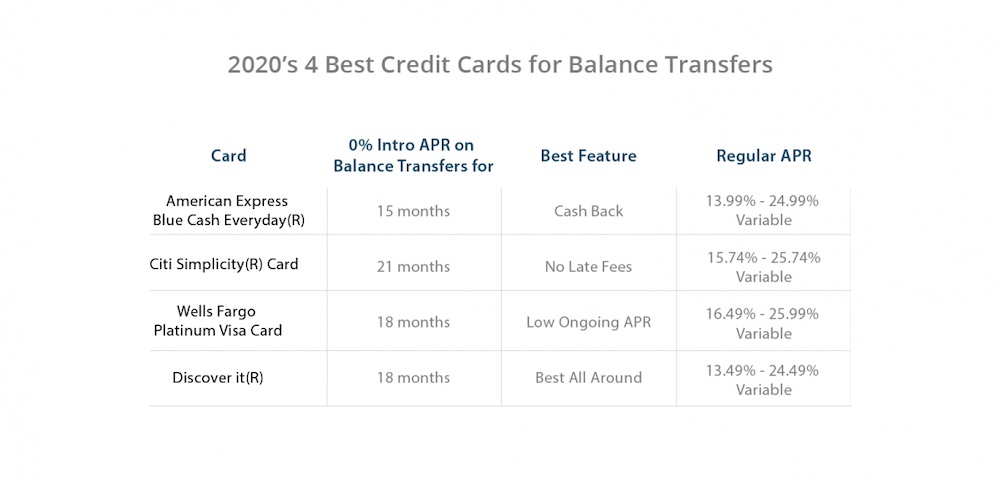

Major banks like Chase, Citi, American Express, and Bank of America often have cards with excellent balance transfer offers. They tend to be reliable and provide decent intro periods, sometimes up to 18-21 months. These are usually good for people with very good to excellent credit.

The Up-and-Coming Innovators

Sometimes, newer or less traditional issuers can surprise you with aggressive offers. Keep an eye on online-only banks or those that focus heavily on rewards and balance transfer programs. They might have slightly different fee structures or intro periods.

The "No Fee" Fantasies (Rare but They Exist!)

Every now and then, a card issuer will run a promotion offering 0% intro APR on balance transfers with no balance transfer fee for a limited time. These are like unicorns – magical and highly sought after! If you see one of these, seriously consider it.

How to Choose YOUR Perfect Balance Transfer Card

So, you’ve got your wishlist ready. How do you actually pick the one that’s going to be your debt-slaying sidekick?

- Calculate Your Debt: Know the exact amount you want to transfer. This will help you determine how long of a 0% intro APR period you really need.

- Do the Math on the Fee: If you transfer $10,000 with a 3% fee, that’s $300. Will you save more than $300 in interest by moving it? Almost certainly, but it’s good to be aware of the upfront cost.

- Compare Intro APR Lengths: This is your primary weapon. Prioritize the longest 0% intro APR period that suits your repayment plan.

- Check the Regular APR: If you’re not confident you can clear the balance within the intro period, a lower regular APR is a good backup.

- Read the Fine Print: I know, I know, it’s about as exciting as watching paint dry. But seriously, look for details about how payments are applied (especially if you make new purchases), and any other hidden fees.

- Consider Your Credit Score: Be realistic about what you'll qualify for. It's better to apply for a card you have a good chance of getting approved for than to get rejected and ding your credit score.

The Grand Finale: Your Path to a Lighter Load

Alright, my friends, we’ve navigated the sometimes-tricky waters of balance transfer credit cards. Remember, this isn't just about getting a new card; it's about taking control of your finances and setting yourself free from the shackles of high-interest debt. Think of the relief, the freedom, the sheer joy of seeing that balance shrink month by month, thanks to that beautiful 0% APR!

Choosing the right balance transfer card is a smart financial move that can save you a significant amount of money and give you the breathing room you need to get back on track. It’s a tool, a powerful one, that can help you achieve your financial goals. So go forth, be bold, do your research, and find that perfect card. The road to a lighter financial load is within your reach, and trust me, the view from there is absolutely spectacular. You’ve got this!