Berkshire Hathaway Vs S&p 500 Last 20 Years

Hey there, curious minds! Ever heard of a little showdown in the world of investing? It's like a friendly, but seriously competitive, race between two giants. We're talking about Berkshire Hathaway and the S&P 500. Think of it as a seasoned champion taking on a whole league of talented players. And the crazy part? This race has been going on for the last 20 years!

Now, you might be thinking, "Investing? Isn't that a bit dry?" Well, usually, yes. But this particular contest? It's surprisingly entertaining. Imagine watching your favorite sports team play every single day for two decades. You’d get invested, right? You’d see the ups, the downs, the surprising comebacks. That’s kind of what it's like with these two. It’s a story that unfolds over time, filled with moments that make you go "Wow!"

So, who are these contenders? On one side, you have Berkshire Hathaway. This is the company famously run by the legendary investor Warren Buffett. He's like the wise old owl of Wall Street, known for his common sense approach and his knack for picking winning companies. Think of it as a curated collection of amazing businesses. They own everything from Geico insurance (you know, the gecko!) to Coca-Cola. It’s like a super-powered conglomerate built on smart decisions.

On the other side, we have the S&P 500. This isn't one single company. Instead, it’s a basket of 500 of the largest, most well-known companies in the United States. Think of the household names you see on products every day. It’s a snapshot of the entire American economy. So, it’s like comparing one super-talented individual athlete against a whole team representing the best of the best in their sport.

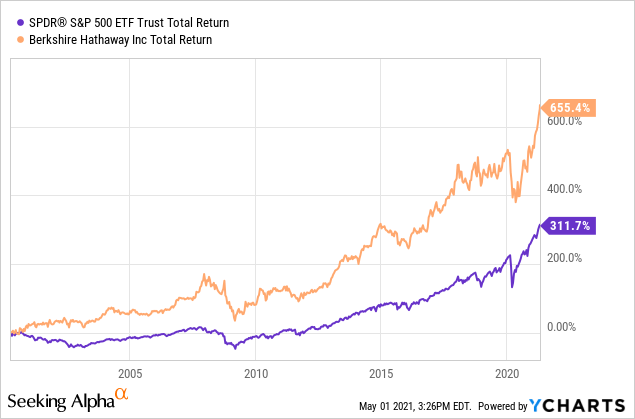

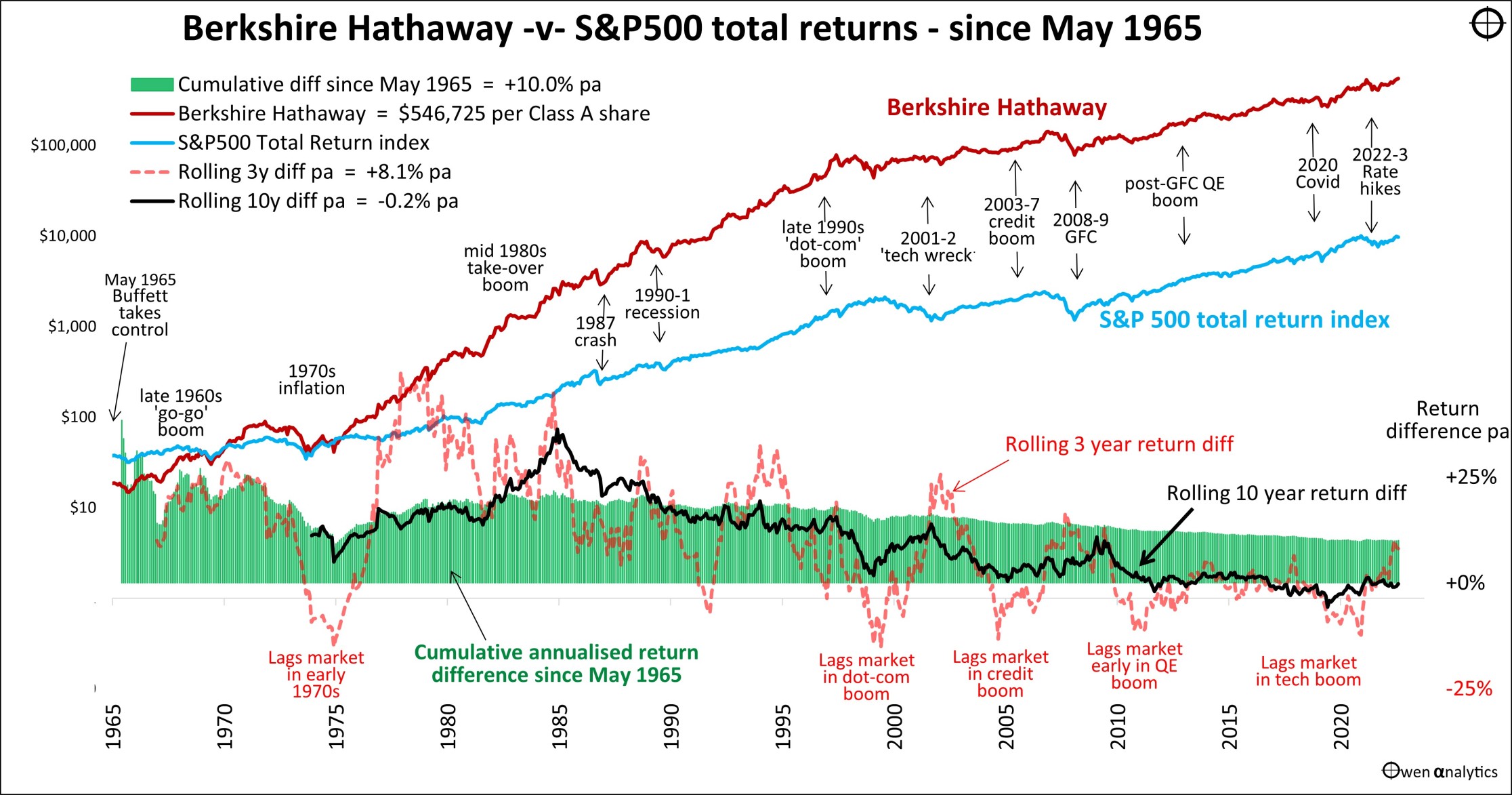

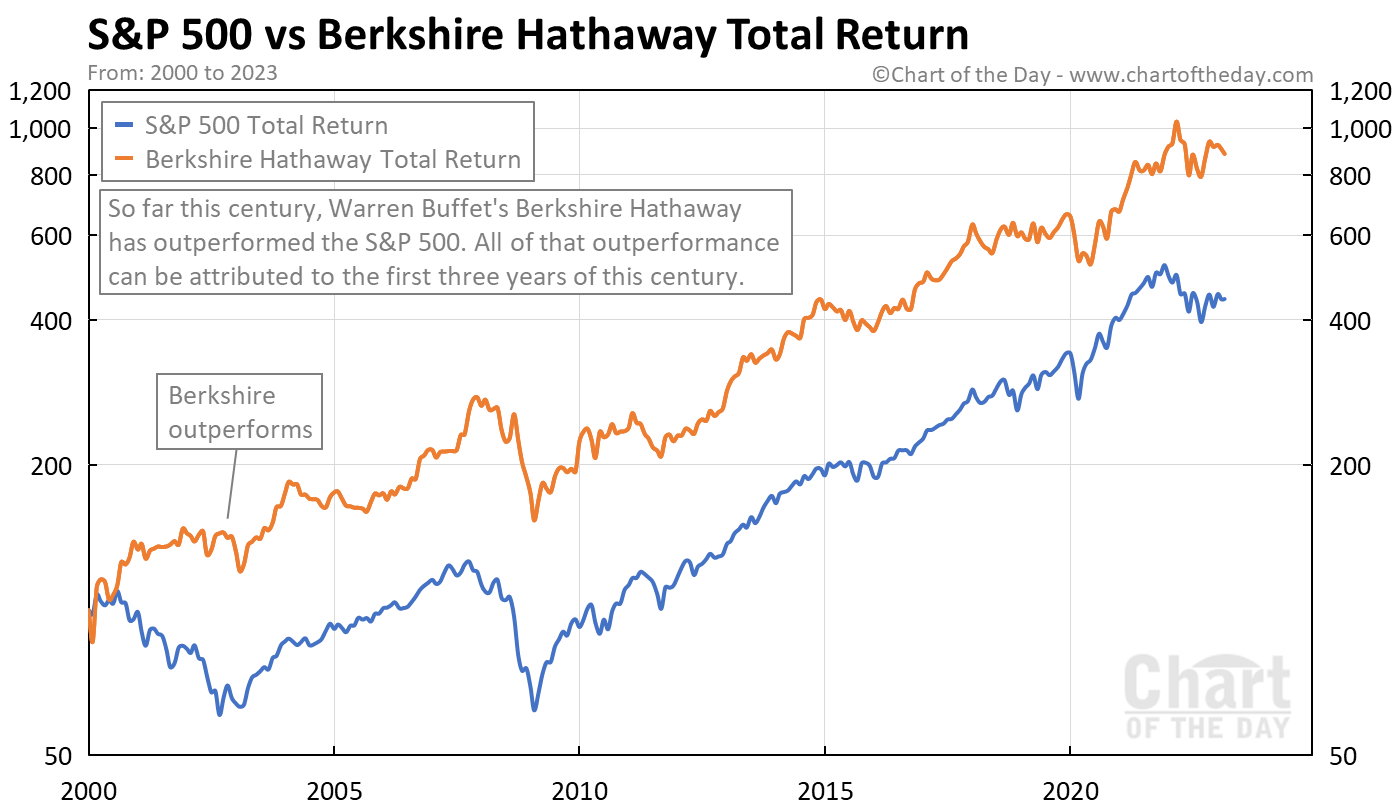

The big question is: who’s been winning this 20-year marathon? And the answer is... well, it’s more interesting than just a simple score. For a long time, Berkshire Hathaway was absolutely crushing it. Like, blowing the S&P 500 out of the water. It was a consistent performance that made a lot of people incredibly happy and very rich.

Picture this: you invested your money with Warren Buffett back then. Over the years, your money would have grown at an astonishing rate. Much faster than if you had just put it into a broad market index like the S&P 500. It felt like a sure bet. People would pore over Berkshire Hathaway's annual letters, eager to hear Buffett's wisdom and learn his secrets. It was a masterclass in investing, delivered with a folksy charm.

But here’s where the story gets even more engaging. In the last decade or so, things have gotten a little more... competitive. The S&P 500, with all its massive companies, especially those in the tech world, has started to catch up. Think of companies like Apple, Microsoft, and Amazon. They've had some incredible growth spurts, and they are a big part of the S&P 500. This means the league of companies has been performing exceptionally well.

So, while Berkshire Hathaway still delivered solid returns, the gap between its performance and the S&P 500 narrowed. It’s like a star athlete facing some incredibly strong competition from the team. This shift has made the ongoing comparison even more fascinating. It's no longer just about watching a champion easily win; it’s about seeing a true contest unfold.

Why is this so special? Because it’s a real-world experiment. It shows us that even the most brilliant investor and the most successful company aren't guaranteed to win forever. It highlights the power of diversification – the idea of having a wide range of investments. The S&P 500, by spreading its bets across 500 different companies, benefits from the growth of many different industries.

"It's a reminder that the investing world is always changing."

And what makes it entertaining is the human element. We’re talking about Warren Buffett, a personality beloved for his integrity and his straightforward advice. Then you have the collective power of the largest companies in America. It’s a clash of styles, a comparison of strategies, all playing out in the financial markets. It’s a story that’s both educational and, dare I say, a little bit thrilling.

Think about it: for 20 years, investors have been able to look at these two paths. One, the tried-and-true, personalized approach of a legendary investor. The other, the broad, diversified sweep of the American economy. And the results have been different, evolving, and always worth watching. It’s like having a front-row seat to a masterclass in long-term investing, with plenty of drama and valuable lessons sprinkled in.

It really makes you curious, doesn't it? What will the next 20 years hold? Will Berkshire Hathaway reclaim its dominant lead? Or will the relentless march of innovation and the power of the S&P 500 continue to challenge? It's a story still being written, and that's what makes it so captivating. It’s a constant reminder that the world of investing is a dynamic and ever-evolving spectacle.