Benefits Of Buy Now Pay Later For Merchants

Hey there, business owners and shopkeepers! Ever feel like you’re leaving money on the table? Like, there’s a whole chunk of potential customers who really want what you’re selling, but they just can’t swing the whole payment at once? It’s a bummer, right? Well, what if I told you there’s a super cool, totally chill way to snag those hesitant buyers and boost your sales, without you having to do much of the heavy lifting? Yep, we’re talking about “Buy Now, Pay Later” (or BNPL for short), and it’s seriously a game-changer for merchants.

Think about it. You’ve got these awesome products, right? You’ve poured your heart and soul into them. But sometimes, life happens. People have bills to pay, unexpected car repairs, or maybe they’re just saving up for a dream vacation. That doesn’t mean they don’t appreciate a good quality item or a fantastic service. It just means their bank account might be playing a little hard to get at that exact moment.

So, how does BNPL swoosh in like a superhero (a very financially savvy superhero, that is) and save the day? Let’s dive in, shall we?

Making Shopping More Approachable (For Everyone!)

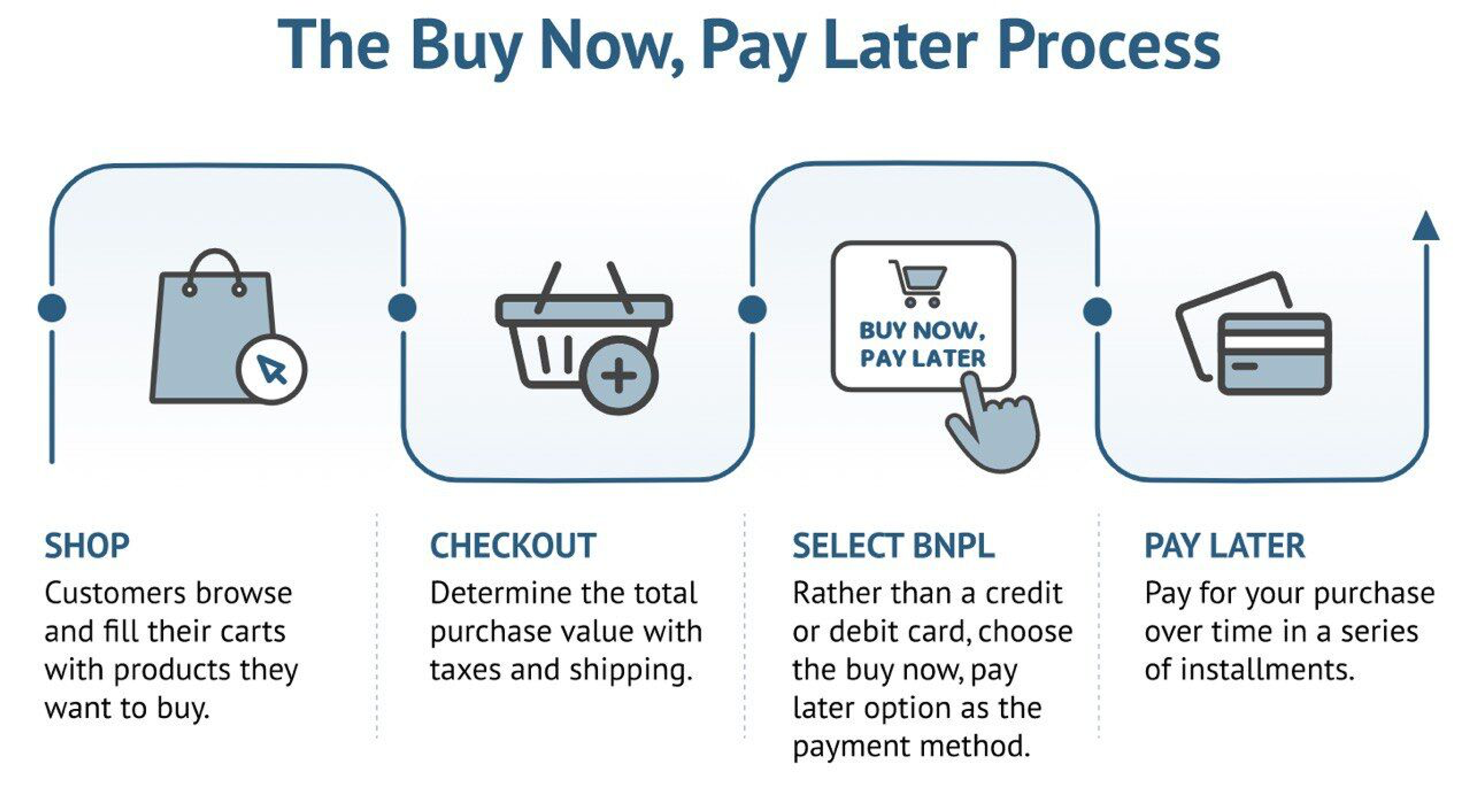

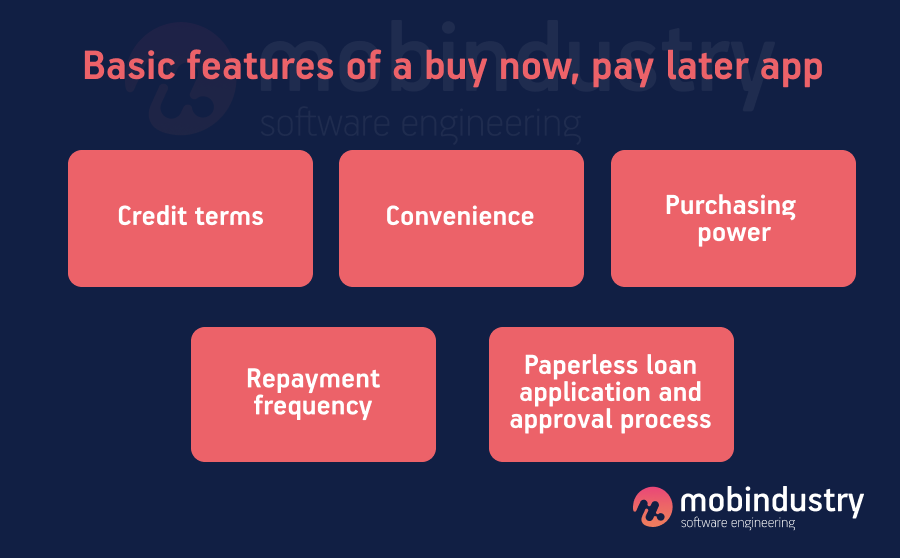

This is the big one, folks. BNPL is basically like offering a little bit of breathing room for your customers. Instead of asking them to shell out a lump sum, you’re saying, “Hey, you can enjoy this awesome thing now, and pay for it over a few weeks or months, with zero or low interest!” How cool is that? It’s like getting a slice of that delicious cake before you’ve finished your whole dinner. Everyone’s happier, right?

For you, the merchant, this translates into a bigger pool of potential customers. People who might have scrolled past your product, thinking, "Ooh, I like it, but..." can now say, "Yes! I can actually afford this!" It’s like unlocking a secret level in a video game, where suddenly all the cool stuff is within reach.

The "Impulse Buy" Power-Up

We’ve all been there. You see something you love, it sparks joy, and you really want it. But then that little voice of reason pipes up about the price. BNPL can help silence that voice (in a good way!). It lowers the barrier to entry, making it easier for customers to make those delightful impulse purchases. You know, the ones that make them feel good and keep them coming back for more?

Think of it like this: you’re at a carnival, and there’s a prize you really want. The ticket price is a little steep. But if they offered you a few tickets for a dollar instead of five all at once, you'd probably grab those tickets, right? BNPL works the same magic for your products. It makes that desirable item feel more attainable and less daunting.

Boosting Your Average Order Value (Cha-ching!)

This is where it gets really interesting for your bottom line. When customers have the flexibility to spread out payments, they’re often more willing to spend a bit more. That’s right, we’re talking about a potential increase in your Average Order Value (AOV). Who doesn’t want that?

Imagine someone eyeing a slightly more expensive, premium version of your product. Without BNPL, they might stick to the budget option. But with the option to pay in installments, that premium item suddenly becomes a lot more attractive. It's like choosing the deluxe combo meal instead of just the burger because the price difference feels manageable when spread out. Your customers get a better product, and you get a bigger sale. Win-win!

It’s also a fantastic way to encourage customers to add those little extras. You know, the accessories, the add-ons, the little delights that make their purchase even better? With BNPL, those small additional costs can feel almost negligible when they’re bundled into a larger, manageable payment plan. It’s like adding sprinkles to your ice cream – it’s a small extra that makes the whole experience sweeter, and the cost feels less significant when you’re already enjoying the main treat.

Fewer Abandoned Carts, More Happy Customers

Oh, the dreaded abandoned cart! We’ve all stared at those statistics, wondering where all those potential sales went. A significant reason for cart abandonment is often the sticker shock at checkout. Customers get to the final step, see the total, and their enthusiasm deflates faster than a cheap balloon at a birthday party.

BNPL acts as a fantastic cart recovery tool. By offering this payment option, you’re removing a major hurdle that causes people to click away. They can see a payment plan that works for them, and suddenly, that item they loved is heading to their cart – and eventually, to their doorstep! It’s like having a friendly assistant who helps customers overcome that final hurdle of commitment.

Attracting a New Generation of Shoppers

Let’s be honest, the way people shop is evolving. Younger generations, in particular, are accustomed to flexible payment options. They’ve grown up with streaming services, subscription boxes, and all sorts of services that are paid for in smaller, regular chunks.

By integrating BNPL, you’re not just offering a payment method; you’re signaling that your business is modern, flexible, and understands their financial habits. It's like speaking their language! This can make your brand incredibly appealing to a demographic that might otherwise overlook you. They see BNPL as a standard, convenient way to shop, and if you don't offer it, you might be missing out on a huge chunk of their spending power.

Building Trust and Loyalty

When you offer BNPL, you're essentially saying, "We trust you, our customer, to manage your payments." This can really go a long way in building customer trust and fostering loyalty. It shows you're invested in making their shopping experience positive and stress-free.

Think about how good it feels when a business makes things easy for you. You remember that feeling, and you're more likely to go back. BNPL contributes to that positive experience, making it more likely that customers will not only return to your store but also recommend you to their friends and family. It's like giving them a little pat on the back for choosing you, and they feel appreciated.

What About the Risk for Merchants? (The Chill Answer)

Now, you might be thinking, "Okay, this sounds good, but what about the risk for me? Do I have to chase payments?" And here’s the really cool part: most BNPL providers handle the risk for you. They typically pay you the full amount upfront, minus their fee, and then it’s their responsibility to collect from the customer. It’s like outsourcing the payment-collection headache!

This means you get your money, your sales go up, and you can get back to doing what you do best – running your amazing business! It’s a low-effort, high-reward situation that can really transform how you operate. It’s like having a secret ingredient that makes your business recipe even more delicious, without you having to learn a whole new cooking technique.

So, there you have it! BNPL isn't just a trend; it's a smart, customer-centric approach that can bring some serious benefits to your business. It makes shopping more accessible, boosts your sales, attracts new customers, and builds loyalty, all while taking a lot of the payment-related stress off your shoulders. Pretty neat, huh? Give it a whirl, and see your business flourish!