Bank Account With Overdraft With Bad Credit

Ever found yourself staring at your bank balance with a mix of dread and, dare we say, a flicker of curiosity? You know, that moment when you’re just about to make a purchase, and a little voice whispers, "But what if there's not quite enough?" Well, let's dive into a topic that might sound a little intimidating at first, but is actually quite a common and surprisingly useful tool: a bank account with overdraft capabilities, even if your credit isn't perfect. Think of it as a financial safety net, a little wiggle room for those unexpected moments.

So, what exactly is this magical thing? Essentially, it's a standard checking account that allows you to spend more money than you currently have in it, up to a pre-approved limit. This is the overdraft feature. Now, you might be thinking, "But my credit score isn't exactly stellar." And that's where the "bad credit" part comes in. Historically, overdrafts were often tied to impeccable credit. However, many banks and financial institutions are now offering overdraft protection to a wider range of customers, recognizing that life happens, and a temporary dip in your credit history shouldn't necessarily lock you out of basic financial services.

The primary purpose is simple: to prevent your transaction from being declined. Imagine this: you're at the grocery store, your cart is full, and you realize you're a few dollars short. Without overdraft, that card would be declined, leading to potential embarrassment and an incomplete shopping trip. With overdraft, your transaction goes through, and you have a little breathing room to rectify the situation. This can be incredibly helpful in everyday life, especially for things like unexpected car repairs, a last-minute bill payment, or even just ensuring your rent check doesn't bounce. It’s about avoiding those frustrating declined transactions that can snowball into bigger problems.

In an educational context, this can also be a lifeline. Students often have fluctuating incomes. An overdraft could mean the difference between buying essential textbooks on time or facing late fees. It’s about providing a small buffer, a way to manage the ebb and flow of student life without derailing your academic progress. It’s not about encouraging overspending, but rather offering a pragmatic solution for temporary cash flow challenges.

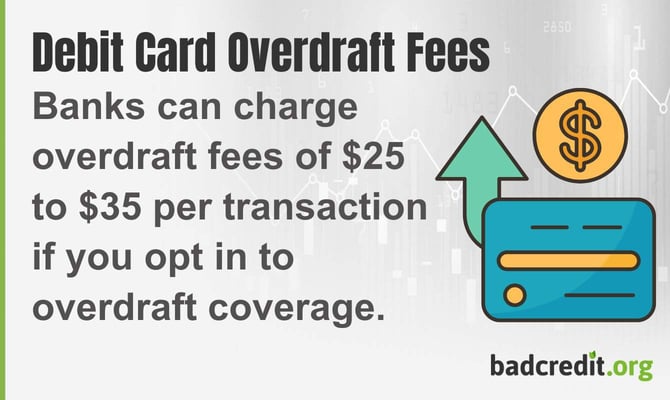

Ready to explore this a bit more? Start by researching banks and credit unions that explicitly offer overdraft protection for individuals with less-than-perfect credit. Many online banks are known for their flexible policies. When you're looking, pay close attention to the fees associated with overdrafts. These can vary significantly, so understanding them is crucial. Some banks charge a flat fee per overdraft, while others might have a daily charge. Also, check the overdraft limit they are willing to offer. It might be small to start, but it's a step!

A simple way to explore is to talk to a representative at your current bank or a few other institutions. Ask them directly about their overdraft policies and what the requirements are, specifically mentioning any concerns you might have about your credit history. You might be surprised at the options available. It’s about understanding the tool and using it wisely, not as a crutch, but as a convenient way to navigate the occasional financial hiccup.