Average Price To Earnings Ratio S&p 500

Hey there, ever heard of something called the P/E ratio? It sounds a bit like a secret code, doesn't it? But really, it's just a fun way to look at how much people are willing to pay for a dollar of a company's earnings. And when we talk about the S&P 500 P/E ratio, we're zooming out to look at the whole big picture of the stock market. It's like taking a peek at the overall mood of the business world!

Think of the S&P 500 as a giant basket holding 500 of the biggest, most well-known companies in America. It's a really popular way to see how the whole stock market is doing. Companies like Apple, Microsoft, and Amazon are all in this big basket. So, when we talk about the S&P 500 P/E ratio, we're looking at the average price people are paying for a piece of all those awesome companies, compared to how much money they're making.

Why is this so entertaining? Well, it's like a game of "What's the vibe?" for the stock market. A high P/E ratio can mean people are super excited about the future. They believe these companies are going to make even more money down the road. They're willing to pay a bit more now because they expect big rewards later. It's like buying a ticket to the hottest concert in town – everyone wants in, and the price goes up!

On the other hand, a low P/E ratio might suggest that people are a little more cautious. Maybe they're not as sure about the future, or perhaps the companies just aren't as popular at the moment. It doesn't necessarily mean it's a bad thing, though! Sometimes, a lower P/E can mean you're getting a great deal, like finding a hidden gem in a sale bin. You get more earnings for your buck.

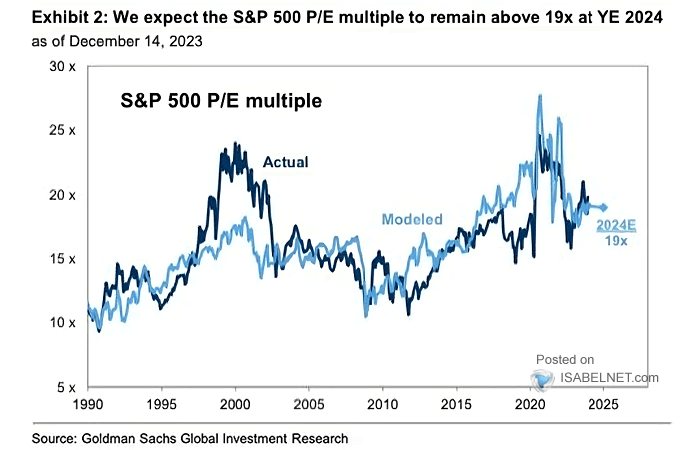

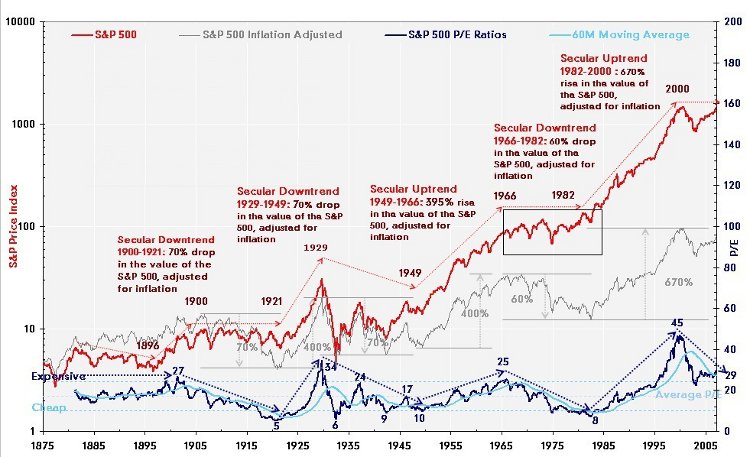

The average P/E ratio for the S&P 500 is constantly changing, like the weather. It goes up and down depending on what's happening in the world, in the economy, and with the companies themselves. It's a number that investors and analysts love to watch. They use it to try and figure out if the stock market is "cheap" or "expensive." It's like trying to guess if it's a good time to go shopping for stocks!

Imagine you're at a big party, and everyone's chatting about the latest trends. The S&P 500 P/E ratio is kind of like the buzz of that party. If the P/E is high, everyone's talking excitedly about growth and future potential. If it's lower, the conversation might be a bit more reserved, focusing on value and stability.

So, what's considered "average" anyway? This is where it gets really interesting. Historically, the average P/E ratio for the S&P 500 has hovered around the 15-20 range. But this is just a ballpark! Sometimes, it can creep up into the 20s or even higher when investors are feeling really optimistic. And in tougher times, it can dip down lower.

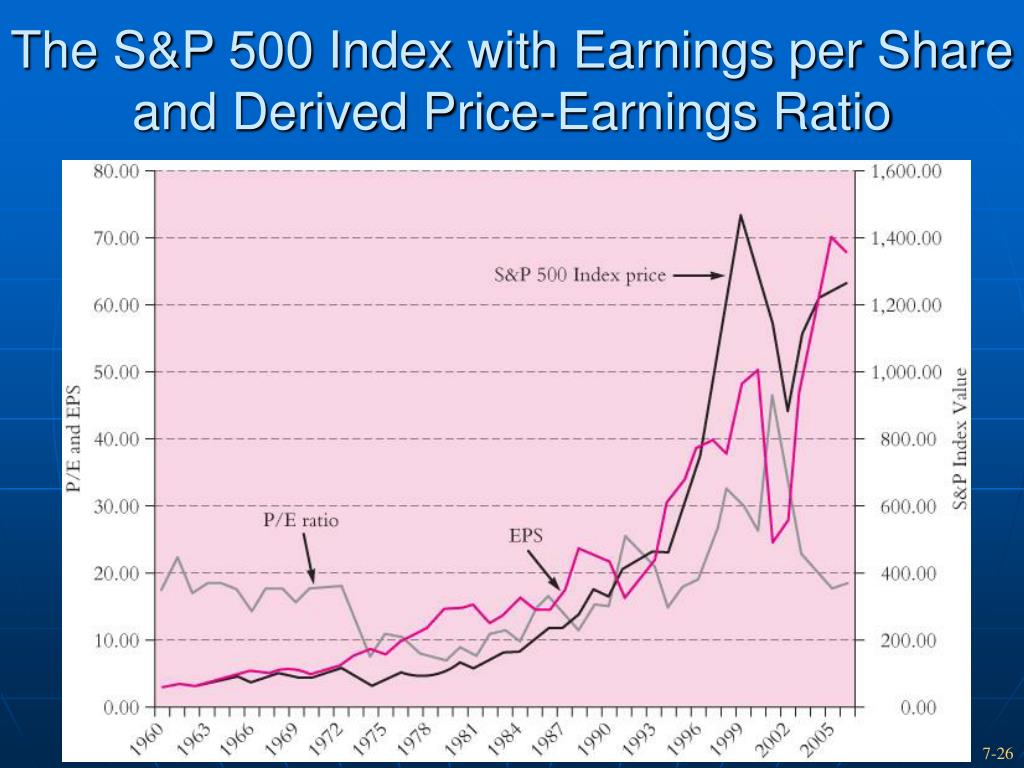

Think of it like this: If the P/E ratio is 15, it means that, on average, investors are paying $15 for every $1 of earnings the S&P 500 companies are making. If it jumps to 25, they're paying $25 for that same $1 of earnings. That's a pretty big difference, right?

This number isn't just some boring statistic; it tells a story. It's a story about investor confidence, about economic outlook, and about how the biggest companies in the world are performing. It's a peek behind the curtain of the stock market, and it's actually quite addictive to follow.

What makes it special is that it’s a simple way to get a feel for the overall sentiment. You don't need to be a Wall Street wizard to understand the basic idea. It’s about supply and demand for company earnings. When demand is high (people are eager to buy), prices go up, and the P/E ratio follows.

And the S&P 500 aspect? That’s what makes it so powerful. Because it includes so many major companies, it gives us a really good snapshot of the entire US stock market. It’s not just about one company doing well or poorly; it’s about the collective performance and the collective optimism (or pessimism) of the market.

It’s fun to look at charts of the S&P 500 P/E ratio over time. You can see the peaks and valleys, the periods of booming confidence, and the times when things got a little bit more serious. It's like looking at a heartbeat monitor for the economy!

It's a fascinating way to gauge the mood of the market without needing a crystal ball.

So, the next time you hear about the average price to earnings ratio for the S&P 500, don't let it intimidate you. It's just a cool number that tells us how much people are valuing the earnings of the biggest companies in the country. It’s a little puzzle piece in the grand picture of the stock market, and understanding it can make following the financial news a lot more interesting. Maybe you'll even find yourself checking it out now and then, just to see what the market's vibe is!