Average 401 K Contribution Percentage By Age

Hey there, future-you! Ever find yourself staring at your paycheck, noticing that little chunk that disappears for your 401(k), and thinking, "What even is this magic money pot, and am I putting enough in?" You're definitely not alone. It's like that mysterious Tupperware lid in your kitchen drawer – you know it belongs to something, but what exactly?

Let's chat about 401(k) contributions, specifically how much the average Joe and Jane are putting in at different stages of their careers. Think of this as a friendly peek into the communal cookie jar of retirement savings, but without any of the awkwardness of asking your neighbor if they've seen your spatula.

The 'Just Starting Out' Jitters (20s & Early 30s)

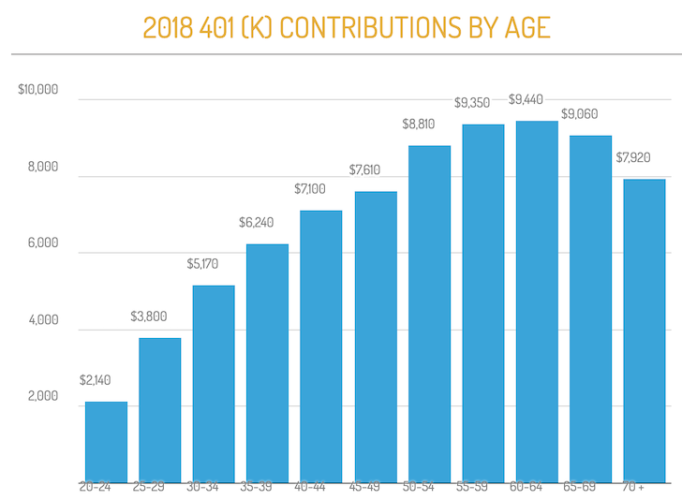

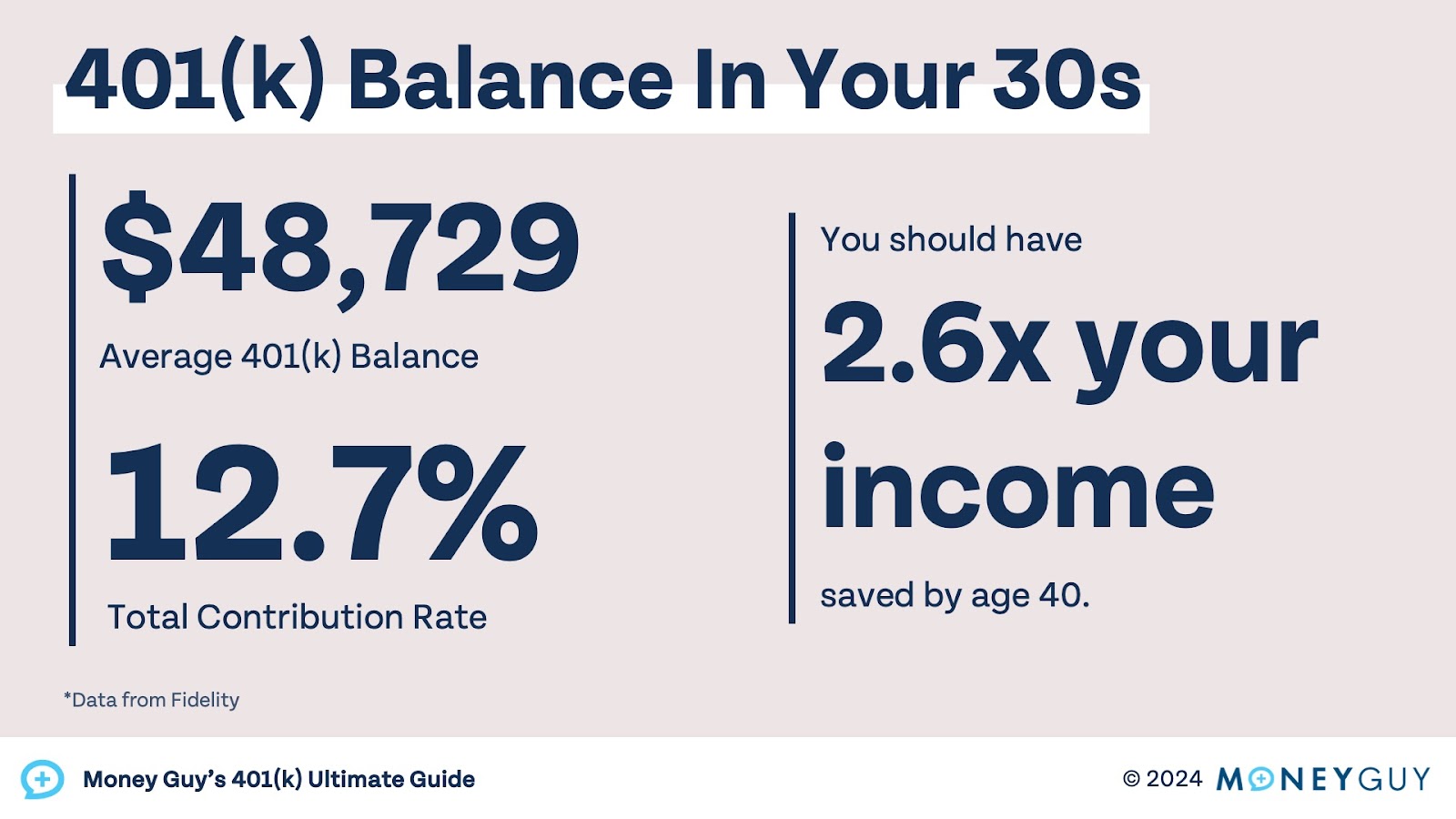

Ah, the 20s. A glorious time of figuring things out, maybe living on ramen (again), and perhaps feeling like retirement is as distant as that mythical unicorn everyone talks about. When it comes to 401(k)s in this phase, many folks are just dipping their toes in. The average contribution percentage here can hover around 5-7% of their salary.

Imagine you're buying your first tiny succulent for your apartment. You might start with just a little bit of soil and water, not a whole greenhouse setup. That's kind of what 401(k) looks like in your 20s. You're getting the hang of it, maybe your employer is throwing in a little match (hello, free money!), and you're just building that habit.

It's also a time when, let's be honest, student loans and that shiny new gadget can feel more pressing than retirement. But here's the super cool part about starting early: time is your best friend. Even small contributions can grow into something significant over decades, thanks to the magic of compound interest. It's like planting a tiny seed that, with consistent watering (your contributions) and sunshine (market growth), becomes a mighty oak tree.

Sarah's Story: The Early Bird Gets the Worm (Eventually!)

My friend Sarah started her first "real" job at 24. She was contributing 5% to her 401(k), and her company matched half of that up to 3%. So, effectively, 7.5% was going in! She wasn't saving a fortune, but she was consistent. She often said it felt like a drop in the bucket compared to her rent and car payment. But looking back now, at 35, that "drop" has already started to make a noticeable ripple, and she feels a sense of calm knowing she didn't wait.

Hitting Your Stride (Late 30s & 40s)

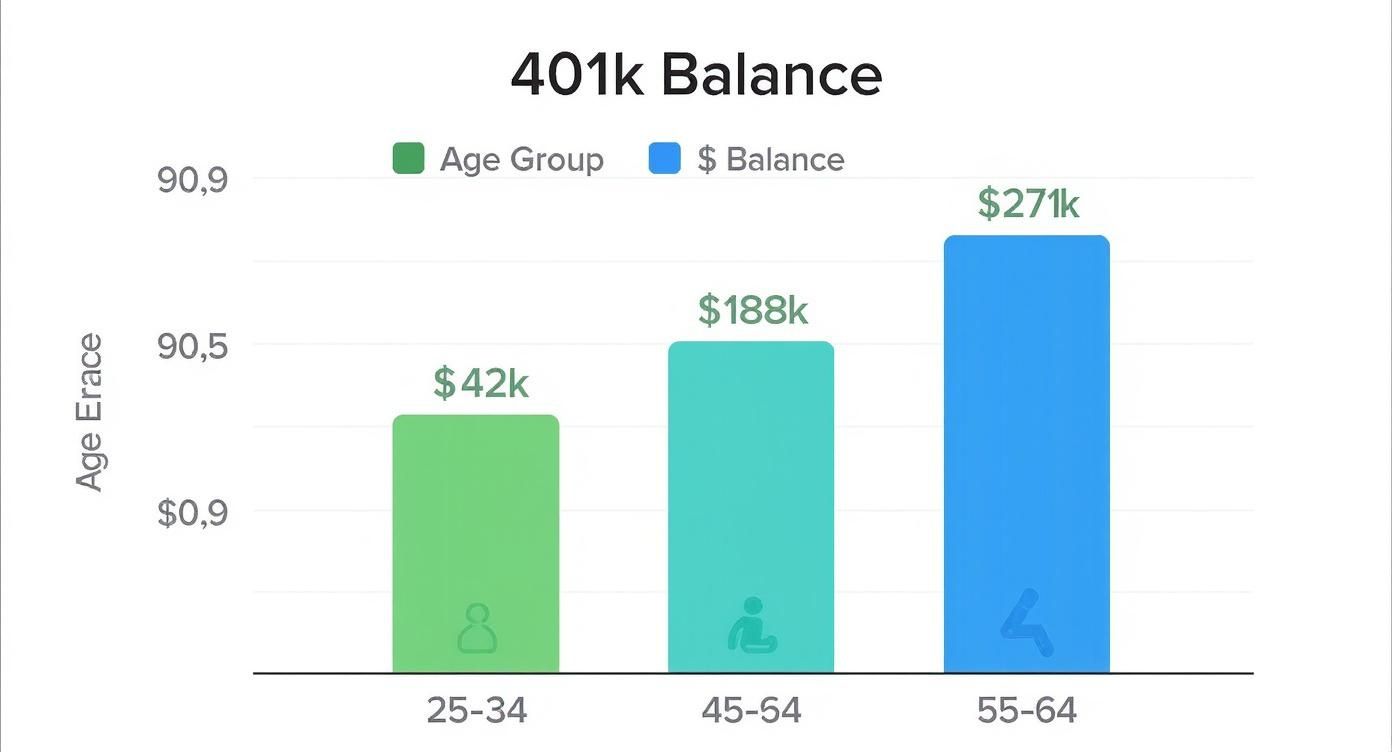

Now, let's talk about the 30s and 40s. This is often when life gets a little more… settled. Maybe you've got a mortgage, a family, and a slightly more sophisticated coffee maker. Your income is likely higher, and hopefully, those student loans are shrinking. This is where you see average contribution percentages climb, often to around 8-10%.

Think of it like upgrading your succulent's pot. You're not just adding a bit more soil; you're getting a bigger pot, more fertilizer, and a really good watering can. You've got a better handle on your finances, and retirement, while still a ways off, feels a bit more tangible. You might be thinking about those future travel plans or how you want your "golden years" to look.

This is also a prime time to really take advantage of any employer match. If your company matches 50% of your contribution up to 6%, and you're putting in 6%, that's a 9% effective contribution! It’s like getting a bonus for doing something you’re already doing. Seriously, if your employer offers a match, don't leave that money on the table. It’s the easiest way to boost your savings.

Mark's Journey: The Realization Hits

My cousin Mark, at 42, suddenly realized he’d been coasting with his 401(k) contributions for years. He was putting in just enough to get the company match. Then he saw a friend who was much more aggressive with their savings and felt a pang of "what if?" He sat down with a financial advisor (which, by the way, is totally worth it!) and bumped his contribution up to 12%. He said it was a bit of a pinch at first, but the peace of mind was immediate. He felt like he was finally steering his ship, not just drifting.

The Home Stretch (50s & Beyond)

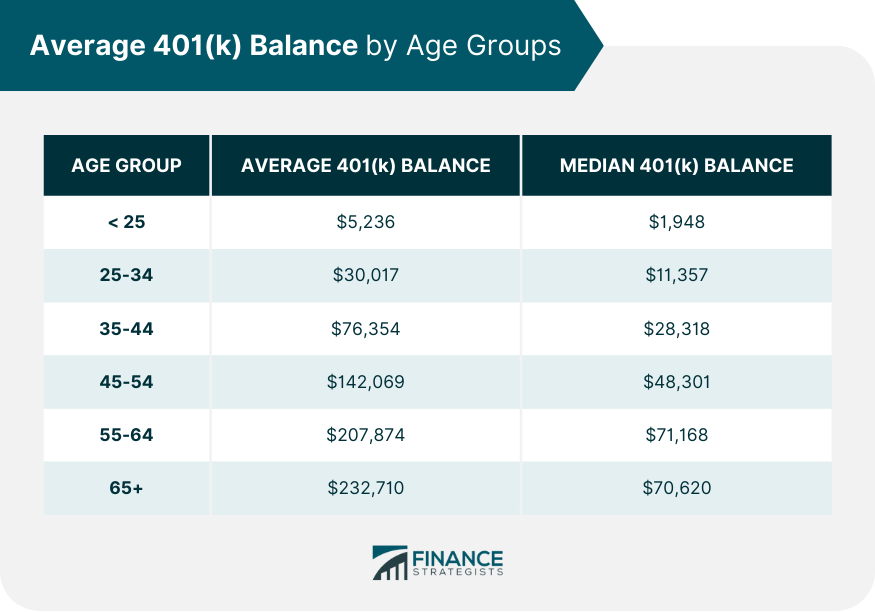

Welcome to the 50s, where retirement feels like a warm, inviting porch swing is just over the horizon. For many, this is the time to really supercharge those savings. The IRS actually allows for "catch-up" contributions for those over 50, which is a fantastic perk. Average contribution percentages can now be in the range of 12-15% or even higher.

This is like finally buying that spacious greenhouse you’ve always dreamed of for your plants. You’re all-in! You've got more disposable income, perhaps the kids are out of the house, and your focus is squarely on building that nest egg. You're actively playing the long game, and every extra dollar you can put away now makes a huge difference.

![Average 401k Balance By Age 2025 [Complete Breakdown By Age]](https://saltmoney.org/wp-content/uploads/2023/08/Average-401k-Balance-by-Age-3.jpg)

Think of it as your final sprint towards the finish line. You're putting in the extra effort, knowing that those last few yards are the most critical. The catch-up contributions are like a cheat code to give your retirement savings a significant boost right when you need it most.

Susan's Success: The Catch-Up Advantage

Susan, who’s 55, just recently started taking advantage of the catch-up contributions. She’d been a consistent 8% contributor for years, which was great. But when she realized she could add an extra $6,500 on top of her regular contributions (that's the 2023 catch-up amount, by the way – check your plan for current limits!), she jumped at it. She said it feels empowering to know she’s actively boosting her retirement security in these final working years.

Why Should You Even Care?

Okay, so why is this all important? Well, it’s about more than just a number on a screen. It’s about freedom. It's about having the choice to do what you want when you want to do it later in life.

Do you want to travel the world? Spend more time with grandkids? Learn to paint? Volunteer for a cause you love? Or maybe just have the peace of mind knowing you won't have to worry about bills in your later years? Your 401(k) contributions are the building blocks for that future.

It’s also about avoiding the dreaded "what ifs." What if I had saved a little more? What if I had started earlier? By understanding the averages and seeing how people at different ages contribute, you can get a sense of where you stand and what might be a good goal for you. You don't have to be the highest contributor, but you should strive to be a smart contributor.

So, take a peek at your own 401(k) statement. Don't let it be that elusive Tupperware lid anymore. Understand what it’s for, and feel empowered to contribute in a way that makes sense for you, at every stage of your journey. Your future self will thank you, probably with a really nice, stress-free cup of coffee.