Are Home Foreclosures Increasing In Us 2025

Hey everyone! Let’s chat about something that pops up in the news now and then, and might make you tilt your head a bit: home foreclosures. You know, when someone can’t keep up with their mortgage payments and the bank has to step in. It sounds a bit serious, and it is, but let’s break it down in a way that’s as comfortable as your favorite worn-out sweatpants.

You might be wondering, with 2025 just around the corner, are we seeing more homes going through this process? It's a fair question, especially when you see those "For Sale" signs pop up a little more frequently in your neighborhood or hear about it from a friend of a friend. Think of it like this: remember when everyone was suddenly obsessed with sourdough starters during the pandemic? Or how every other song on the radio seemed to be about a breakup? Sometimes trends just… happen. And we’re curious if foreclosures are in one of those “happening” phases.

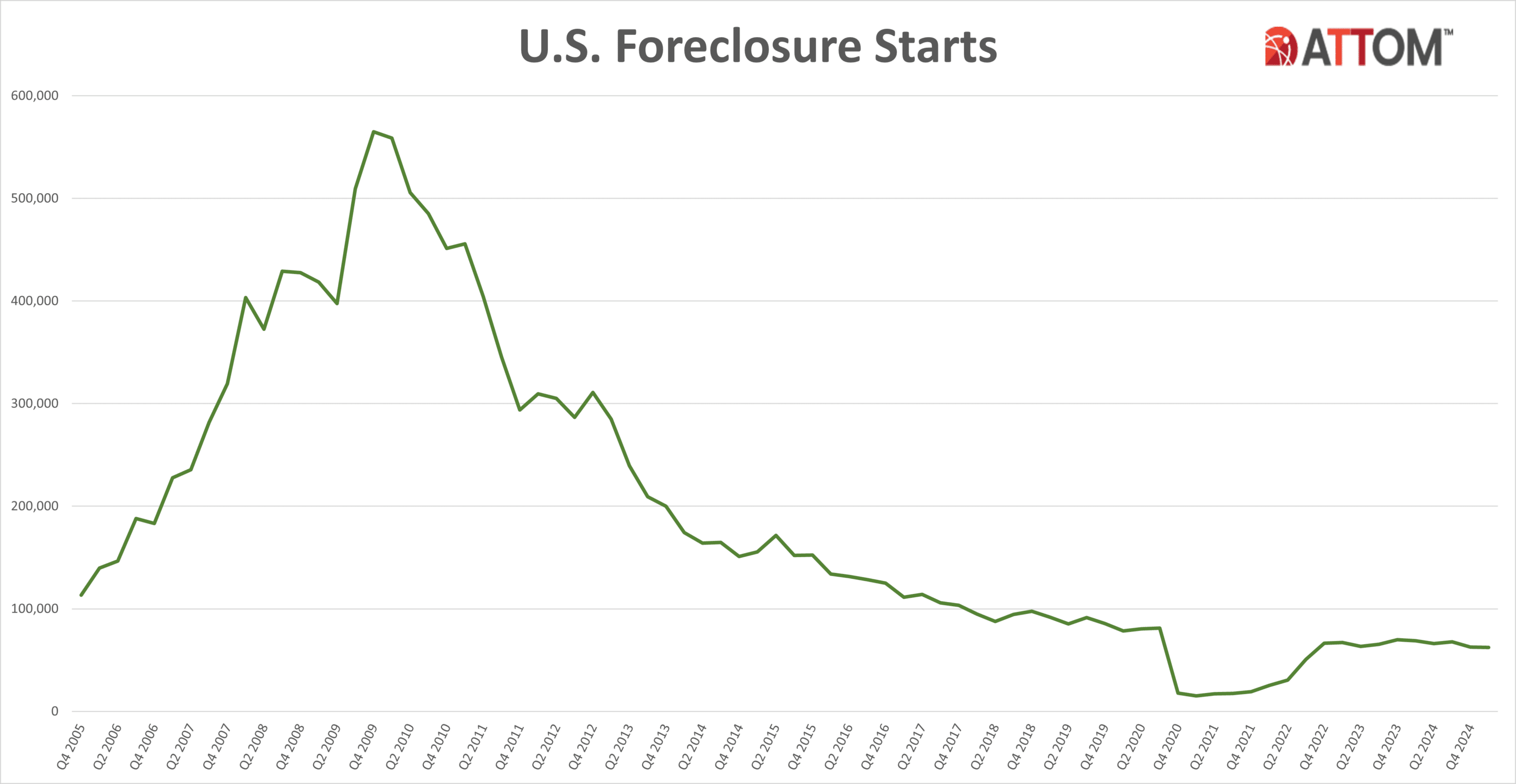

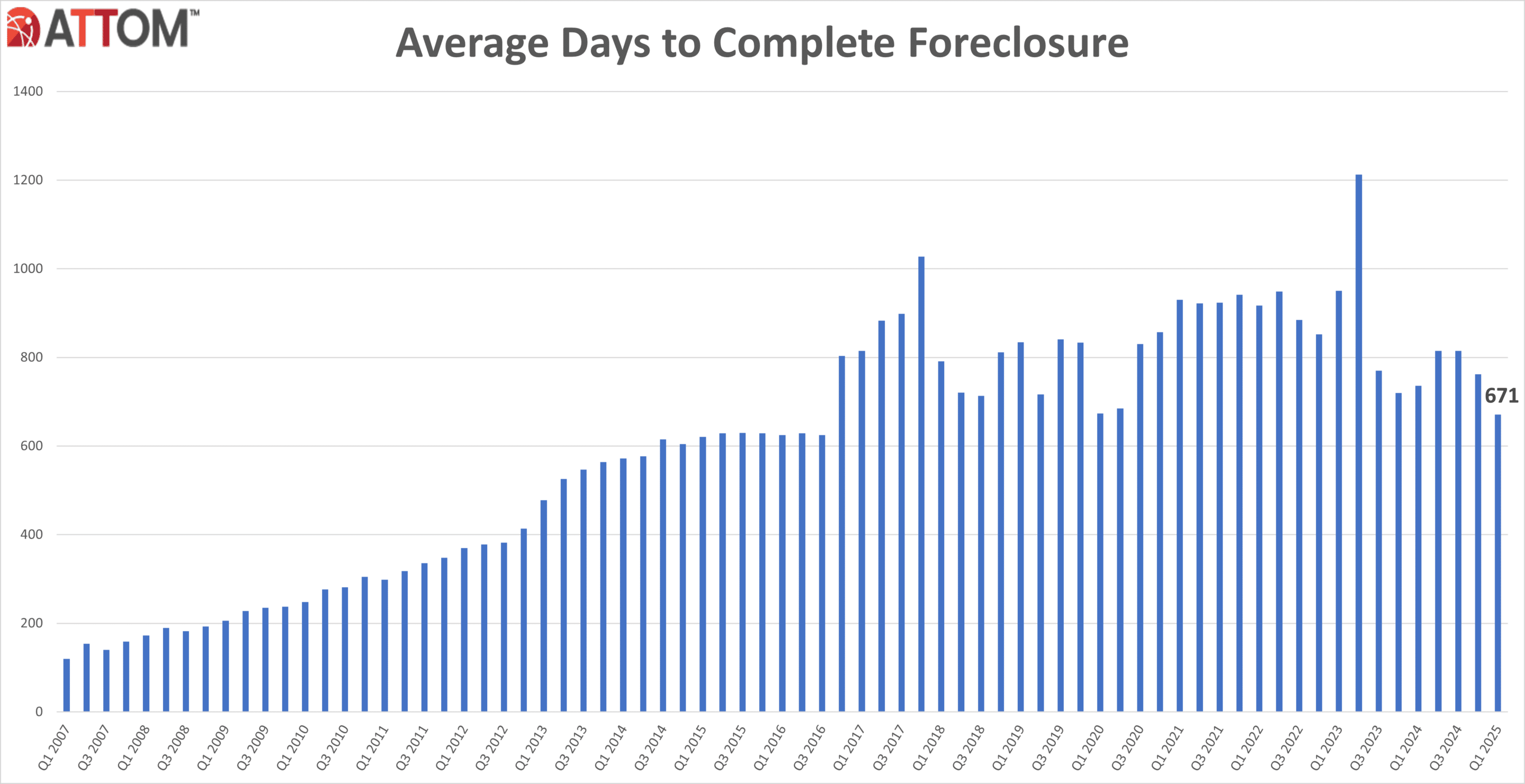

So, what’s the big picture for 2025? Well, the smart folks who crunch numbers for a living (they’re basically the financial fortune tellers) are keeping a close eye on this. Most of the current predictions suggest that we’re not heading for a massive foreclosure crisis like we saw back in the late 2000s. Phew! That’s like finding out your favorite pizza place isn’t closing down – good news for everyone.

Why the relief? A few things are different this time around. For starters, lending practices are a lot stricter now. Banks are a bit more cautious about who they hand out those big home loans to. It's like a parent vetting a new friend for their teenager – they want to make sure they're a good influence! They're asking for more proof of income, better credit scores, and generally making sure folks can actually afford to buy a home.

Plus, remember all the talk about interest rates going up? While that can make monthly payments higher for new buyers, many homeowners who bought a while back have locked in pretty low interest rates. So, their payments are still a lot more manageable. It's like you got a great deal on a subscription service years ago, and now everyone else is paying way more. You're breathing a little easier.

Another huge factor is the overall strength of the job market. When more people have jobs, they have money to pay their bills, including their mortgages. It’s a pretty simple cause-and-effect, right? If your paycheck is steady, you're not stressing about making rent or your mortgage. It’s the financial equivalent of having a well-stocked pantry – you feel more secure.

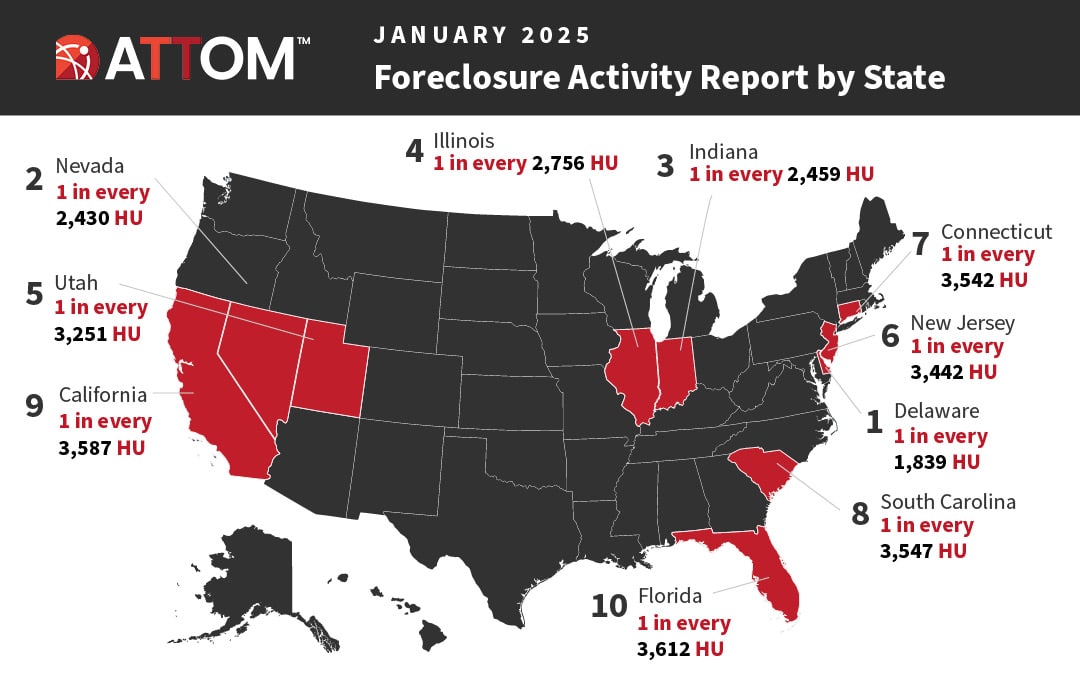

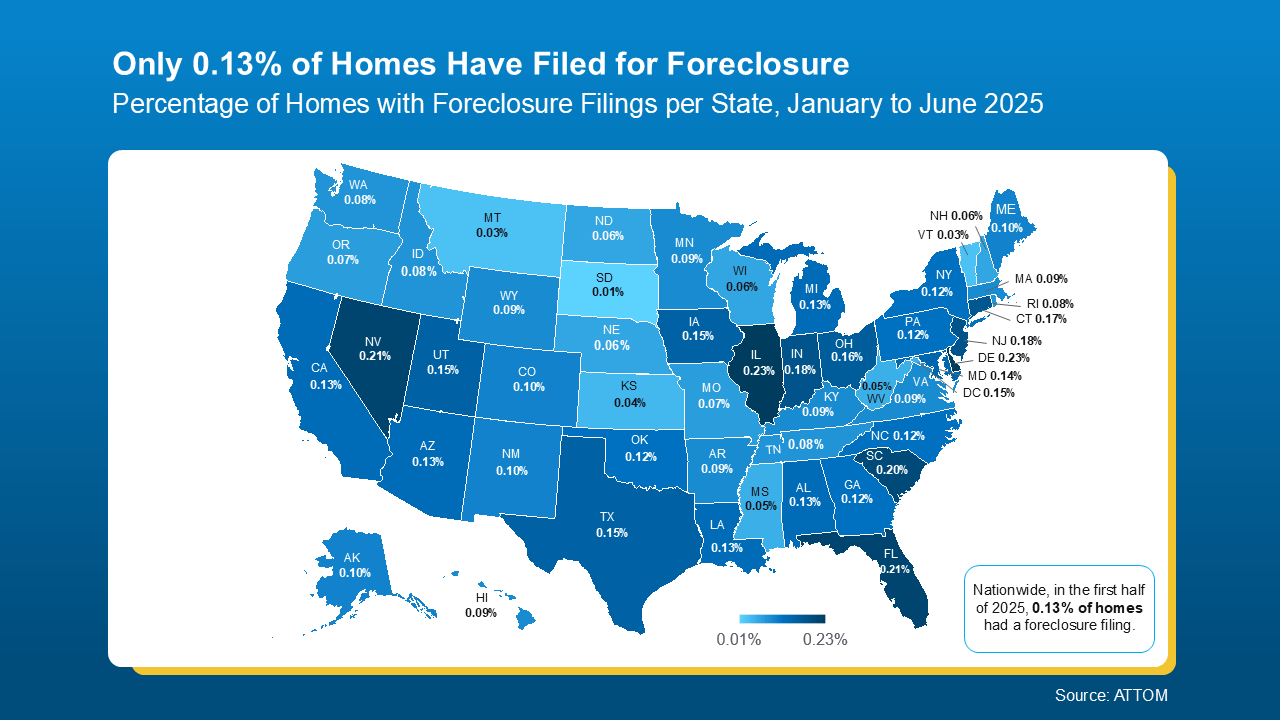

However, it’s not all sunshine and rainbows. While a full-blown crisis seems unlikely, we might see a slight uptick in foreclosures compared to the historically low numbers we’ve experienced recently. Why? Well, life happens. People lose jobs unexpectedly, medical emergencies pop up, or sometimes divorce can shake things up financially. These are real-life situations that can put a strain on any budget, no matter how well-planned.

Think about it like this: you’re juggling a few important tasks, like making dinner, helping your kid with homework, and trying to catch your favorite show. If one of those balls drops – say, the power goes out and your oven won’t work – it can throw your whole evening off. Similarly, a sudden financial shock can make it hard for even responsible homeowners to keep up.

So, why should you care if a few more homes go into foreclosure? It’s not just about the individual families, though that’s a big part of it, of course. It’s about the health of our communities. When homes sit vacant, they can become eyesores. They can drag down property values for everyone around them. It’s like if one of your favorite local shops suddenly closed – it leaves a gap and can make the whole street feel a little less vibrant.

More broadly, a surge in foreclosures can signal underlying economic stress. It’s a bit like a canary in a coal mine. If too many people are struggling to keep their homes, it suggests there are bigger issues at play, like inflation hitting harder than expected or employment opportunities shrinking. This can affect all of us, even if we own our homes outright or are happily renting.

Imagine if your favorite coffee shop started cutting back on staff and their pastries weren’t as fresh. You might start wondering if they’re having trouble, and that could make you a little less enthusiastic about stopping by. A neighborhood with a lot of foreclosures can feel a bit like that – a sign that things aren’t quite as stable as they could be.

On the flip side, a stable housing market, where people can afford their homes and neighborhoods are thriving, is good for everyone. It means more stable communities, a stronger tax base for local services (like schools and parks!), and a general sense of well-being. It's like a healthy garden – everything benefits when the soil is good and the plants are well-cared for.

The good news is that experts are pretty confident we’re not facing anything like the widespread problems of the past. The systems in place are stronger, and most people are in a more stable financial position. So, instead of stressing, it’s more about being aware. It’s like knowing to wear a jacket if the weather forecast says it might rain – you’re prepared, but you’re not panicking.

It’s always a good idea for everyone, whether you own a home or not, to keep an eye on their own financial health. Having a little emergency fund, or even just knowing where you stand with your bills, can make a world of difference if unexpected things happen. Think of it as your personal financial umbrella – ready to deploy if needed.

So, to wrap it up, are foreclosures increasing in the US for 2025? The general consensus is that we're likely to see a slight rise from historically low levels, but not a major crisis. This is thanks to better lending rules, many homeowners with good mortgage rates, and a generally solid job market. It's a sign to stay informed and perhaps a gentle nudge to keep our own financial houses in order, but for the most part, the news is pretty reassuring!