American Funds Insurance Series Growth Fund

Let's talk about something that can feel a bit like a treasure hunt, a long-term journey towards a brighter future: investing. For many, the idea of putting their hard-earned money to work can be both exciting and, let's be honest, a little daunting. But imagine having a trusted guide, a seasoned explorer who knows the lay of the land and can help you navigate the path towards your financial goals. That's where something like the American Funds Insurance Series Growth Fund can come into play, offering a structured and potentially rewarding way to grow your wealth.

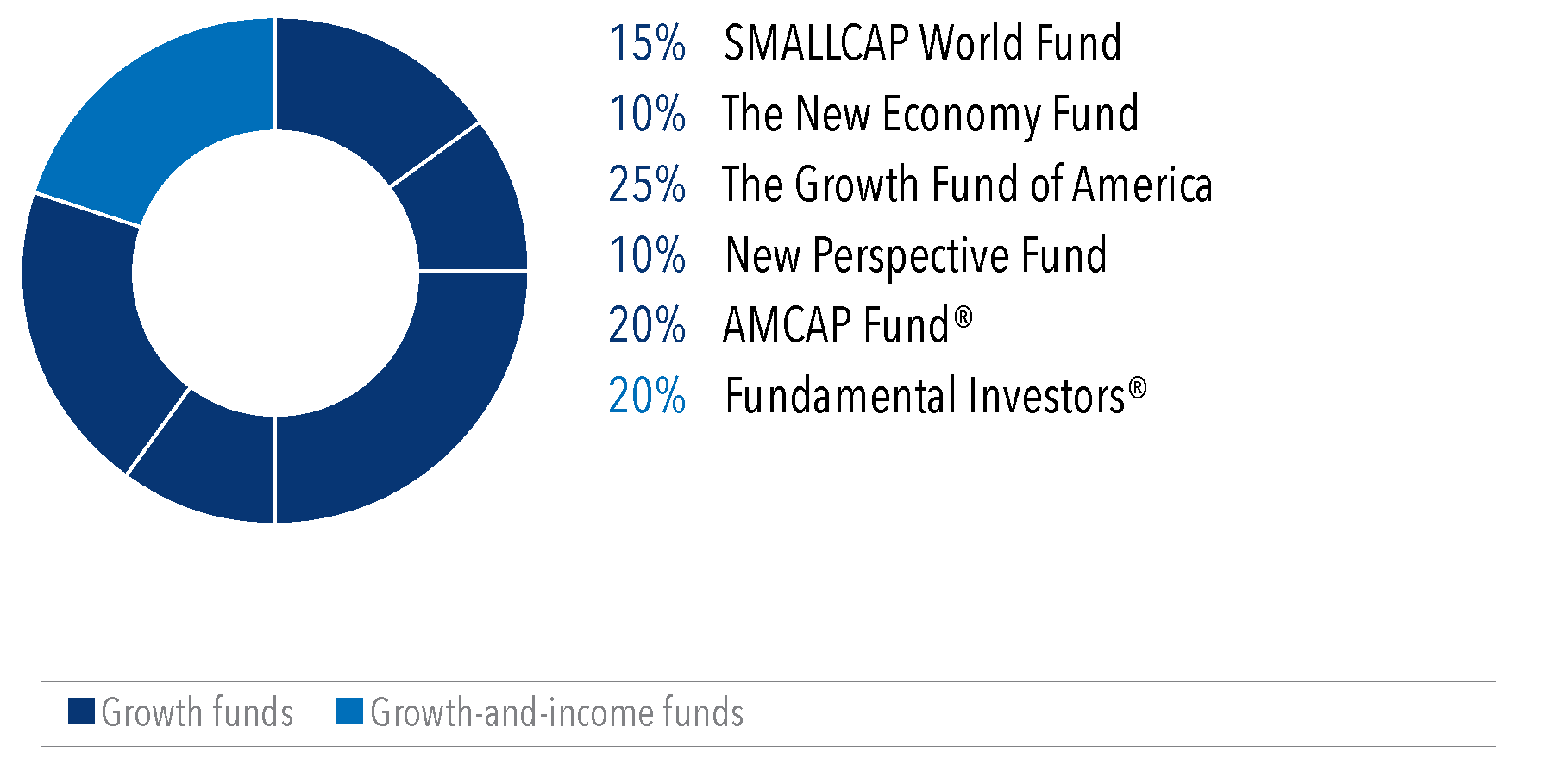

The primary purpose of a fund like this, especially when held within an insurance wrapper, is to offer you a vehicle for long-term growth. Think of it as planting a seed. You nourish it, give it time, and with the right conditions, it blossoms into something much larger. This fund aims to achieve that by investing in a diversified portfolio of companies that are believed to have strong potential for growth. This diversification is key; it's like not putting all your eggs in one basket. If one company stumbles, others might be thriving, helping to smooth out the ride.

So, how does this translate to everyday life? Well, imagine you're saving for a significant future event – perhaps your retirement, a child's education, or even a down payment on a dream home. Instead of just letting your savings sit in a regular savings account, which might not keep pace with inflation, the Growth Fund seeks to outperform. It's about making your money work smarter, not just harder. Common examples include using it as a component of a larger investment strategy, often within the tax-advantaged environment of a life insurance policy, which can offer additional benefits beyond just investment growth.

Now, how can you make the most of this financial journey? First and foremost, understanding your goals is paramount. Are you looking for aggressive growth, or a more balanced approach? The Growth Fund, as the name suggests, leans towards growth, so it’s important to align it with your risk tolerance. Secondly, consistency is your best friend. Investing a set amount regularly, known as dollar-cost averaging, can help mitigate the impact of market volatility. Think of it as buying more shares when prices are low and fewer when they're high. Thirdly, and this is crucial, don't try to time the market. Long-term investing is about time in the market, not timing the market. Patience is a virtue, especially when you're aiming for significant growth over years, not weeks or months.

Finally, remember that this is a tool, and like any tool, it's most effective when used with knowledge and a clear plan. If you're unsure, seeking advice from a qualified financial advisor can provide personalized guidance. They can help you understand how the American Funds Insurance Series Growth Fund fits into your unique financial picture, ensuring you're on the right track to cultivate your financial future. Happy investing!