American Funds 2050 Target Date Fund R6

Imagine a magical crystal ball that could peek into your financial future, specifically for your retirement around the year 2050. Sounds pretty cool, right? Well, while we might not have actual magic, there are some really clever financial tools that come pretty close to offering that kind of foresight. One of the stars of this show is the American Funds 2050 Target Date Fund R6. It’s not just some stuffy financial product; it’s a smart, hands-off way to navigate the exciting journey towards your golden years. Think of it as your personal retirement co-pilot, expertly adjusting the flight path as your destination gets closer.

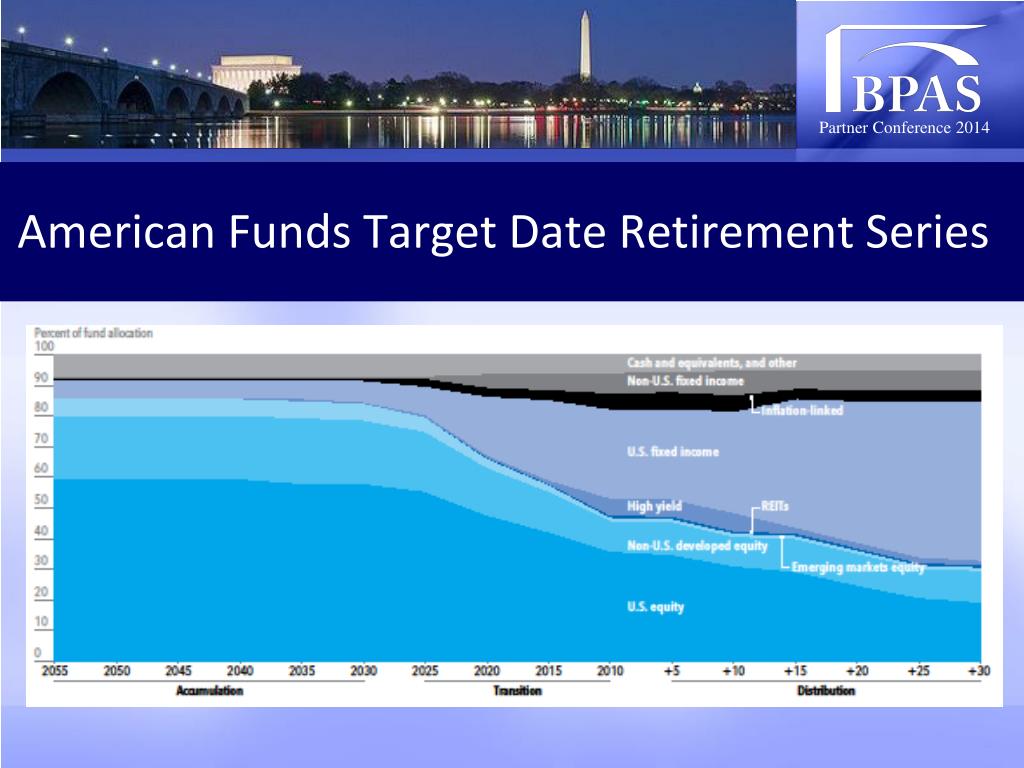

So, what’s the big deal about a "target date fund"? At its heart, it’s designed for people who want to save for retirement but might not have the time, the interest, or the expertise to constantly manage their investments. The "2050" part is the key: it signifies the approximate year you expect to retire. The fund’s magic is in its automatic adjustment. When you're young and have decades until retirement, the fund typically holds a higher percentage of stocks. Why stocks? Because historically, they’ve offered the potential for higher growth over the long term. It’s like planting a sapling – it needs room and time to grow strong. As you get closer to 2050, the fund’s strategy automatically shifts, gradually reducing its exposure to stocks and increasing its holdings in more conservative investments like bonds. This is like reinforcing the sapling’s roots to ensure stability as it matures. This "glide path" is the core concept, and it’s designed to balance growth potential with risk management as your retirement horizon shrinks.

Now, let’s talk about the "R6" designation. This is where things get a little more insider-y, but it’s important because it often translates to a fantastic benefit for you: lower costs. In the world of mutual funds, different share classes exist, and the R6 class is typically reserved for institutional investors or those investing through certain retirement plans. The beauty of the R6 share class is its significantly lower expense ratio. What’s an expense ratio? It’s a small annual fee that mutual funds charge to cover their operating costs. Even a small difference in expense ratios can add up to thousands of dollars over a long investment period. So, by having access to the American Funds 2050 Target Date Fund R6, you’re essentially getting a premium product at a more budget-friendly price. It's like buying a top-tier product without paying the premium markup.

The primary purpose of this fund, and any target date fund for that matter, is to simplify retirement investing. It takes the guesswork out of asset allocation. Instead of you having to decide how much to allocate to different types of investments and then rebalance them periodically, the fund does it all for you. This hands-off approach is incredibly appealing to many people. It allows you to focus on other aspects of your life, confident that your retirement savings are being managed with a long-term strategy in mind. It’s a “set it and forget it” approach, with the crucial caveat that "forgetting" is relative; the fund is actively managed to stay on track with its target date.

The benefits are numerous. First and foremost is the convenience. You pick the fund that aligns with your expected retirement year, and the fund manager takes care of the rest. This is a huge relief for those who find financial markets intimidating. Secondly, it offers automatic diversification. Target date funds invest in a wide range of underlying assets, including stocks and bonds from various sectors and geographies. This diversification helps to reduce overall risk. If one segment of the market performs poorly, other segments might perform well, smoothing out the ride. Thirdly, as we touched upon with the R6 class, the potential for lower costs can lead to greater long-term returns. Every dollar saved on fees is a dollar that stays invested and working for you. Finally, there’s the benefit of risk management. The fund’s glide path is designed to become more conservative as you age. This means that as you approach retirement, your portfolio will generally hold fewer volatile assets, aiming to protect your accumulated savings from significant market downturns when you can least afford them.

Let’s consider a hypothetical scenario. Sarah is 30 years old and just started contributing to her 401(k). She’s aiming to retire around 2050. Instead of trying to research and pick individual stocks and bonds, or even multiple mutual funds, she opts for the American Funds 2050 Target Date Fund R6. In her early years, this fund might be heavily weighted towards global equities, seeking to capture growth. As 2040 approaches, the fund will start to tilt more towards bonds, and by 2050, it will be a much more conservative mix, prioritizing capital preservation. Sarah doesn’t have to lift a finger to make these shifts; the fund’s sophisticated management system handles it. She can sleep soundly knowing her investments are being professionally managed according to a plan designed to get her to retirement successfully.

It’s important to remember that no investment is entirely risk-free. Even with a conservative allocation, market fluctuations can impact the value of your investments. However, the structure of a target date fund like the American Funds 2050 Target Date Fund R6 is specifically engineered to navigate these risks over a long time horizon. It’s a testament to how financial innovation can make complex goals, like a comfortable retirement, more accessible and less daunting for everyday investors. It’s a smart tool for building your future, one year at a time, towards that exciting 2050 horizon.