Alphabet (googl) Earnings: What To Watch, Key Numbers, And Market Reactions

Get ready, folks! It's that time again. The tech giant, Alphabet, the parent company of Google (yep, the one that powers your searches and YouTube binges), is about to drop its latest earnings report. Think of it like a big show, and we're all invited to see how the magic behind the scenes is really working.

Why should you care about a company's financial numbers? Well, for Alphabet, it's a bit like checking the pulse of the internet itself. Their performance tells us a lot about how online advertising is doing, how people are using their cloud services, and even how their futuristic projects are progressing.

This isn't just about dollars and cents; it's about the future of how we find information, connect with each other, and even how businesses operate. When Alphabet talks, the tech world listens. And when they release their numbers, the market really pays attention.

The Big Numbers We're All Buzzing About

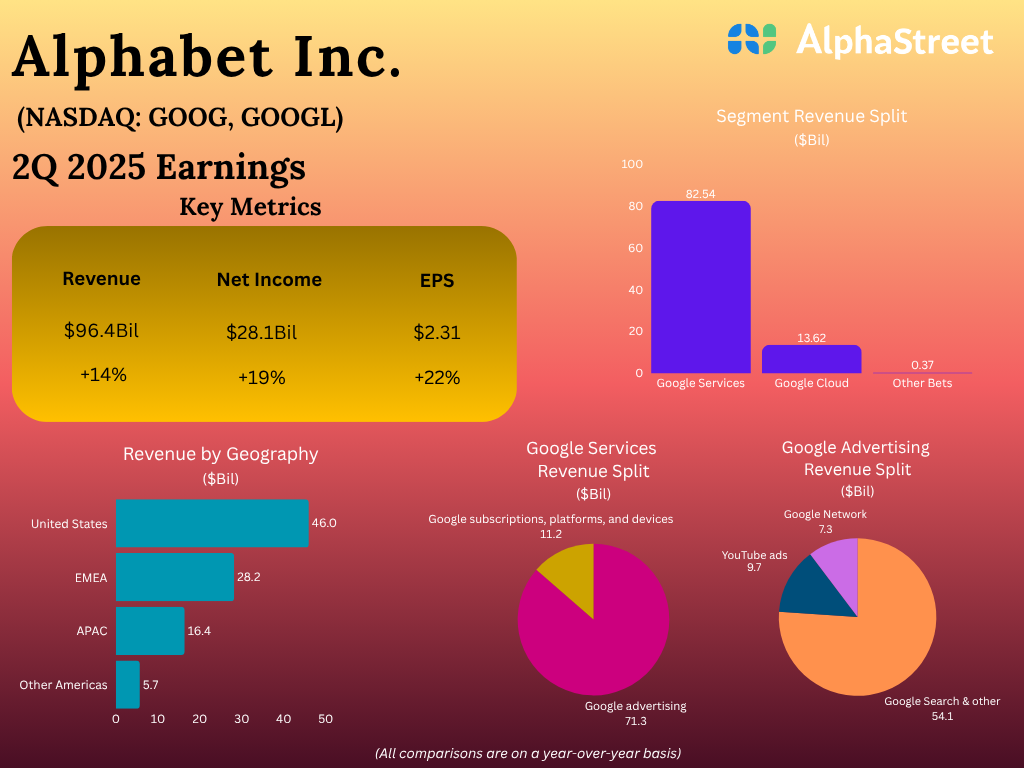

So, what are the key figures that have everyone on the edge of their seats? We're looking for things like revenue, which is basically all the money they brought in. For Alphabet, a huge chunk of this comes from Google Search and YouTube ads. Are these numbers growing? Are they shrinking? This is the first big clue.

Then there's earnings per share (EPS). This sounds a bit technical, but it's simply the profit divided by the number of shares. It's a good way to see if the company is becoming more profitable for its shareholders. Did they make more money per share than last time? That's the question!

And let's not forget profit margins. This tells us how much of their revenue actually turns into profit. A healthy profit margin means they're running a tight ship and making good use of their resources. It's like seeing how much of that delicious pie is actually yours to eat!

Where the Money Comes From: The Secret Sauce

Alphabet isn't just about search anymore. They've got a whole buffet of services. We'll be watching their Google Cloud numbers closely. This is their big play in the business world, competing with giants like Amazon and Microsoft. Is it growing as fast as they hoped? This is a really important battleground.

Then there's YouTube. It’s a whole universe of content, from funny cat videos to in-depth tutorials. How much are advertisers spending to reach those eyeballs? The performance of YouTube ads is a massive indicator of their overall success.

And what about the "Other Bets"? These are their more experimental ventures, like self-driving cars with Waymo or their health tech projects. While they might not be making huge profits yet, their progress and investment levels tell us about Alphabet's vision for the future. It’s where the really wild ideas are brewing!

What the Market Does: The Big Dance

Once the numbers are out, the market reacts. It's like a giant, unpredictable dance. If Alphabet beats expectations, you'll often see their stock price jump. People are happy, they see a bright future, and they want in.

But if they miss the mark, or give a less-than-stellar forecast, the stock can take a tumble. It's a bit like a rollercoaster – exciting but can also be a little scary! Investors are always looking for signs of strength and growth.

Analysts also weigh in. These are the financial gurus who study companies like Alphabet. Their opinions and ratings can also influence how the market moves. It's a constant flow of information and reaction.

Beyond the Numbers: The "Why" Behind It All

But it's not just about hitting certain figures. Investors and observers will be digging deeper. They'll want to hear what the executives have to say about the company's strategy. Are they confident about the next quarter? Are they facing any new challenges?

We’ll be listening for insights into consumer behavior. How are people spending their time and money online? Are they watching more videos? Are they relying more on digital tools for work?

Alphabet's earnings calls are like a peek behind the curtain. You get to hear the narrative, the explanations, and the hopes for what's to come. It’s where the story behind the numbers really unfolds.

The Future is Now: What's Next?

So, whether you're an investor, a tech enthusiast, or just someone who uses Google every day, these earnings reports are a big deal. They shape the direction of one of the most influential companies in the world.

It’s a fascinating glimpse into the world of technology and business. It’s where innovation meets the bottom line, and where the digital landscape we all navigate is constantly being shaped. It's definitely worth keeping an eye on!

Think of it as a quarterly check-up for the internet's doctor. And seeing how healthy it is tells us a lot about our own digital well-being. So, get ready for the show! It’s going to be an interesting one.

Key Takeaway: Alphabet's earnings are more than just financial reports; they're a pulse check on the digital world and a window into the future of technology.

We'll be watching to see if their various segments, from the ever-popular Google Search to the growing Google Cloud, are hitting their targets. And, of course, how the market will react to all this juicy information.

Are they investing more in AI? Are they seeing growth in new areas? These are the questions that fuel the excitement and the sometimes wild swings in the stock price. It’s a real-time story of innovation and business strategy.

It’s like watching a chess match, but with billions of dollars and the future of the internet on the board. Every move, every number, every word from the executives matters.

So, when you see headlines about Alphabet's earnings, remember it's not just about numbers. It's about the engine that powers so much of our modern lives, and its performance is a direct reflection of how that engine is doing.

It’s always a good reminder of how intertwined our lives have become with these tech giants. And their financial health has a ripple effect that touches us all in some way, shape, or form.

So, tune in, do a little digging, and see what the latest report reveals. You might be surprised by what you learn about the world of tech and the company that keeps it all running.

It’s a chance to understand the forces shaping our digital landscape. And it’s a story that’s constantly evolving, quarter after quarter.