100k A Year Is How Much An Hour After Taxes

So, you’ve seen the magic number: $100,000 a year. Sounds pretty darn good, right? It’s like the golden ticket in a world of slightly less golden ones. Most people hear that and picture a life of effortless yachts and endless vacations. But hold on to your hats, folks, because we’re about to dive into the not-so-glamorous reality.

We’re talking about what 100k a year really means when the government decides it’s time to collect its share. This isn't about judging anyone's income, mind you. It's just about getting real with our hard-earned cash. Think of it as a friendly chat with your wallet.

Let’s crunch some numbers, shall we? And by "crunch," I mean we'll lightly tap them with a rubber mallet. No intense spreadsheets here. We’re aiming for understanding, not a doctorate in tax law. Your brain should feel more like it’s having a spa day.

First, we need to acknowledge that $100,000 a year is a nice, round figure. It’s a target for many. It’s the benchmark that gets whispered in break rooms and dreamed about at 3 AM. It feels like a victory. And in many ways, it is!

But here’s the plot twist, the sprinkle of salt on our sugary dream. That 100k isn’t all going into your pocket. Uncle Sam has his hand out. And it’s not just a polite tap; it’s more of a determined grab. This is where the fun really begins, if by "fun" you mean a slightly bewildered shrug.

So, how much is 100k a year, after taxes? It’s a question that gets asked a lot. And the answer is… well, it’s complicated. Like a toddler explaining quantum physics. It depends on a gazillion little things.

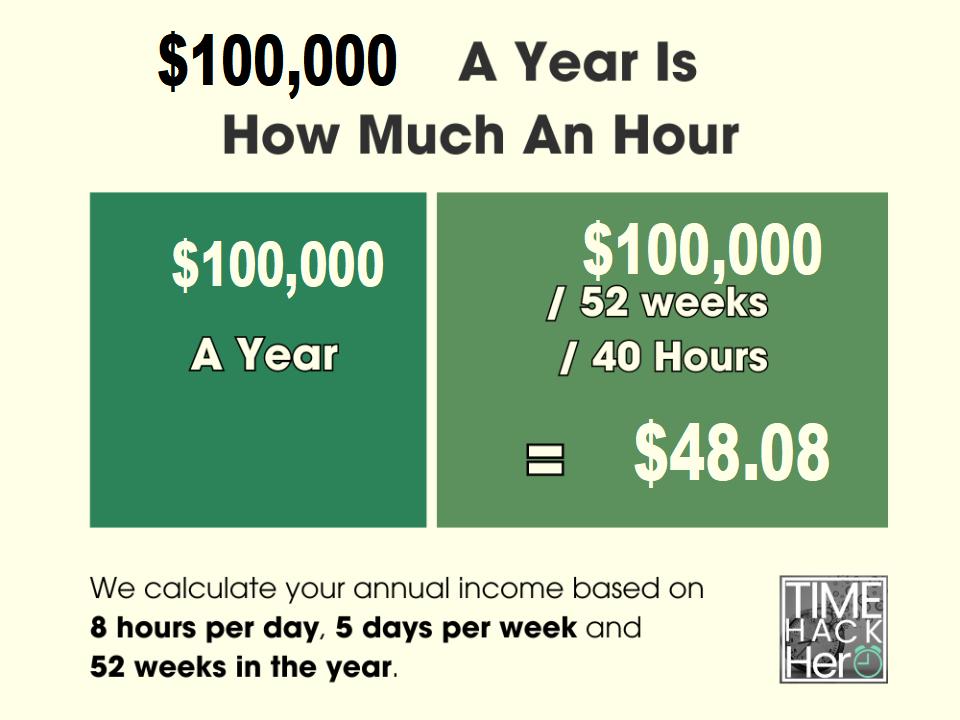

Let’s break it down hour by hour. The standard work year is often considered to be around 2,080 hours. That’s 40 hours a week for 52 weeks. A nice, neat number. Now, let’s do some quick math. If you did get to keep the whole 100k, that would be about $48.08 per hour. Not too shabby!

But remember that little thing called taxes? They’re like that surprise guest who shows up unannounced and eats all the good snacks. Federal income tax is the big one. Then there’s state income tax, which varies wildly from state to state. Some states are tax-friendly, and some are… well, let’s just say they appreciate your contribution.

Then we have FICA taxes. That’s Social Security and Medicare. These are pretty standard across the board. They’re the reliable friends who always show up, rain or shine, to take a cut. They're important, but they do chip away at the shiny pile of money.

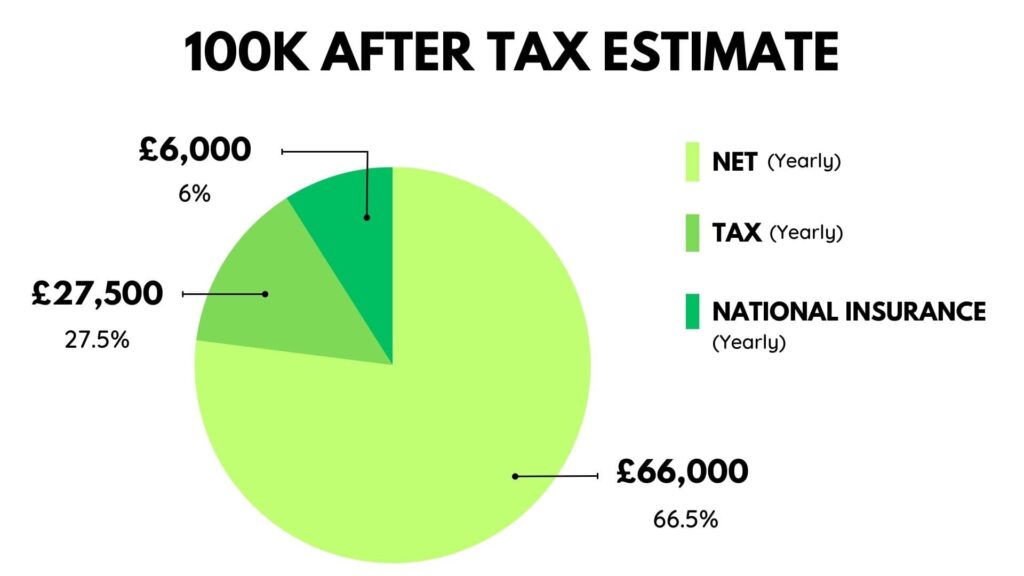

So, let's say, for the sake of argument, that your total tax burden is around 25%. This is just a rough estimate, folks! Your mileage may very well vary. Your neighbor's might be higher. Your cousin's might be lower. It’s a tax lottery, really.

If you have a 25% tax rate, that $100,000 magically shrinks to $75,000. Ouch. That’s a 25% reduction. It’s like buying a fancy cake and then realizing half the frosting fell off in transit. Still cake, but less… festive.

Now, let’s take that $75,000 and divide it by our 2,080 working hours. We’re looking at roughly $36.06 per hour. See? We went from dreaming of yachts to thinking about maybe affording a really nice inflatable pool toy.

But wait, there’s more! Some people have deductions. Some have credits. Maybe you have kids. Maybe you donate to charity. Maybe you have a very enthusiastic cat who requires artisanal salmon, and you can write that off (okay, probably not). These things can lower your taxable income.

And what about health insurance premiums? Retirement contributions? Those usually come out before taxes are even calculated. So, if you’re being a responsible adult and saving for the future, your "take-home" pay will look even less like $100,000.

Let's say you contribute 10% to your 401(k). That’s $10,000. Now your taxable income is $90,000. And if you're also paying, say, $5,000 for health insurance, your actual take-home before income tax is even less. It’s a beautiful cascade of deductions!

The point is, that $100k number is a pre-tax fantasy. It’s like looking at a menu and seeing the prices, then forgetting about the tip and the drinks. The real cost is always a bit higher, or in this case, the real take-home is lower.

So, 100k a year is how much an hour after taxes? For our hypothetical person with a 25% tax rate and no other deductions, it's about $36 an hour. But that's a simplification. It could be higher. It could be lower. It's an adventure in personal finance!

Some high-tax states could see that number drop significantly. Think about places like California or New York. Their tax rates can be quite steep. Your $100k might feel more like $60k or $50k after all the deductions are made.

In that scenario, your hourly rate could dip into the $20s. Suddenly, that dream of a daily gourmet coffee seems a lot more realistic than the yacht. And there’s nothing wrong with a good gourmet coffee, by the way!

It’s an “unpopular opinion,” perhaps, that the $100k dream isn’t quite as shiny in reality. But it’s better to know the truth, right? It helps manage expectations. It helps appreciate the smaller wins. Like finding a forgotten $20 bill in your old jeans. That’s a real win.

Think of it this way: if someone offers you a $100 bill, but then says, "Oh, and I'm taking 25% of that for myself," you'd be a little less thrilled. This is the same principle, just with a lot more paperwork and slightly less direct confrontation.

The journey from $100,000 gross to your actual hourly spending money is a fascinating one. It involves federal, state, FICA, and sometimes even local taxes. Not to mention the voluntary deductions for your future self.

So, when you hear someone talking about $100k a year, just smile. Nod. And remember the magic of taxes. It’s what keeps the lights on… for everyone. And it’s what turns a seemingly massive number into a more manageable, and dare I say, relatable hourly wage.

It's an invitation to appreciate the income you do have. Because even if it's not yacht-level, it's still something to be proud of. And a good cup of coffee is always a good start. Or maybe a slightly more affordable inflatable pool toy. The possibilities are… well, they’re there.

Ultimately, the exact number is less important than the understanding. It’s about demystifying the big numbers and making them feel a little less intimidating, and a lot more real. And a little bit funny, because what else can you do?